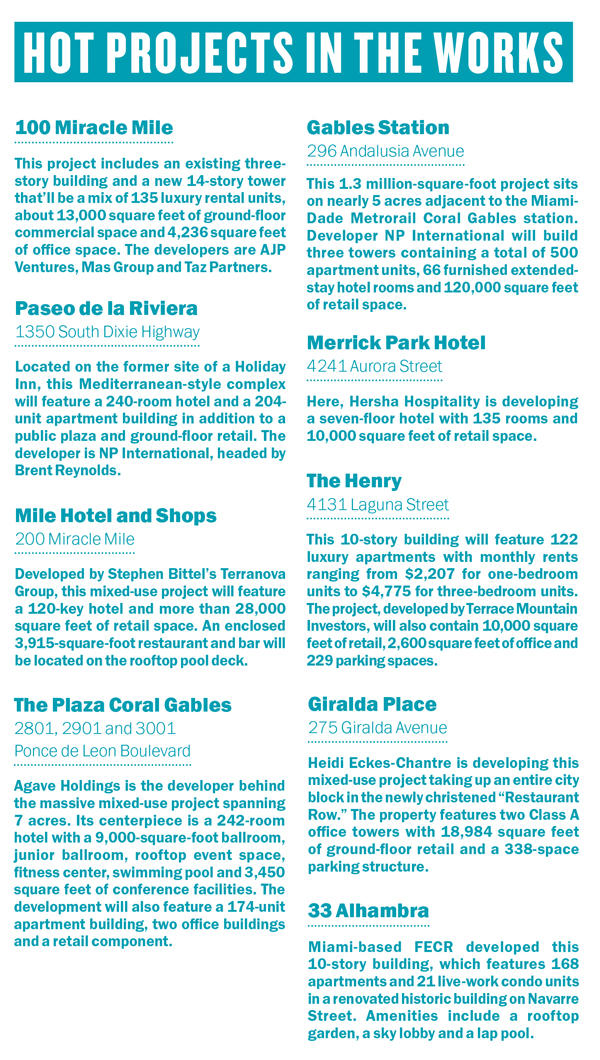

UPDATED January 7, 11:45 a.m.: At the corner of Malaga Avenue and Ponce de Leon Boulevard, work crews recently topped off a Class A office building and an apartment tower that make up the first phase of the Plaza Coral Gables, the largest commercial project in the city’s history. Agave Holdings, a commercial real estate firm that includes the family behind the Jose Cuervo spirits brand, is making a $600 million gamble that Coral Gables can absorb 2.25 million square feet of new construction that entails a 242-key hotel, 174 apartments, 161,000 square feet of retail space, roughly 450,000 square feet of office space and more than 2,000 parking spaces.

In a city that once kept a tight leash on development, Agave’s gargantuan complex would have been enough for one cycle. Instead, the City Beautiful is in the midst of a boom that is adding roughly 1,500 apartments, approximately 800 hotel rooms, more than 500,000 square feet of office space and more than 300,000 square feet of retail by 2022. Other developers such as NP International, Terranova Corporation and Hersha Hospitality are building large and medium-scale mixed-use projects incorporating hotels and apartments in a 1.5-square-mile area between U.S.1 and Miracle Mile, representing nearly $1.5 billion in new construction.

It’s a development wave predicated on attracting new residents, corporate tenants and travelers who want to avoid the traffic-congested confines of downtown Miami, its neighboring Brickell district and unincorporated south Miami-Dade. The Real Deal interviewed brokers and developers in Coral Gables to find out how each market segment will be able to absorb so much new inventory in a two-year window.

Taking office

The Plaza Coral Gables project is already having an impact on local office leasing, according to Maggie Kurtz, a senior vice president with CBRE’s Miami office. Agave Holdings’ high asking rates for the 290,000 square feet of office space due for early-2020 completion come at a time when rates are already rising due to a number of office building sales in the past year, she said.

“They are quoting $55 to $57 a square foot,” she said of Agave’s project. “As a result, others that were quoting around $40 are now quoting $48 to $50.”

“They are quoting $55 to $57 a square foot,” she said of Agave’s project. “As a result, others that were quoting around $40 are now quoting $48 to $50.”

According to an Avison Young market report from the third quarter of 2019, the local office leasing rate averaged $40.34, while downtown Miami’s rate hit $42.96 and Brickell’s was $47.31.

Historically, Coral Gables is one of the healthiest office markets in South Florida, Kurtz said.

