The historic Biltmore Hotel in Coral Gables has never lacked for luxury. A stroll through the property’s resplendent hallways and alongside its swimming pool — once the largest in the world — serves as a testament to the old-school elegance of a property that came of age during Florida’s original land boom of the 1920s. But with more than 10 years passed since the property overhauled its 275 guest rooms, management decided this year that it was time for a refresh.

In June, the Biltmore commenced a $25 million renovation, which will include a refurbishment of all guest rooms as well as enhancements to the golf course, among other items. The work is scheduled for completion in December.

“There is immense competition at all the various levels of hospitality,” Biltmore General Manager Matthias Kammerer said. “A lot of new and renovated product. And it was time for us to be serious about renovating the most impactful areas of our guest experience.”

Indeed, around South Florida’s tri-county area, competition is intense as older properties fight to maintain market share against the plethora of new properties that have come online over the past handful of years. Still, although more than 10,000 keys are in the pipeline over the next two years in Miami-Dade County alone, experts say growth has begun to slow as lenders tighten the reins.

The pipeline slowdown

Over 2016 and 2017, a total of 42 lodging properties opened in the Miami, Fort Lauderdale and Palm Beach areas, adding more than 6,000 units of inventory, according to global hotel real estate consultant Lodging Econometrics. But the growth has since begun to taper off.

Two years ago, Miami had 87 projects and 15,701 rooms in the hotel construction pipeline, trailing only New York among the top 25 U.S. markets in terms of the size of the hotel pipeline as a percentage of hotel supply, Lodging Econometrics data shows. By the end of this year’s second quarter, the Miami pipeline had shrunk to 69 projects and 12,238 keys, proportionally the fifth-largest pipeline among those 25 major markets.

While that isn’t a small amount of inventory on the way, analyst Boaz Ashbel, managing director at Aztec Group, a Miami-based firm that invests in and brokers hotel projects, said that lenders have become reluctant to finance South Florida hotel projects. Labor shortages are also making project delivery more difficult and expensive.

“Lenders have pretty much reached their capacity for goals in the hotel space and aren’t going to give out additional loans,” said Ashbel, who added that what opportunity remains at present is mainly for midrange properties. Lenders will only look at borrowers with a long history of development experience, he added.

Ali Lehson, a partner in the real estate group of the Miami-based law firm Bilzin Sumberg, agreed that lenders are reserving the best terms for only the most promising projects, but she’s still seen plenty of loans issued. “We’ve done a considerable amount of funding in the last couple of years and with strong borrowers. We’ve gotten good terms,” Lehson said.

She added that hotel development opportunities remain in growing urban centers, such as the downtowns of Delray Beach, West Palm Beach and even hotel-dense downtown Miami. There’s also untapped demand in the millennial markets, Lehson said, citing the fact that Latin American upscale hostel brand Selina has chosen Little Havana’s old Tower Hotel as its first U.S. location. Selina will be joined in Miami’s emerging micro-hotel and upscale hostel market by citizenM, a newly announced 348-key project that will be part of the sprawling Miami Worldcenter development downtown.

“I think you are seeing the market create more and more diversity,” said Nitin Motwani, managing principal of Miami Worldcenter Associates. The Netherlands-based citizenM chain caters to millennial travelers by offering technologically advanced hotels with extensive public spaces. Its project will fill an unmet need in the downtown hotel landscape, Motwani said.

Similarly, Ronny Finvarb, principal of the Finvarb Group, said that the key for South Florida hotel developers going forward will be to carefully fill unmet needs in the market. The Finvarb Group announced this summer that it would make a 150-room Thompson Hotel its newest project because the brand — a luxury boutique hotel outfit catering to a high-end clientele in New York, Seattle, Nashville, Chicago and soon Los Angeles — has been absent from Miami Beach since 2016, when Hyatt bought the former midbeach Thompson property in order to convert it into the Confidante Miami Beach.

“We felt that it was a brand niche that needed to be filled again,” Finvarb said.

Checking in on room rates

Amid the influx of inventory, revenue per available room (RevPAR) suffered for South Florida hoteliers in 2016 and 2017, especially in Miami-Dade.

