While some banks are taking a conservative approach when it comes to construction lending, investment and private equity funds are increasingly putting capital into projects to fill the gaps in the current real estate cycle.

International investors have also stepped up this time around, sinking their money deep into South Florida’s soil, flooding the area’s new projects with funding and helping to fuel the current development boom, real estate experts say.

“What we are seeing is that great projects have capital readily available, both from the equity and debt standpoint,” said Nitin Motwani, managing principal of Miami Worldcenter, the massive $2 billion, 28-acre mixed-used project in downtown Miami.

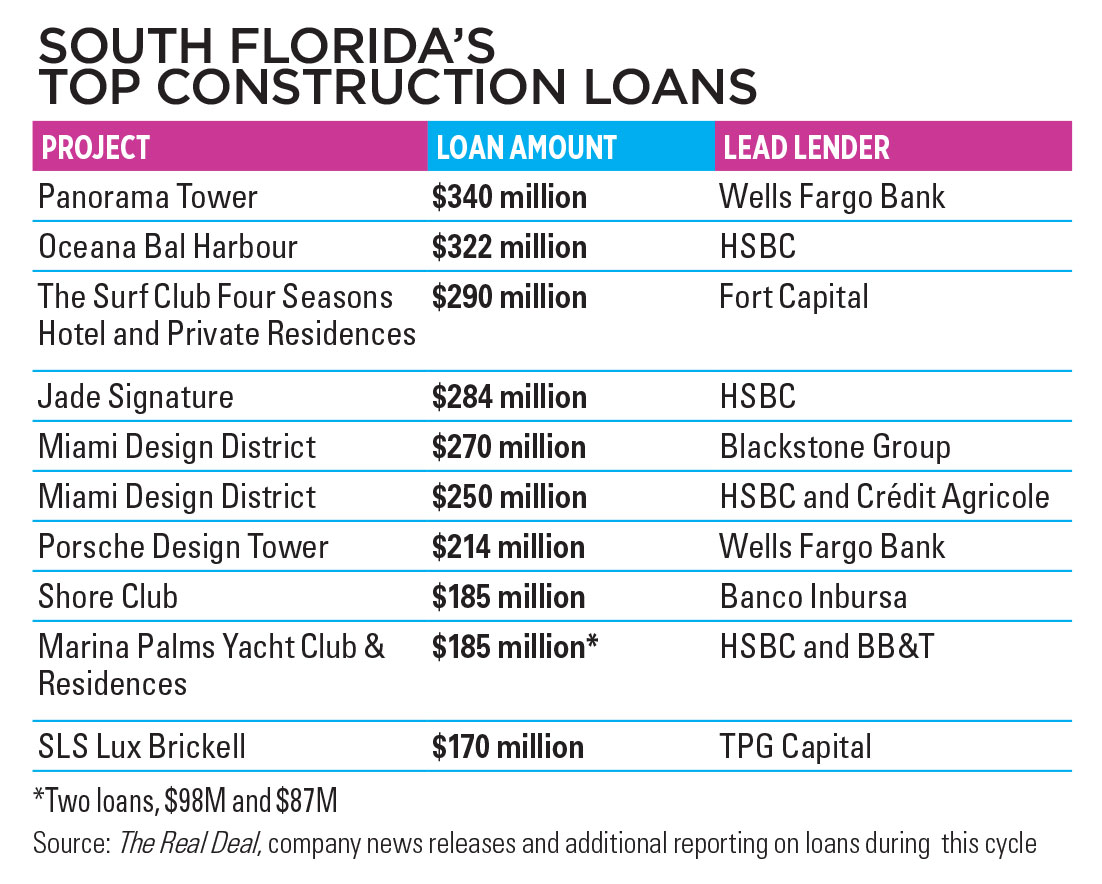

Motwani, along with others in the industry, emphasized that despite banks’ stricter lending terms this cycle, major projects by developers with a proven track record for success were able to secure large loans with favorable rates. HSBC, Wells Fargo and even Bank of the Ozarks are among those actively funding projects, insiders say.

“From my perspective, the capital markets for quality projects and quality operators have never been better,” Charles Foschini, the Miami-based vice chairman of CBRE’s institutional group for debt and equity finance, said. “The debt markets are very attractive, so the ability to get extremely low interest rates is available, and widely available from a number of lending sources.”

Indeed, the confluence of low interest rates for investors, strong demand for vacation homes and commercial projects and a need for capital investment for development is drawing money to South Florida, said Ezra Katz, chairman of the Aztec Group. He calls it “a balanced attack,” from banks, private equity and lending funds.

“2014 was a breakout year in terms of liquidity, the likes of which I had not seen in decades,” Katz said. “2015 is turning into even more of a liquid market — not only is debt available, but equity is available, and transactions are plentiful.”

Blackstone Group, Canyon Capital Advisors and Fort Capital Private are among the equity and investment funds that have stepped up their game during this real estate cycle.

Insurance companies are also looking to invest in commercial real estate projects, said Adam Lipkin, assistant vice president of Grandbridge Real Estate Capital in Miami.

For Class A projects a “bidding war” can even ensue. “There is lots of capital chasing deals and stretching their limits to be competitive with higher leverage, lower rates and more flexibility,” he said.

Amid an uncertain global environment marked by geopolitical turmoil and currency devaluations, money is still flowing to safe havens. South Florida is among the beneficiaries, particularly when it comes to the über-rich who already have their money parked in the U.S.