“The Gables has always fared well and has one of the lowest vacancy rates,” she said. In the third quarter of 2019, that rate was 8.2 percent, compared to 9.2 percent in Brickell and 19.6 percent in downtown Miami, the Avison Young report found.

But Kurtz is concerned that new Plaza Coral Gables office space may overtake demand. “It’s a decent amount of office space to come online at the same time,” she said.

Still, Coral Gables is an attractive city for owners of small to medium-sized companies relocating their businesses. Two local office buildings CBRE handles leasing for have seen an uptick in leasing by financial services and law firms that have left Miami’s central business district. “They are tired of the traffic and the high rents,” Kurtz said.

In addition, more wealth management firms from the Northeastern U.S. are relocating to Coral Gables. “It all has to do with our beautiful weather, and the taxes are just too much in New York and Connecticut. It is as simple as that,” Kurtz said.

Phil Gutman, president of Brown Harris Stevens’ Miami office, has noticed a similar trend at the office condo project Ofizzina at 1200 Ponce de Leon Boulevard, where the brokerage is handling sales.

“We started with CEOs who live in Coral Gables who were fed up with the traffic situation in downtown and Brickell,” he said. “Now we are getting people from New York who have figured out the ramifications of tax reform has made Florida a much more attractive place.”

The multifamily way

A steady rise in the local population has kept multifamily developers confident about their projects. In the first 10 months of 2019, more than 34,300 individuals migrated to Miami and Coral Gables. That’s nearly 5 percent more than in the same period in 2018, according to a third-quarter multifamily report from Berkadia.

Over that same time period, developers delivered 797 apartments in Coral Gables, while the market absorbed 680 units, or 85 percent of them, Berkadia found. The average monthly rent in Coral Gables was $1,892, the third highest among 22 South Florida submarkets.

Considering that employers also added 15,200 jobs to local payrolls in 2019, developers like Henry Torres, principal of the Astor Companies, believe multifamily projects will continue to be a sure bet.

“These are people who don’t want to drive to work,” he said. “They want to be able to get to their jobs in 10 minutes or less.”

Astor developed the 227-unit Merrick Manor condominium at 301 Altara Avenue. Due to the slowing luxury condo market, the firm converted 50 of the units into rentals.

“We leased all of them within a couple of months after listing them,” Torres said. “A lot of people are still hesitant to buy, but they will rent a nice condo fairly quickly.”

NP International is more than a year into construction of Gables Station, a transit-oriented development near U.S. 1 and Ponce de Leon Boulevard with 444 apartments, 66 hotel rooms and 20,000 square feet of retail. One of the project’s three structures will house 400 beds managed by Ollie, a company that provides co-living studios and shared suites with hotel-like services. Just a few blocks south on U.S. 1, the firm is also building Paseo de la Riviera, an apartment-and-hotel project spanning 2.66 acres.

The neighborhood amenities of Miracle Mile and the Shops at Merrick Park are sweeteners for renters seeking a relatively low-key central location, Torres said.

“There are three different golf courses and everything is close by, including the airport,” Torres said. “And it’s not the hustle-bustle of downtown Miami, where you stand in traffic for 20 minutes to travel three blocks.”

Resto-retail

Coral Gables has been teaming with new restaurants and casual dining spots ever since the completion of a Giralda Avenue pedestrian mall.

Close to a dozen more new eateries have opened in storefronts along Giralda and Miracle Mile, with nearly a dozen more slated for 2020 openings, said Venny Torre, a custom home developer who is president of the Coral Gables Business Improvement District, or BID.

According to Colliers International’s Q3 South Florida retail report, Coral Gables has a retail vacancy rate of 3.7 percent, compared to 11.3 percent in Brickell and 22 percent in downtown Miami. The averaging asking rent of $49.51 is about $20 cheaper than Brickell but $3 more expensive than downtown Miami.

The streetscape project, coupled with a BID marketing campaign promoting downtown Coral Gables, has helped property owners along Miracle Mile and Giralda fill empty spaces, Torre said.

“A lot of developers are seeing the benefits,” he said. “There is more activity and people downtown. You see it just driving by Miracle Mile.”

Meanwhile, projects like the Plaza Coral Gables will bring in entertainment-style retail that will attract more people to the city’s downtown, Torre said. For instance, bowling and entertainment company Pinstripes has inked a lease for 30,000 square feet on two stories of the project.

“There is already a great amount of employment downtown that is driving development,” Torre said. “You already have a good number of people who work and live here. It is only going to get bigger.”

Correction: This story has been amended to reflect that some retailers previously reported as opening on Giralda and Miracle Mile are not yet opened.