On television, real estate professionals flip homes and easily walk away with as much as $50,000 in profit — on a slow day. Or they sit comfortably in the shark’s chair like Barbara Corcoran, with a net worth of $80 million derived from launching and selling what is now one of New York’s largest real estate companies.

But in real life — and particularly in South Florida — competition is fierce and every dollar is hard-won. As the sluggish residential luxury market limps along with an excess of inventory and the commercial market sees tenant incentives galore, real estate pros are working overtime for their money.

Fewer buyers, more product coming online and the impact of Hurricane Irma have made 2017 a particularly challenging time for residential sales, luxury agents told The Real Deal. The frenzy of activity the area experienced in recent years has quieted, and sales have become ultra-price sensitive. “It is definitely harder to sell homes right now, and it’s more expensive,” said Jill Eber, a top broker and one half of the power duo behind the Jills, a Coldwell Banker Real Estate team. “You have to market more … We are using whatever tools we need to use — videos, drones, the internet — whatever we have to do to stay ahead and service clients.”

Meanwhile, commercial real estate is plugging along, neither doing abysmally nor posting much news to write home about. Overall, sales activity has slowed from 2015 highs, but rates in some commercial sectors, like industrial and office leasing, are up slightly.

Meanwhile, commercial real estate is plugging along, neither doing abysmally nor posting much news to write home about. Overall, sales activity has slowed from 2015 highs, but rates in some commercial sectors, like industrial and office leasing, are up slightly.

TRD spoke with industry veterans and dug into public records to get a sense of the incomes across a dozen of the more popular fields in residential and commercial real estate, and to gauge the effects — if any — the market slowdown is having on earnings. There are caveats to our findings, of course. With commission-based occupations, income can vary by the size of deals conducted, how fees are structured and level of experience. Other jobs in real estate offer salaries, which can also differ hugely from firm to firm.

Residential sales and rental agents

Star sales brokers may continue to pull in eye-popping commissions, but they’re also paying out a growing share of them to the teams of assistants, marketers and other agents who help them find buyers. It’s an increasingly necessary expense, given that buyers are much harder to find today than they were in years past.

Luxury sales agent Karen Elmir leads a team of six in the Elmir Group for Cervera Real Estate. The team sells luxury homes in Coconut Grove and divvies up their commissions. “Everyone has a role: Two people do the showings, another does business development,” Elmir said. “I am the leader in front of the client, making deals.”

Each team operates with a different model as to whether and how they share commissions, but that isn’t the only thing that’s cutting into a broker’s bottom line. The cost of marketing tools also chips away significantly at take-home pay, brokers said.

It’s crucial to direct cash toward mining referrals, launching targeted marketing efforts and publicizing successes so that buyers see you as a specialist in their area and seek you out, said agent Rachel Herbert of Coldwell Banker. Those expenses, combined with the cost to make a house photograph- and internet-ready, come out of profits. “Usually, the investment does pay off,” she said.

Eber said that in the current market, in which luxury homes are taking longer to sell, some owners are cutting their prices, which also means a smaller commission for the real estate agent.

Most agents split their 3 percent commission 50-50 with their brokerage. However, top agents are able to negotiate better terms with their firms for a larger split for themselves.

“Some agents won’t show homes if the commission is under 3 percent,” said Michele Diamond with United Realty Group in Plantation, who works the middle market, homes priced between $200,000 and $600,000. In that price range, demand now exceeds supply, which has made the dynamics challenging. And some sellers want to cut out the agents altogether and sell properties themselves, or offer only 2.5 percent to the agent, Diamond said. In South Florida’s new condo developments, developers pay their in-house sales agent 1.25 percent of the unit’s sale price, sources said.

Many sales agents also work the rental market. Some agents, however, exclusively handle rentals. The annual income of a rental agent is drastically less than a sales agent’s. A single rental for $2,000 a month — a $24,000 annual lease — might earn the agent a $1,000 to $2,000 commission in total (one month’s rent, or half that if the agent has to share with the landlord’s agent). The upside is that deals get done faster. “A beginning agent just starting out may do all rentals because the money is much quicker to come,” Herbert said.

The Bureau of Labor Statistics shows the average annual wage for a residential real estate broker — sales or rental — in the tri-county area was $73,000 in 2016. Residential agents, who must work for a brokerage to close a deal, earned slightly less, with an average income of $72,380. But that was an increase from the year prior, when the average was $68,610 in South Florida.

