Without a doubt, the biggest news to break in Miami’s office market in recent memory came in December, when Spanish billionaire Amancio Ortega paid an incredible $516.6 million for the landmark Southeast Financial Center downtown.

The deal was a record-breaker for commercial property prices in Miami-Dade County, capping a year that had already seen a host of high-profile office towers trade hands.

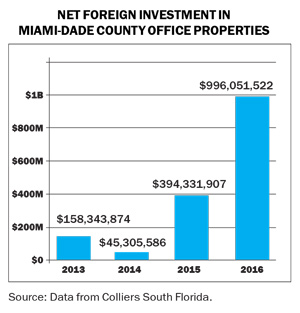

But the sale signified much more than just an eyepopping price tag. It came in the same year that Miami’s office market fetched more foreign dollars than any other commercial sector this cycle, with Colliers South Florida reporting the market raked in roughly $996 million worth of net investments alone, though that’s largely thanks to Ortega’s gargantuan purchase.

Miami’s top commercial brokers said the increased appetite for Miami office assets is being driven by deep-pocketed institutional investors abroad.

Major international players accounted for three of the five largest office deals in South Florida last year: Ortega’s Southeast Financial grab, Japanese trade conglomerate Sumitomo Corp.’s $220 million purchase of the Miami Tower and the Spanish family-owned Masaveu Corp.’s $175 million acquisition of a majority stake in the Courvoisier Centre on Brickell Key.

But will the trend hold in 2017? Some in the industry have expressed fears that political and economic turmoil abroad, as well as President Donald Trump’s foreign trade and immigration policies, will put a damper on activity. Many of these elements have already affected South Florida’s residential market.

However, others say that it’s exactly that uncertainty abroad — as well as over what Trump will do next — that is the main motivation for buyers’ rushing to place such large bets on the Miami office market. “Just about always, the United States is the safest country for [foreign investment]; the one with the most transparent laws,” said Hermen Rodriguez, a senior managing director with HFF who helped broker the Southeast Financial deal. “In times of volatility, it seems like most of the foreign capital wants to be in the United States.”

However, others say that it’s exactly that uncertainty abroad — as well as over what Trump will do next — that is the main motivation for buyers’ rushing to place such large bets on the Miami office market. “Just about always, the United States is the safest country for [foreign investment]; the one with the most transparent laws,” said Hermen Rodriguez, a senior managing director with HFF who helped broker the Southeast Financial deal. “In times of volatility, it seems like most of the foreign capital wants to be in the United States.”

It’s no surprise, then, that last year saw net foreign investment in the office market more than double from the $394 million spent in 2015.

It’s the type of climate that has Ortega, the world’s second-richest man, with a net worth pegged at $71.4 billion by Forbes, assembling a portfolio of trophy properties in major cities around the world.

In Miami, that influx of demand from overseas has certainly caught the attention of property owners. CBRE’s José Lobón said requests for marketing proposals have ballooned since the beginning of 2016, a signal that commercial owners are looking to test out what the market is willing to pay for their properties.

But it’s not just volatility abroad that’s piqued the interest of international investors. Lobón said the relative health of downtown Miami’s office market has made it an attractive bet to foreign investors.

A recent fourth-quarter report from CBRE stated office vacancies in the central business district had fallen to 11.6 percent by the end of 2016, their lowest level since 2009. And in another clear sign of recovery from the financial crisis, asking rents for Class A office space in the greater downtown area have reached $51.61 per square foot, surpassing the price peak of roughly $44 per foot set in 2008.

Those trends of rents swelling and vacancies shrinking are likely to continue, Lobón said, as speculative office development has only recently started to pick up. CBRE’s figures show developers have 964,000 square feet of office space currently under construction — still well below the 1.6 million square feet delivered in 2010, when office construction was at its peak. And considering the market chewed through a net total of 352,000 square feet in the fourth quarter alone, that influx of new space likely won’t cause a reversal in the decline of vacancies.

From left: José Lobón, Kenneth Krasnow, Hermen Rodriguez

Trump’s pledge to deregulate the financial industry could also act as a boon to leasing activity in the Miami office market, said Kenneth Krasnow, who heads Collier’s South Florida division. Banks, hedge funds and wealth managers already make up a significant portion of the tenant mix in downtown Miami, he said, and with fewer restrictions on the financial industry, they’re likely to expand their practices.

For investors, there’s also the question of pricing, said Krasnow. Foreign institutions looking to spend as much as Ortega or Sumitomo tend to shop around, he said, and it’s no secret that the Miami office market is a considerably cheaper option than New York City — another investment hot spot. He said the $516.6 million Ortega spent on the Southeast Financial Center could have easily translated to more than $1 billion for a similar property in New York.

Though the office market is on strong footing, Krasnow said he doesn’t expect to see the same leap in investment volume this year, compared with 2015 and 2016, mostly because of the Ortega deal, which Krasnow described as “once in a generation.”

However, there’s still plenty of anticipation in the marketplace for high-profile office trades to be struck this year.

Sources told TRD that Equity Office, a real estate investment trust that was bought out by the Blackstone Group in 2007 for $39 billion, is shopping around its 27-story 1221 Brickell Avenue office tower. On top of that, sources said Prudential Financial is quietly marketing the Sabadell Building at 1111 Brickell Avenue, for which it paid $184 million in 2013.

“It may not be at the same sort of record level it was,” Krasnow said. “But overall, the trend is still moving in the right direction.”