UPDATED, March 29, 11:36 A.M.: As in any commission-based business, competition is cutthroat in Miami-Dade’s residential real estate scene. And when you manage to make it to the top, sometimes it’s best to keep mum about the people who help you stay up there. Jill Hertzberg had to learn that the hard way.

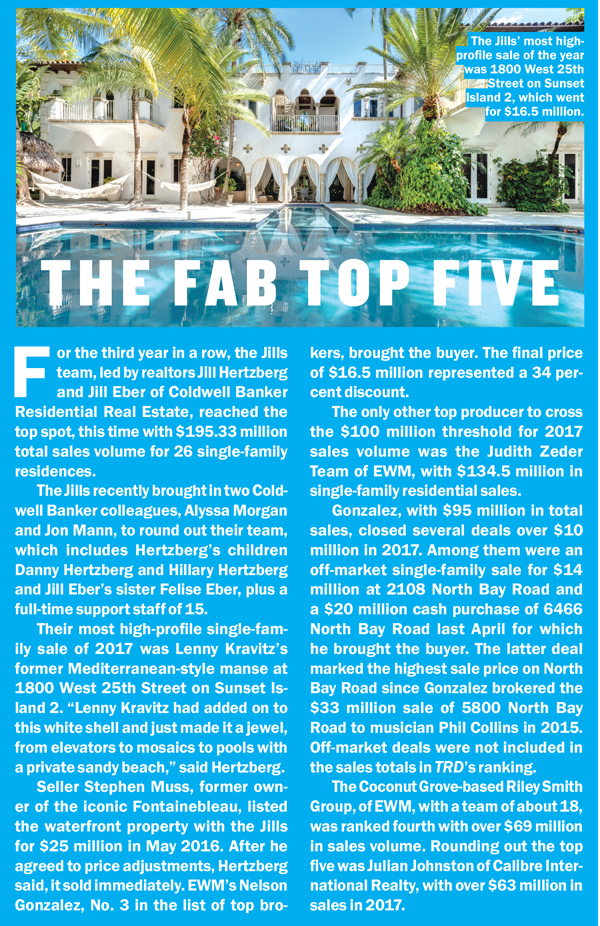

The broker who co-heads the No. 1 team on The Real Deal’s ranking of top brokers and broker teams in the county, Coldwell Banker Residential’s the Jills, had a great marketing employee — so great, in fact, that Hertzberg kept boasting about her, and “next thing I know, Douglas Elliman hired her away. So I guess that’s the nature of the beast, right?”

Top producers said being courted by another firm is common. Some brokerages offer titles such as senior vice president to entice top agents to their firms.

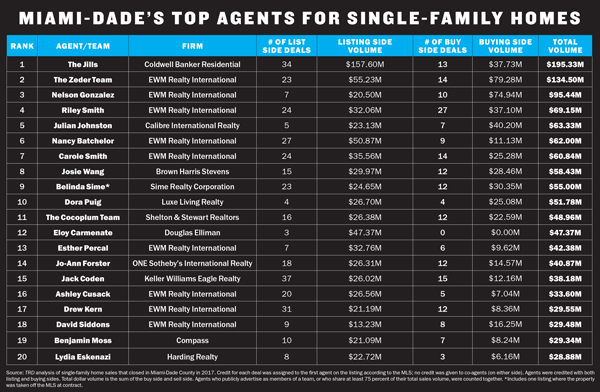

“Every top agent in the city is going to get a call from the top brokerage company,” said Judy Zeder of the Zeder Team from EWM Realty International, which came in second in the ranking. TRD ranked top brokers by analyzing sales of single-family homes that closed in 2017 as recorded on the MLS. Credit for each deal was assigned to the first agent on the listing, according to the MLS; no credit was given to co-agents on either side. Agents were credited with both listing and buying sides, in keeping with the MLS accounting method.

“It’s part of the market, and it’s probably good when the key people move around,” Zeder added. “I think you are with companies because you like them and you trust them and you have a good relationship with them. We say, ‘Show me who you go with, and I’ll show you who you are.’”

“It’s part of the market, and it’s probably good when the key people move around,” Zeder added. “I think you are with companies because you like them and you trust them and you have a good relationship with them. We say, ‘Show me who you go with, and I’ll show you who you are.’”

Recent prominent moves include the Levy Group’s transition to EWM Christie’s after more than 15 years at Coldwell Banker; EWM Realty International’s poaching in August of Coldwell Banker mother-daughter duo Laura Mullaney and Jane Gomez-Mena, the former a 25-year veteran of Coldwell; and Audrey Ross’ move to Compass last July after 17 years at EWM.