Broker/agent assistant

New agents often start out as assistants, working under a more seasoned mentor and handling open houses or showings. They learn the business from the pro, but they also earn a small piece of the senior agent’s commission.

Depending on the price of the homes sold, that small piece could be a couple of thousand dollars or as much as $10,000. “We leave that up to individuals to make a deal between themselves,” said Ron Shuffield, president of EWM Realty. “It’s a great way for new people to get started in our business.”

Depending on the price of the homes sold, that small piece could be a couple of thousand dollars or as much as $10,000. “We leave that up to individuals to make a deal between themselves,” said Ron Shuffield, president of EWM Realty. “It’s a great way for new people to get started in our business.”

So in a very loosely calculated scenario, if a wannabe agent has a deal with a senior broker who provides a cut of $5,000 per sale, and they sell eight homes together in a year, the assistant will net around $40,000 in commissions.

But not all assistants aspire to be agents. Some work on salary, usually around $25,000 to $35,000, and some firms also have office managers who earn $30,000 to $60,000, depending on required tasks.

Repositioning/bulk sales agent

With a continued glut of luxury condo inventory in Miami-Dade, there’s perhaps no job more necessary than a repositioning or bulk sales agent, who helps to sell off the remaining inventory in new developments by marketing units to local agents or by doing international outreach. Many repositioning agents earn from $24,000 to about $160,000 on a single sale, industry insiders said.

With a continued glut of luxury condo inventory in Miami-Dade, there’s perhaps no job more necessary than a repositioning or bulk sales agent, who helps to sell off the remaining inventory in new developments by marketing units to local agents or by doing international outreach. Many repositioning agents earn from $24,000 to about $160,000 on a single sale, industry insiders said.

Mark Pordes of Pordes Residential said this niche can be very lucrative at this point in the cycle. He said the broker earns a 3 to 4 percent commission on each sale. His firm will set up on-site and market residential units for the project owner/developer. Pordes’ agents sell beachfront residences for $2.5 million to $4.5 million and units in boutique buildings for $600,000 to $1.5 million. The on-site sales director earns a split of the commission from every sale as well. Pordes has four South Florida properties it markets at this time.

Commercial sales and leasing broker

The commercial markets are churning along, albeit at a slower pace than in recent years. The rate of retail leasing deals was down in the third quarter, according to a report from JLL, but the office leasing market remained strong over that time, according to a Cushman & Wakefield report.

Commercial brokers say overall activity is slowing down. “But it’s not stopping, and there is no crash coming our way in the foreseeable future,” said Jim Fried of Sandstone Realty Advisors in Miami. “Sales activity continues at healthy pace, just not at a breakneck pace.”

Commercial brokers say overall activity is slowing down. “But it’s not stopping, and there is no crash coming our way in the foreseeable future,” said Jim Fried of Sandstone Realty Advisors in Miami. “Sales activity continues at healthy pace, just not at a breakneck pace.”

Real estate professionals who work the commercial sector most often have a commission-based income, but brokerages differ on how they structure the splits. The bigger the firm, the more ways the fee is split, often with market research and support staff also getting a share, sources said.

In 2016, 20 commercial sales closed for more than $100 million each in South Florida, Fried said. The broker or team selling a $100 million property could earn a commission of about $1 million. However, commercial sales brokers can at best expect to close a handful of sales per year — in a good market. And then they have to split the commission with the brokerage and the rest of their team.

Most new brokers start out by providing support to senior brokers and typically earn a base salary. Eventually, the broker will ease into a commission structure. By the third year, the agent should be in the six figures, Fried said.

There are many more leasing agents than sales brokers, and in leasing transactions, the agent gets paid at the origin of the lease and again at renewal. “The agent and/or their firm may get 6 percent on initiation, 3 percent on renewal and 1 percent on the next renewal; however, it’s all negotiable,” Fried said.

Managers of commercial firms are typically compensated with a base salary plus a bonus based on the office’s performance. “In a significant market like Miami, that usually is a six-figure salary. It could be $150,000 or as high as $300,000 or much higher,” Fried said.

Developer

With big risk comes big reward for the canniest developers in South Florida. As the masterminds of residential and commercial construction projects, they must be able to withstand at least a couple of years with little to no income, since there is no cash flow from a project until it is complete.