Cosmopolitan areas like Miami’s Brickell Avenue and Miami Beach are among those that foreign nationals, acting as equity investors, continue to flock to.

Aztec’s Katz said that he regularly gets calls from investors from all over the world looking to put their money into Miami. “Yesterday, I had a group in here from the Middle East.”

For some smaller projects, the desire to invest in South Florida projects is so strong that developers are able to use crowdfunding to source capital.

Omega Grid Development recently raised $7.7 million through Earlyshares.com for its proposed 44-room extended-stay hotel, Med Inn Suites & Residences, near the Jackson Memorial Hospital campus.

Here’s a look at the funding behind a few of the largest projects underway in South Florida:

Miami Worldcenter

Motwani said each of the development’s many components will be funded individually, with a combination of 30 to 50 percent equity, and the remainder debt. That includes the Miami Worldcenter Mall, being developed by the Forbes Company and Taubman; a convention center hotel under development by MDM Development Group and Paramount Miami Worldcenter; and a 60-story condo tower developed by Daniel Kodsi and Miami Worldcenter partners Arthur Falcone and Motwani.

The project will also get $88 million in property tax rebates over 12 years.

“If you look at Miami Worldcenter’s retail component, you have a great location and a great city, top-tier sponsorship in Forbes and Taubman as the developers, and we have anchors like Bloomingdale’s and Macy’s. So the equity will come internally,” Motwani said. “The lenders are readily available on a project like that.”

The mall has not yet announced its primary lender, but it will be a nine-figure facility from a major U.S.-based bank, Motwani said.

Paramount’s developers will be securing separate financing, also likely to be from a U.S.-based bank, he said. “There is a lot of interest from different institutions,” Motwani said. “It will be a large institutional lender.”

The convention center hotel is also securing its own funding, he said. “Given the product type, location and sponsorship, they have a lot of interest from a lot of groups.”

Miami Design District

Craig Robins, president and CEO of Dacra, began buying property in the once-gritty Miami Design District in 1994, nearly two decades before L Real Estate — a private equity fund dedicated to luxury retail real estate development whose investors include LVMH Moet Hennessy — paid him an undisclosed amount to be a 50/50 partner in 2011.

“We never really sourced equity,” said Robins, who is spearheading the transformation of the district into a high-end shopping destination. “My partners at L Real Estate and I capitalized the company very substantially at the beginning, and we now have 25 to 30 percent leverage on the assets, so it’s easy to borrow.”

The development partnership, Design District Associates, therefore, carries 70 to 75 percent equity in the project. Today, the project is valued at $2 billion, Robins said.

In all, Design District Associates controls 900,000 square feet of land, amounting to about 70 percent of the neighborhood.

Last year, General Growth Properties, a Chicago-based real estate investment trust, and New York-based Ashkenazy Acquisition Corp. formed a joint venture to acquire a minority interest in the holdings of Design District Associates. Together, they paid $280 million for a 20 percent stake in the 10-square-block neighborhood.

“We didn’t do the transaction to raise equity,” Robins said of the 20 percent sale. “We did it because we thought they were strategic partners, and we cashed out a little bit.”

In 2012, Design District Associates closed on what was at the time the largest real estate loan that had been issued in South Florida since the downturn, a $250 million construction loan from HSBC and Crédit Agricole, Robins said.

Since then, Blackstone Group has funneled $80 million into the project, and by the end of March, Robins said the partnership would borrow another $270 million from Blackstone to complete the next phase of construction.

“The asset is worth over $2 billion, and the debt is 30 percent of that at $600 million,” Robins said.

The partners expect to secure separate debt funding for the hotel and condo projects that are yet to come, he said.

“It will be under 50 percent loan to value,” Robins said, but nothing is finalized yet. “There are a few people that want to do it.”

Related Group’s Hyde Resort & Residences, SLS Brickell, SLS Lux & 1 Paraiso

While Related is best known for its prolific condo development, the company is also undertaking hotel, retail and single-family developments, among other project types.

During this cycle, Related’s largest construction loans have not come from banks, but investment groups like Blackstone, which lent $102 million for Hyde Resort & Residences in Hollywood; Canyon Capital Advisors, which lent $157 million for SLS Brickell; and TPG Capital, which lent $170 million for SLS Lux as well as $115 million for 1 Paraiso.

Related’s Hyde Beach Resort and Residences project received a $102 million construction loan from Blackstone.

“Traditional banks have stepped away, and these groups have stepped in,” Matthew J. Allen, Related’s executive vice president and chief operating officer, said. “Interest rates are higher, but they have provided much-needed facilities for these jobs.”

Allen said that as far as equity outside of company backing, Related relies on partners — insurance companies, pension funds and private funds from wealthy South Americans, as well as Related Chairman Jorge Perez’s personal funds.

Depending on the type of project, the total equity portion of a deal can be as low as 10 percent, or up to about 30 percent.

“If we are doing affordable housing, it is all banks and tax credits, with very little of our own money,” Allen said. At the other end of the spectrum, “on multifamily, it’s generally 70 percent debt and 30 percent equity.”

For Related, equity partners have included Prudential Financial, Heitman, the Carlyle Group and Rockpoint Group, along with wealthy families from Argentina, Venezuela and Chile, who Allen declined to name.

As far as construction financing for condos, it is generally about 50 percent of the funding, with buyer deposits and equity from the company and its partners making up the difference.

Multifamily projects have carried construction loans from Regions Bank, SunTrust, Bank of America, City National Bank and Citibank, according to Allen.