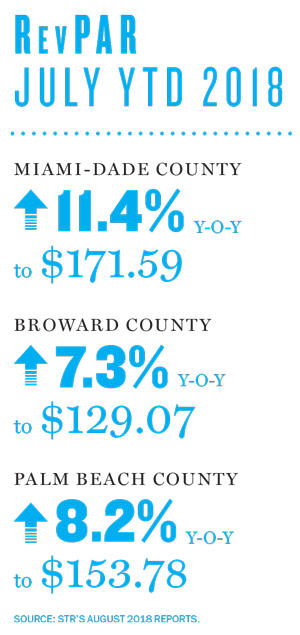

But even in this increasingly inventory-rich landscape, room rates are inching up in 2018. In Miami-Dade County, RevPAR was up 11.4 percent year over year through July, according to the lodging industry analytics company STR. Broward County hoteliers, meanwhile, enjoyed a 7.3 percent year-over-year RevPAR increase, and RevPAR in Palm Beach County was up 8.2 percent.

Analysts and industry representatives cite a number of reasons for the market strength the tri-county area hotel industry experienced in the first half of the year. Like others, Stacy Ritter, CEO of the Greater Fort Lauderdale Convention & Visitors Bureau, cited hotel closures in the Keys and in Caribbean destinations that were devastated by Hurricane Irma as one factor that has boosted room rates this year. But she said that the increasing diversity of Broward’s hotel offerings, as well as the growing appeal of the off-beach Fort Lauderdale and Broward County markets, have been more important.

Analysts and industry representatives cite a number of reasons for the market strength the tri-county area hotel industry experienced in the first half of the year. Like others, Stacy Ritter, CEO of the Greater Fort Lauderdale Convention & Visitors Bureau, cited hotel closures in the Keys and in Caribbean destinations that were devastated by Hurricane Irma as one factor that has boosted room rates this year. But she said that the increasing diversity of Broward’s hotel offerings, as well as the growing appeal of the off-beach Fort Lauderdale and Broward County markets, have been more important.

“I don’t see RevPAR going down when Puerto Rico and the Keys get back to full force,” Ritter said. “We have a whole group of people who found us, and they are going to stick with us.”

Soon to open

While the overall South Florida hotel room pipeline is smaller than it was two years ago, new properties are continuing to come online in rapid succession in Miami-Dade and Broward counties. Through August, 11 properties accounting for more than 1,200 rooms had opened this year in the two counties, according to Lodging Econometrics.

Downtown Miami this year saw the opening of the 208-unit Hyatt Centric Brickell Miami as well as the SLS Lux Brickell Hotel & Residences, a mixed-used development under the sbe brand that includes 70 hotel-condominium units.

Prominent openings slated for Miami in the coming months include the 190-room EVEN Hotel Miami Airport — an InterContinental Hotels (IHG) wellness brand — opening in November; the boutique 92-room Greystone Hotel on Miami Beach’s Collins Avenue in December; and the 140-room Hotel Indigo Miami Brickell, another IHG brand, also in December.

In Broward, openings this year have included the 111-room CIRC Hotel, part of a mixed-use development in downtown Hollywood, and the 150-room TRYP Maritime by Wyndham on Fort Lauderdale’s Marina Mile, which caters to yachters.

Among the properties slated to open this fall is a 25-story luxury product, the Dalmar, in downtown Fort Lauderdale, which will house 209 rooms and suites. The 307-room Costa Hollywood Beach Resort is also scheduled for a fall opening.

To the future

Further down the line, plenty of noteworthy projects are expected to be completed before the end of 2020. Among them are the 164-room Boca Raton Mandarin Oriental and the 130-room Four Seasons on Fort Lauderdale Beach, which will also have 90 private residences. In Miami, a variety of midmarket branded hotels, such as Holiday Inn Expresses and Hilton Garden Inns, are among the products in the pipeline. In addition, the Seminole Hard Rock Hotel & Casino in Hollywood expects to complete a $1.5 billion, 806-room expansion next year. And MDM Group expects to break ground this fall on the 1,700-room Marriott Marquis at Miami Worldcenter, with an anticipated completion date of 2021.

In the midst of these completions, the fate of a potential major project is yet to be decided. In November, Miami Beach voters will have their say on a proposed 800-room Miami Beach Convention Center hotel, which would augment the nearly complete $620 million expansion of the convention center itself (see TRD’s ballot guide on page 19). The plan is modified from a version that voters rejected in 2016. The 2018 proposal calls for a structure that would rise to only 185 feet, rather than the 288 feet included in the 2016 proposal.

Convention center hotel advocates might take umbrage over the fact that voters in the Miami area have already given one victory to the hotel industry this year. In August, City of Miami residents gave the go-ahead for ESJ Capital Partners, which owns Jungle Island, to build a 300-room eco-themed hotel on

city-owned Watson Island. The company now has up to 10 years to build the project.