Apartment construction is still booming in downtown Fort Lauderdale, but development activity may be cresting farther north of the Tarpon River in Flagler Village, a residential extension of the downtown area that has attracted a pack of multifamily developers.

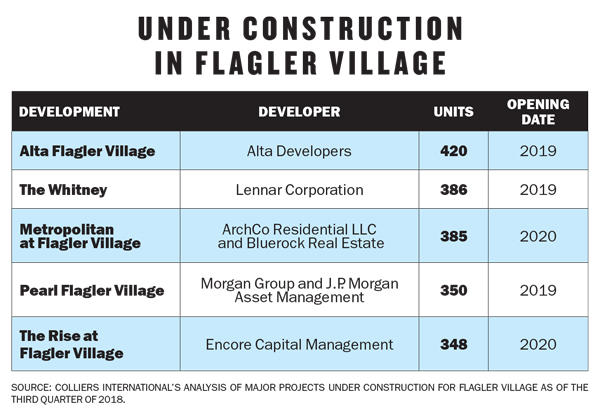

Flagler Village has a pile of new apartment buildings being built. Research by Colliers International shows that a total of 4,566 apartments were under construction in downtown Fort Lauderdale and in Flagler Village as of the end of September — including 1,889 apartments at five major Flagler Village developments scheduled for completion in 2019 and 2020, as seen in the chart on this page.

However, once all those properties come online, they may not command the kinds of rents that provide a rapid and robust return on investment, experts said. Furthermore, the planning and production of so many rental projects may be contributing to a downward pressure on land values in Flagler Village. This year, the average price of Flagler Village land was $101.87 per square foot, a huge drop from $135.53 per square foot in 2017 and also below the rates in 2016 ($106.65) and 2015 ($109.76), according to Colliers and CoStar.

Local developer Doug McCraw is undeterred, though. He and his business partner, Lutz Hofbauer, have teamed up with Related Group on a 150-unit apartment development called the Gallery at FATVillage — a name inspired by a compact cluster of art galleries, artists’ studios and other businesses known as FATVillage, a mural-filled former warehouse district in the northwest corner of Flagler Village. In the late 1990s, McCraw and Hofbauer bought most of the property in FATVillage when it was a nameless blighted area.

The Gallery at FATVillage development “is still moving forward,” McCraw said in Dec. 5 interview. However the city has not approved it yet.“It has taken a lot longer than they [Related Group] had planned, but … it’s definitely in the pipeline.” He said the rental housing market has been absorbing new apartments in Flagler Village at an encouraging pace. But he also acknowledged that few major apartment buildings in Flagler Village have opened for occupancy in recent years, in contrast to the imminent influx the area will soon see.

The Gallery at FATVillage development “is still moving forward,” McCraw said in Dec. 5 interview. However the city has not approved it yet.“It has taken a lot longer than they [Related Group] had planned, but … it’s definitely in the pipeline.” He said the rental housing market has been absorbing new apartments in Flagler Village at an encouraging pace. But he also acknowledged that few major apartment buildings in Flagler Village have opened for occupancy in recent years, in contrast to the imminent influx the area will soon see.

When veteran developer Jay Jacobson chose a location to build a high-rise apartment building in Fort Lauderdale’s urban core, he selected a downtown site, purposely sidestepping Flagler Village. “I do like the Flagler Village area. I’ve just found it always to be too competitive, and there are too many opportunities for more competition to come in,” said Jacobson, president of Coconut Grove-based Eden Multifamily, which is planning a January groundbreaking for Eden Las Olas, a 374-unit apartment building at 419 Southeast Second Street downtown.

Last year, Virgin Trains USA (formerly known as Brightline) opened a new station next to Flagler Village, which allows passengers to travel to a downtown station in Miami or West Palm Beach, and eventually will offer access to the main airport in Orlando. The city’s newfound mobility by rail is a factor in rental housing demand and development in Flagler Village. “It’s really a game changer for South Florida,” said Bradley Arendt, a Fort Lauderdale-based vice president at Colliers.

Under pressure?

Some owners in Flagler Village are holding rents steady as new apartment buildings come out of the ground at nearby construction sites, Arendt said. “We see a little bit of leveling off … but I haven’t started seeing a decrease yet,” he said. “We have a lot of units that are going to come on line in the next 12 to 24 months.” Among apartment developers with projects in the planning stage, “there may be a wait and see attitude,” he added.

Flagler Village may be a residential extension of downtown Fort Lauderdale, but the two areas are distinct rental housing markets, according to Jacobson and other real estate experts.

Flagler Village may be a residential extension of downtown Fort Lauderdale, but the two areas are distinct rental housing markets, according to Jacobson and other real estate experts.

Colliers’ research shows monthly apartment rents at the end of September averaged $2,114 in Flagler Village, compared to $3,173 in downtown Fort Lauderdale and $2,316 just south of the Tarpon River.

“We probably are going to see moderating rents for the next 18 to 24 months as we digest the additional [apartment] deliveries in Flagler Village,” said Robert Given, vice chairman of brokerage firm Cushman & Wakefield. “We have to digest the development that’s occurring there before we add too much more.”

Some developers, however, are not waiting. Having flipped the 332-unit Edge at Flagler Village in 2016, the Morgan Group is betting big again on Flagler Village. The Houston-based developer has advanced a 350-unit apartment complex called Pearl Flagler Village, with expected completion in the first quarter of 2019. Evan Schlecker, Miami-based head of the East Coast region of Morgan, said the firm will temporarily offer one month free to prospective tenants for certain apartments within the complex, matching a concession offered by the nearby 386-unit Whitney apartment complex, which was developed by Lennar Corp.

While landlord concessions are common during the initial lease-up period for new apartment buildings, these concessions could become sizable if developers deliver apartments faster than the Flagler Village market can absorb them.

“When the market starts to get a little soft, which it is now, you start to see one-month free, lower deposits, that sort of thing,” said Eden Multifamily’s Jacobson. “When you start seeing projects offering two months free, then you know the market’s got an issue.”

Jacobson agrees that Flagler Village apartment rents haven’t started to decline, but he said that many of the area’s landlords have stopped raising rents. “I look at it as a short-term issue. Maybe it lasts a year or two. But sooner or later, the inventory gets absorbed and rents will start moving.”