In South Florida, success has earned some developers multimillion-dollar profits, particularly when the projects sell to real estate investment funds, sources said.

In South Florida, success has earned some developers multimillion-dollar profits, particularly when the projects sell to real estate investment funds, sources said.

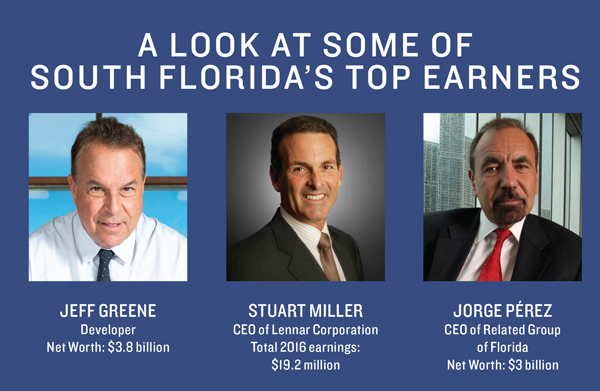

At Lennar Corporation, one of the country’s largest housing developers, CEO Stuart Miller received total compensation of $19.2 million in 2016, according to public filings. Lennar President Rick Beckwitt’s compensation was $17.19 million in 2016.

And then there’s Jorge Pérez, CEO of Related Group of Florida, which is known for its high-rise condo developments. Perez has a net worth of $3 billion, according to Forbes.

Of course, that’s not representative of what most developers make. Real estate attorney Brian Kopelowitz, co-founder of the law firm Kopelowitz Ostrow in Fort Lauderdale, said most South Florida developers operate on a small scale.

“There is a cottage industry of developers who buy dilapidated properties, fix them up and sell for a profit of about $20,000,” he said. “It’s a big piece of our economy right now and a big driver of closings.”

Architect

The last few years have been good for design professions in South Florida. Although the building boom has slowed some, there still are projects on local architects’ drawing boards in Florida, Latin America and the Caribbean.

Joseph Dobos, a Fort Lauderdale architect who designs custom homes, said because there are fewer homes for sale, some people are buying land and building, thereby creating work for independent architects who haven’t had much business in the last five years.

Joseph Dobos, a Fort Lauderdale architect who designs custom homes, said because there are fewer homes for sale, some people are buying land and building, thereby creating work for independent architects who haven’t had much business in the last five years.

Dobos said he gets paid per square foot for a home. In Miami, the per-square-foot charge for a residential architect ranges from $2 to $4, sources said. For commercial work, Dobos earns 3 to 4 percent of the total construction cost for a small-to-midsize commercial project. He is currently designing a $12 million multipurpose center in Broward County and earning a $360,000 fee.

In Florida, licenses are required for certain types of architectural design work. For example, an architect must hold licenses to design big projects such as a shopping mall, office building, hotel or apartment building. Having a license and years of experience will factor into salary. For example, a licensed senior architect with experience in an in-demand niche such as hotels could earn as much as $250,000 annually, said Kobi Karp, president of Kobi Karp Architecture and Interior Design in Miami.

In South Florida, there are more than 25,000 architects, who earned an average annual wage of $73,930 in 2016, according to Bureau of Labor Statistics 2016 employment data.

Real estate attorney

Over the last five years, demand for real estate attorneys has picked up, as have starting salaries, sources told TRD. Real estate attorney Kopelowitz said the demand and the increase in salaries are directly related to the activity in the residential market, which is significantly higher than a few years ago, even if sales themselves have slowed in the last few quarters.

“Interest rates are low, and it’s an attractive time to be a buyer or to refinance an existing loan,” he said.

“Interest rates are low, and it’s an attractive time to be a buyer or to refinance an existing loan,” he said.

At top firms, a new real estate lawyer can earn up to $160,000 a year, said Joe Ankus, owner of Ankus Consulting, a South Florida legal recruiting firm. At smaller, local firms, starting salaries are closer to $80,000, Kopelowitz said.

“A more experienced lawyer can earn in excess of $1 million at the partner level, but usually because he has a $3 million book of business,” Ankus said. “Once you are past the associate stage, law firms look at the clients you are bringing in and not just whether you are doing the work.”

Ankus said midlevel real estate attorneys earn from $175,000 to as much as $250,000.