Growing field of players

The number of Miami brokerages has skyrocketed from a few decades ago. The Miami Association of Realtors included just 475 companies 30 years ago, according to George Jalil, 2018 board chairman of the association. Today, it has over 5,000. In order to stay ahead, big players like One Sotheby’s International Realty, Compass and Brown Harris Stevens have all made local acquisitions. Meanwhile, Keyes Companies and Illustrated Properties merged, One Sotheby’s acquired Turnberry International Realty, and Douglas Elliman acquired Delray Beach firm Tauriello & Company Real Estate.

With so many agents and firms in the market, sources noted that collaboration and cooperation between them is crucial. Indeed, Charlette Seidel, branch manager for Coldwell Banker’s Coral Gables office, insisted it’s the kumbaya moments that make the cha-ching possible.

“I would say the majority do [play nice in Miami], but some get a little aggressive, so I just tell the agent, just call them up and say, ‘Let’s work this together.’ The buyer gets the house and your seller gets the price. When we get along and help each other, we make sales.”

Jalil agrees. “Real estate is a very, very competitive business, but by definition it’s also cooperative in the same way. It has always been like this,” he said. “It’s not that realtors want to be nice with each other; it’s just that they have to be in order to get the deals through.”

With over 45,000 members in the Miami Association of Realtors (the nation’s largest local association, according to its website), there’s bound to be “a slightly bad apple” in the bunch, admits Jalil, who sits on the board’s grievance panel. “If we did not have grievance and ethics panels in place, this association on a national level would have fallen apart 100 years ago … We require the highest ethics.”

Though he can’t speak about an ongoing 2015 criminal case, in which Miami Beach realtor Kevin Tomlinson was arrested on charges of trying to extort the Jills, Jalil said that matter was “extremely rare.” More often, the association gets less serious complaints about a realtor using someone else’s MLS photos, or something similar.

“Most of the time it’s a realtor not knowing the right thing and doing the wrong thing by accident,” he said. “Or thinking it’s not a big thing and trying to get away with it.” First, it’s a warning, but fines can reach $5,000 for improper MLS activity. “We really try to be as transparent as possible,” he explained.

“Procured cause” complaints — that is, brokers contesting who is entitled to a commission — are also fairly common, according to another source familiar with the grievance process who spoke on condition of anonymity.

An ombudsman program launched in 2016 is helping to resolve preliminary complaints “faster, easier and more amicably” and helping to reduce the number of cases that advance to mediation and arbitration, said Martha Pomares, managing broker of Douglas Elliman’s Brickell and Coconut Grove offices.

Puzzling over the market

When she can’t sleep, Zeder works on complex laser-cut wooden puzzles. “They’re extremely difficult, and I find them extremely relaxing,” she said. It’s a fitting hobby, given that during the day, the senior vice president of EWM Realty International is piecing together any number of puzzles in order to keep a steady stream of residential sales coming in Miami-Dade. A challenging local market has meant lots of adapting for the area’s brokers.

“Last year was a little rough with real high-end inventory,” said Zeder, whose three-broker team includes her children Kara and Nathan. Despite some struggle, they logged $134.5 million in sales, according to TRD’s ranking.

“We worked seven days a week and a lot of hours a day to get the transactions we did. There was nothing easy about getting those numbers,” Zeder said.

But after two challenging years, some Miami agents said they can finally see beyond the glut of high-rise inventory to an upswing just over the horizon.

“The buyers are there, and the prices are strong,” said Hertzberg. “It’s just that you have to be in line [pricewise].”

If 2016 revealed that sellers were still overly optimistic — pricing based on 2015’s dream market — 2017’s sales volumes indicate that they finally got real: lowering their prices and, as a result, making more sales, brokers said. Sales volume totaled $33.2 billion last year, up 3.75 percent from $32 billion in 2016, according to a Miami Association of Realtors report. The long-term supply of luxury condos continues to keep sellers’ listing prices in check.

“When you have so many condos on the market for sale, it’s going to affect single-family residential. It has to,” said Zeder, who noted that there is now some movement on absorption, particularly of luxury single-family inventory under $2 million.

“Sellers realized they’re not bulletproof. The smart ones, anyway, started reducing the prices of their properties, and they sold,” said Nelson Gonzalez, a senior vice president with EWM Realty International who brought in the third-highest single-family home sales volume last year, raking in over $95 million in sales.

“Sellers realized they’re not bulletproof. The smart ones, anyway, started reducing the prices of their properties, and they sold,” said Nelson Gonzalez, a senior vice president with EWM Realty International who brought in the third-highest single-family home sales volume last year, raking in over $95 million in sales.

