BankUnited, the largest South Florida-based bank by deposits, exited the home mortgage business in January, raising several questions about the state of single-family residential lending in one of the nation’s most popular real estate markets.

The publicly traded bank got out of the market “not because we see anything wrong with the assets, but because we can’t make money in the business,” John Kanas, the chairman and chief executive officer of BankUnited, told analysts on a Jan. 21 conference call.

The bank’s home loan origination volume amounted to roughly $20 million a month and accounted for a fraction of its $4.7 billion in asset growth last year. “If we would have built it two or three times the size of this, we still wouldn’t make money in the business,” Kanas said on the call.

Now several community banks are looking to pick up pieces of the home lending business that BankUnited has foregone — some by hiring former employees of the bank’s residential mortgage division.

“They got rid of their whole department,” said Thomas Lumpkin, chairman of Coconut Grove-based Biscayne Bank, which has about $650 million in total assets. “We think we’ll expand market share in that particular segment.”

Another local player echoed that desire. “It could be a good thing for some of the community banks like ours to scoop up some market share, scoop up new clientele and talent,” said Raul Valdes-Fauli, president and CEO of Coral Gables-based Professional Bank, which has about $300 million in total assets. “While maybe it’s not as easy as it used to be, we still think it’s an important and vital part of what a bank should do. Community banks should be helping people buy homes.”

Local bankers will not only vie with each other, but also with non-bank lenders to scoop up BankUnited’s leftover share of the South Florida home loan market, according to industry insiders.

Professional Bank CEO Raul Valdes-Fauli

So far, however, there are few signs of the reckless residential lending that fueled the Florida housing bubble before it imploded in 2007 and led to one of the worst housing crises in the country. Statewide data and figures for the tri-county region show that far fewer home mortgages in South Florida are going bad in 2016, with default rates at a relative low.

Higher home prices, heightened regulation and a growing number of cash buyers in South Florida’s single-family house market are all likely contributors to the low-default trend. In addition, post-crisis home loan criteria have made qualifying for a mortgage harder for many applicants.

Many of the safest mortgages outstanding in the region were originated after the 2010 enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Meanwhile, South Florida home prices grew by 8.1 percent year-over-year in November, the sixth-fastest appreciation rate among major U.S. metropolitan areas, according to the S&P/Case-Shiller U.S. National Home Price Index. The comparable appreciation rate nationwide was 5.3 percent.

“South Florida home prices have drifted back up to where they were back in 2004, but if you adjust for inflation, they’re about 15 percent below that,” David Cobb, regional director of the Palm Beach Gardens office of Metrostudy, a real estate research and consulting firm, told The Real Deal. “Land prices are even higher now than they were in the last up-cycle, making it very difficult for builders to provide homes for first-time buyers.”

The most troubled residential mortgages — those that are 90-days delinquent or more — as a percentage of all home mortgages peaked at 20.6 percent in the first quarter of 2010 and then declined for 23 consecutive quarters to 5.1 percent in the fourth quarter of 2015, according to Florida data from the Mortgage Bankers Association.

South Florida data from the U.S. Department of Housing and Urban Development (HUD) on FHA-insured home loans show even lower delinquencies for Miami-Dade, Broward and Palm Beach counties. Among the lenders that closed at least 100 FHA loans in South Florida between Feb. 1, 2014 and Jan. 31, 2016, delinquency rates ranged from 1 percent to 2.91 percent in the region, according to “Early Warnings” data from HUD.

The FHA delinquency data for South Florida show just two less-than-stellar outliers: Banking Mortgage Services Corp. in Miami-Dade at 4.78 percent and Gulf Atlantic Funding Group in Broward at 6.5 percent. Representatives for the two mortgage firms did not respond to requests for comment. (The FHA loan delinquency rates may be overstated, according to HUD’s website, because they exclude cases in which home mortgage delinquencies were “cured” by borrower rehabilitation, lender concessions or other means.)

Biscayne Bank chairman Thomas Lumpkin

Non-depository finance companies have taken a bigger share of the home loan market, and one reason is non-banks operate in a more flexible regulatory environment than FDIC-insured banks do, Miami-based bank analyst Ken Thomas said.

“They don’t operate under a bank charter. They’re not subject to all those rules on capital and liquidity,” Thomas said.

The HUD data for the two-year period suggest that non-depository mortgage lenders have a lopsided share of the South Florida market for FHA loans.

The only Federal Deposit Insurance Corporation-insured lenders among the top 10 in each county were Regions Bank (which ranked sixth in Miami-Dade), BB&T (which ranked ninth in Broward) and Wells Fargo (which ranked fifth in Palm Beach). Paramount Residential Mortgage Group closed more FHA-insured home loans than any other lender in each of the three counties in South Florida with 923 loans in Miami-Dade, 969 loans in Broward and 450 loans in Palm Beach.