“Compensation for midlevel attorneys is always going to be a function of their gross revenue. If they bring in $750,000 of revenue, they can earn 30 to 35 percent of it,” Ankus said.

Commercial mortgage broker/banker

In South Florida, commercial mortgage brokers who shop for loans with a number of banks are more common than mortgage bankers who work with only one institution, said Thomas Wood Jr., president of Thomas D. Wood and Company, a Miami mortgage banking firm.

Wood’s firm provides mortgage banking services for lenders. “The last three years have been steady — most of our business is in the $1 million-to-$20 million loan amounts, and there are more smaller loans to originate than larger loans,” he said.

Wood’s firm provides mortgage banking services for lenders. “The last three years have been steady — most of our business is in the $1 million-to-$20 million loan amounts, and there are more smaller loans to originate than larger loans,” he said.

Like most sales professionals, commercial mortgage brokers and bankers charge a commission for their services. They typically charge a “loan origination fee,” which is about 1 percent of the loan amount, paid by the borrower at closing. According to Indeed.com, mortgage brokers in South Florida earn an average annual income of around $77,700. The site found that mortgage bankers in South Florida make about $68,000.

Appraiser

It takes years to learn how to estimate the market value of a property — a complex process that factors in comps, property condition, size and neighborhood.

Britt Rosen, owner of Miami’s Brittex Appraisal Services, has been in the business for 25 years and has only gotten 12 people from trainee to state-certified appraiser over that time. “It’s an aging community, and there are not many young people coming in,” he said.

And there’s a threat to an independent appraiser’s bottom line: Mortgage companies are using appraisal management companies to manage the process. Most often, these companies dole the work out to a pool of qualified appraisers, but by being the middleman, they add a layer of oversight and take a cut. These companies take a percentage of the appraisal fee at closing, typically about 30 percent.

And there’s a threat to an independent appraiser’s bottom line: Mortgage companies are using appraisal management companies to manage the process. Most often, these companies dole the work out to a pool of qualified appraisers, but by being the middleman, they add a layer of oversight and take a cut. These companies take a percentage of the appraisal fee at closing, typically about 30 percent.

In Florida, an appraiser charges $250 to $400 for a basic appraisal. For a home involving complex issues, that fee can be as high as $700.

“Each job is negotiated,” said Rosen. A commercial appraisal that requires a narrative report can bring a fee of about $3,000. Rosen said his firm will complete two or three appraisals a week, often working in teams of two. Rosen also provides expert testimony for $300 an hour.

Appraisers and assessors of real estate earned a median wage of $55,480 in the tri-county area, according to the BLS.

Interior designers

In the aftermath of a luxury boom, the pace of business is changing for interior designers.

“We had good years and then slower times. We are still in an up cycle, but it’s slower,” said Steven Gurowitz, owner of Interiors by Steven G, a luxury interior design firm in Miami. Rather than working on new luxury condos and homes, designers at this stage in the cycle are employed mostly by people and properties for remodeling, he said.

“We had good years and then slower times. We are still in an up cycle, but it’s slower,” said Steven Gurowitz, owner of Interiors by Steven G, a luxury interior design firm in Miami. Rather than working on new luxury condos and homes, designers at this stage in the cycle are employed mostly by people and properties for remodeling, he said.

Some designers charge a flat fee for a project. Others charge by the hour, or a percentage of design materials secured. The American Society of Interior Designers stresses that there is “no such thing as a ‘typical’ … fee for an interior designer.”

Salaries for interior designers averaged $53,370 in South Florida in 2016, according to the Bureau of Labor Statistics.

Gurowitz said he believes that in Miami, the low end is about $50,000 and the high end closer to $250,000. “We stand toe to toe with big cities like New York, Boston and Atlanta,” he said.

Property manager

Property managers are the on-site team or individuals collecting rent and overseeing repairs or improvements to commercial or residential buildings.

Property managers are the on-site team or individuals collecting rent and overseeing repairs or improvements to commercial or residential buildings.

They typically earn on average 10 to 20 percent of the total rental income for a building. Some of the more difficult-to-manage properties may pay more.

Glassdoor.com, a job and recruiting site, estimates the average pay for a property manager with real estate skills in Miami at $57,371 per year. The BLS shows property and community association managers earned a median annual wage of $55,140 in the Miami Metro area.