“It’s still a buyer’s market,” said Brown Harris Stevens realtor Josie Wang, who is seventh on this year’s list. “But things have started to move a little more than before.”

Gonzalez credits current events for shifting the mood among buyers. “Once the [presidential] election was over, everything sort of changed and kicked into high gear again,” he said. Between November 9, 2016, and the end of that year, Gonzalez said, he had five listings go under contract, followed by two sales north of $20 million in the first quarter of 2017. “People who were on the sidelines started to jump in,” he said.

Gonzalez believes stock market gains and the changes to the tax code have caused a “mad rush” of domestic buyers looking for high-end houses and Florida residency. “I’ve found that when Americans have money in their pockets, they have to spend it,” said Gonzalez, a top-selling fixture in Miami Beach for 28 years.

Zeder agreed, and added that the domestic buyers new to the market require a certain amount of education. “We have a lot of people moving into town from all over, and I think their biggest struggle is just trying to understand the Miami market,” she said. “Why a home in Miami Beach is twice the amount of a home in Coral Gables and why Coral Gables is more expensive than Pinecrest. You have huge variation of pricing, for the same size lot, for the same size house.”

Gonzalez said all of his biggest deals of 2017 involved domestic buyers. “That’s a huge change,” he noted. “Usually we get a mix of Americans, South Americans, Europeans and Russians.”

Hertzberg sees a similar trend, fueled by stock market performance and tax changes seen as unfavorable to California and New York residents. “The domestic buyers … are the biggest performers right now,” she said. “We used to have a huge percentage who were South American because we’re a gateway for them; it’s easy to move into Miami,” said Hertzberg. “There’s been a drop in that with what’s going on in Venezuela and Brazil.”

Still, statistics from the Miami Association of Realtors show international buyers accounted for 35 percent of Miami’s closed sales in 2017, purchasing a whopping 41 percent more properties than they did in 2016 (15,400 compared to 10,900). Venezuela, Argentina and Brazil were the top countries of origin for buyers in 2017.

Seidel of Coldwell Banker went so far as to call the current market “outstanding.” After closings delayed months by Hurricane Irma at the end of 2017, she said, she’s smiling again, adding that the rental market is buzzing, too, with millennials in particular.

Lower unemployment numbers in Miami-Dade (from 5.4 percent in 2016 to 4.5 in 2017) and, more recently, a slight increase in wages are having an impact, especially with first-time homebuyers trying to qualify for loans, said Jalil.

Seidel was quick to add that the pricing also has to be right. “We try to educate our sales associates to just tell sellers the truth. If they [sellers] want to listen, fine. If they don’t, they will see.”

Gonzalez agreed that the momentum is up, “just judging by me having to work seven days a week for the last three months.” He predicts prices will begin to go up in another year, spurring spec builders to start building homes again.

Jay Parker, CEO of Douglas Elliman Florida, predicted back in October that it could be up to two years before prices hit their peak.

Even with corrections still occurring on the luxury side, the data shows home values have been rising overall. Statistics compiled by the Miami Association of Realtors show that single-family home prices in Miami-Dade have risen for over six years in a row, with a 6.5 percent year-over-year increase in January 2018.

And some luxury properties are fetching from $1,500 per square foot on the mainland to $2,500 per square foot in Miami Beach. “Pent-up demand for Miami housing has led to more home sales, higher median sale prices and a larger total dollar sales volume,” Jalil said.

A January report from the Miami Association of Realtors and the MLS showed existing condominium and single-family home sales over $1 million gaining steam, up 29.3 percent overall from the same month last year. Transactions involving single-family homes in the $1 million-or-more range rose 7.1 percent month over month for January.

One agent who spoke on condition of anonymity said she’d already shown more Miami Beach waterfront homes in the first couple of months of 2018 than she had in all of 2017.

A December Forbes article quoting Miami experts, including Gonzalez, said homebuyers are looking for sleek, modern construction; expansive spaces for entertaining, including “summer” kitchens, rooftop terraces, tasting rooms and home theaters; and especially views of Miami’s grownup skyline.

Meanwhile, the Jills’ co-founder Hertzberg said she’s already moving toward her next performance goal.

“When you are up front, people are looking at you,” she said. “You’ve got to learn to constantly change because they copy you. You’ve got to evolve. It’s hard because for a minute you kind of want to coast, but you can’t.”

Correction: This ranking has been amended to reflect updated data received by the TRD research team. Julian Johnston of Calibre International Realty was erroneously excluded from the ranking and now places fifth.