But FDIC data for all types of home mortgages, not just FHA loans, show that most of the largest banks based in South Florida remain active originators.

Only borrowers with stellar credit are qualifying for mortgage loans in the Dodd-Frank era of financial reform, according to Cobb at Metrostudy.

“Most have been older and better credit risks,” he said. “In fact, when you look at all the mortgages originated since 2010, they are probably going to have the lowest default rates of all time, because the underwriting guidelines have been so stringent. It’s still somewhat difficult to get a mortgage compared to the way it was back in 2004.”

Low delinquency rates and rising South Florida home prices are among the major motivators for banks and non-banks alike to expand their home loan portfolios going forward, according to several industry observers.

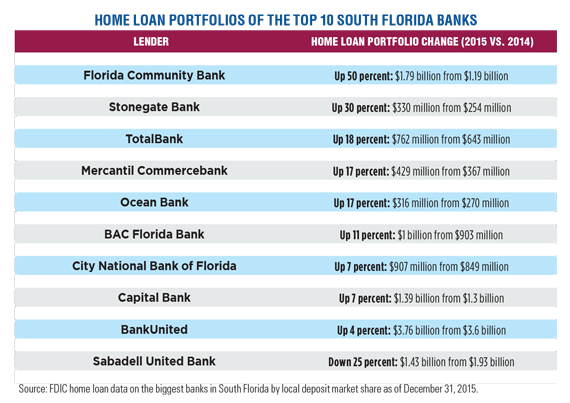

A survey of FDIC data by TRD shows the 10 largest South Florida-based banks increased their combined home mortgages last year to $12 billion as of Dec. 31 from $11.3 billion a year earlier, marking a 6.9 percent increase. The 10 largest banks also reduced the combined dollar amount of their repossessed real estate to $147 million at the end of 2015 from $223 million at the end of 2014, a 51 percent reduction.

But David Seleski, the president and CEO of Fort Lauderdale-based Stonegate Bank, said automated loan providers have made it harder for traditional lenders to compete in residential mortgage finance and have substantially replaced face-to-face meetings between bankers and individuals seeking home mortgages.

“If you’ve got somebody plugging into an application online, you don’t really know that customer,” Seleski said, noting that a substantial amount of consumer lending, especially to younger borrowers, now begins online. “It’s something that we’re struggling with, because that’s more of a wholesale model than a retail model,” he added. “We think we add value because we give them advice, try to put them in the right product.”

Stonegate’s home loan department is now marginally profitable, due to the proliferation of online and other non-bank lending sources and increased regulation under Dodd-Frank. “It just isn’t a super profitable business,” Seleski said. “The only way to make money at it is through scale.”

Thomas, the Miami-based bank analyst, pointed to Quicken Loans, one of the country’s most active non-bank home mortgage lenders, as the biggest “disruptor.”

Quicken — which last year launched a new online service called Rocket Mortgage — ranked as the nation’s third-largest home mortgage lender in the first quarter of 2015 with $78 billion of originations, behind J.P. Morgan Chase with $115 billion and Wells Fargo with $209 billion, according to the trade publication Inside Mortgage Finance.

Regent Bank SVP of residential lending Kevin Hayes

Meanwhile, the HUD data show that during the two-year period that ended Feb. 1, Quicken was the ninth largest originator of FHA loans in Miami-Dade, the third largest in Broward and the second largest in Palm Beach County.

“They are the disruptor right now that is causing all the bankers to scratch their heads, and ask, ‘Wow, what have we done so wrong to allow them to come in and take market share?’” said Thomas.

But not all traditional lenders are feeling the same squeeze.

J.P. Morgan, the largest U.S. bank by total assets and the fourth-largest bank in South Florida by deposits, is growing its portfolio of home loans in the area, especially jumbo loans topping $417,000, said Sean Grzebin, the bank’s Jacksonville-based head of home mortgage lending in Florida.

“We are definitely getting a higher share of bigger loans,” he told TRD.

The momentum in residential mortgage lending in South Florida has shifted toward refinancing as the Federal Reserve slowly raises interest rates, Grzebin noted. The bank executive also said the refinancing trend favors non-bank lenders because banks remain more dominant in lending for home purchases.

“We are seeing a very steady and strong rise in refi,” he said. “The big challenge for some of our non-bank competitors will come as the market turns away from refi.”

And while aggressive acquisition and construction lending for single-family homes helped fuel the last housing bubble, the lack of home building that followed has created an additional safeguard in South Florida, sources say.

“What’s different this time is it seems that home values are pushed up by lack of inventory,” said Kevin Hayes, senior vice president of residential lending at Davie-based Regent Bank, which has about $362 million in total assets. “If something comes along that is reasonably priced, there’s three people bidding on it right away.”