While condo developers have long reigned as the kings of South Florida’s development world, new-apartment developers are starting to pose a challenge to the throne.

Large out-of-state investors such as Mill Creek Residential and Greystar Real Estate Partners — which is developing the Blu on Marina Boulevard Apartments in Fort Lauderdale — see the area as an attractive destination to build in, due in part to the area’s expected population growth.

And some of South Florida’s biggest developers, like Related Group, Terra Group and Mast Capital, are also building Class A trophy projects in Miami and Fort Lauderdale as the condo market has slowed down.

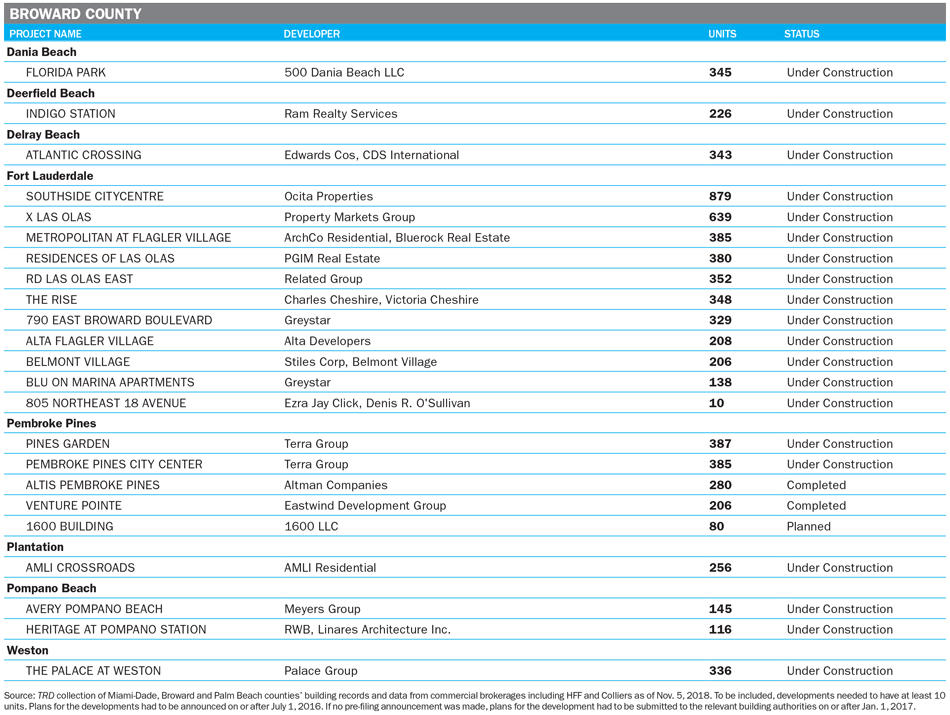

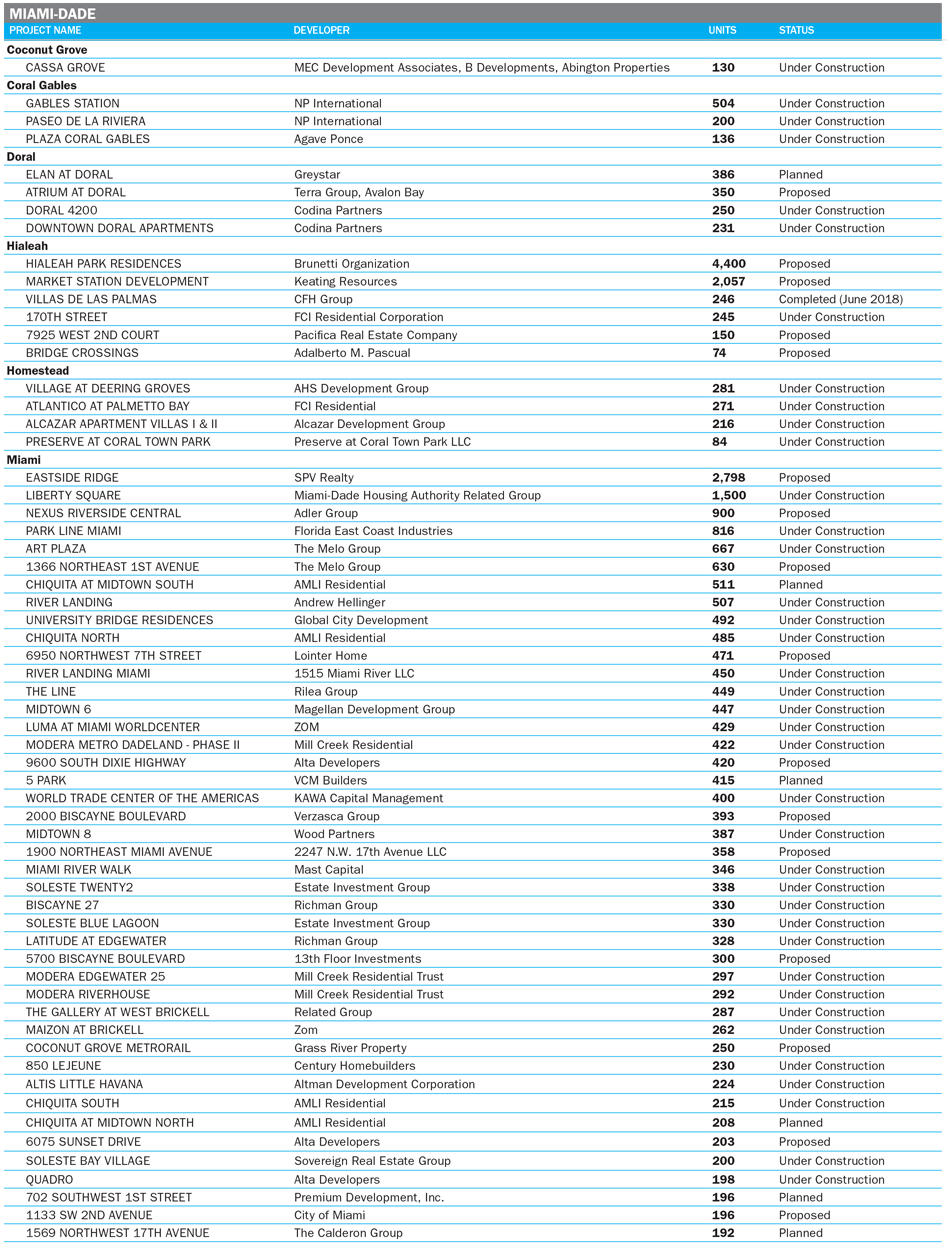

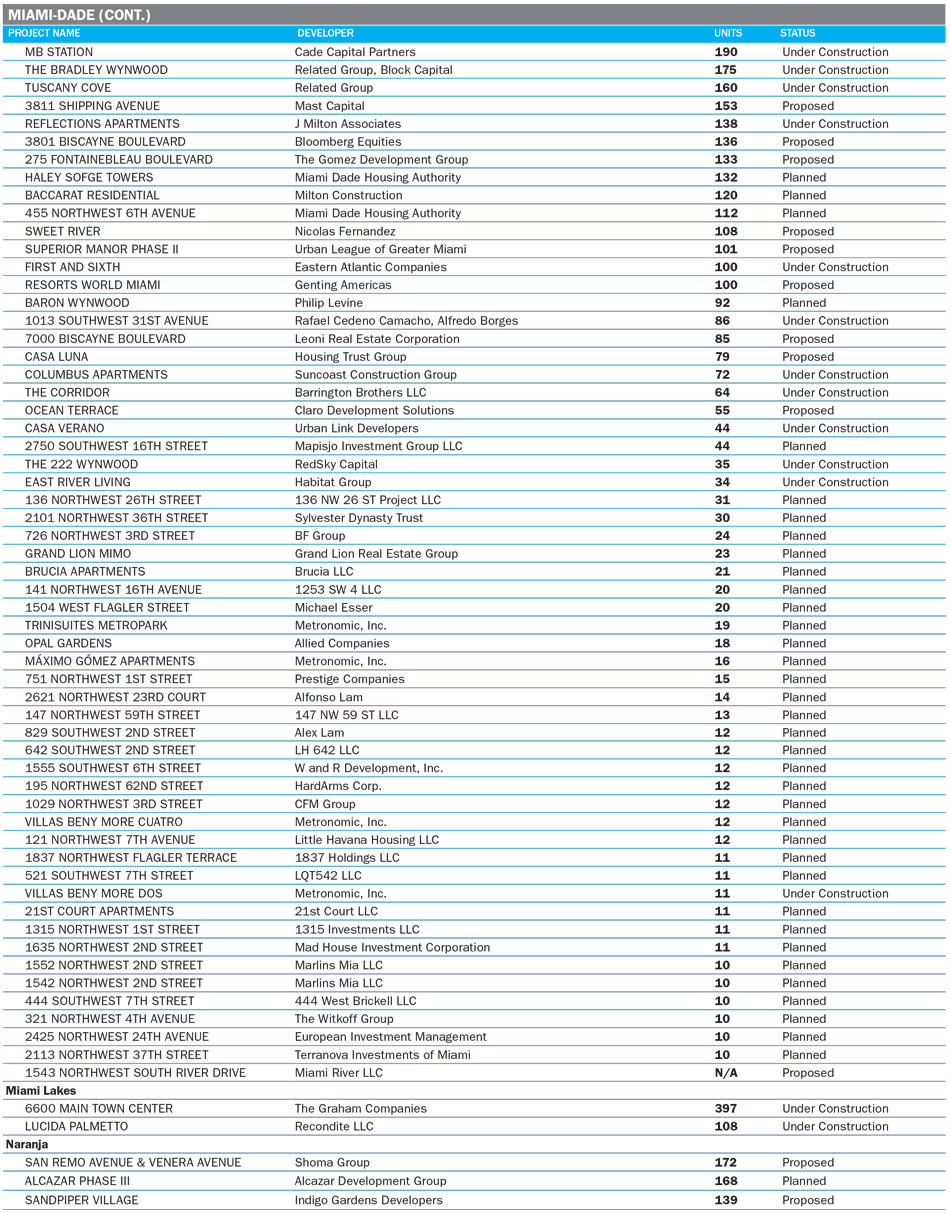

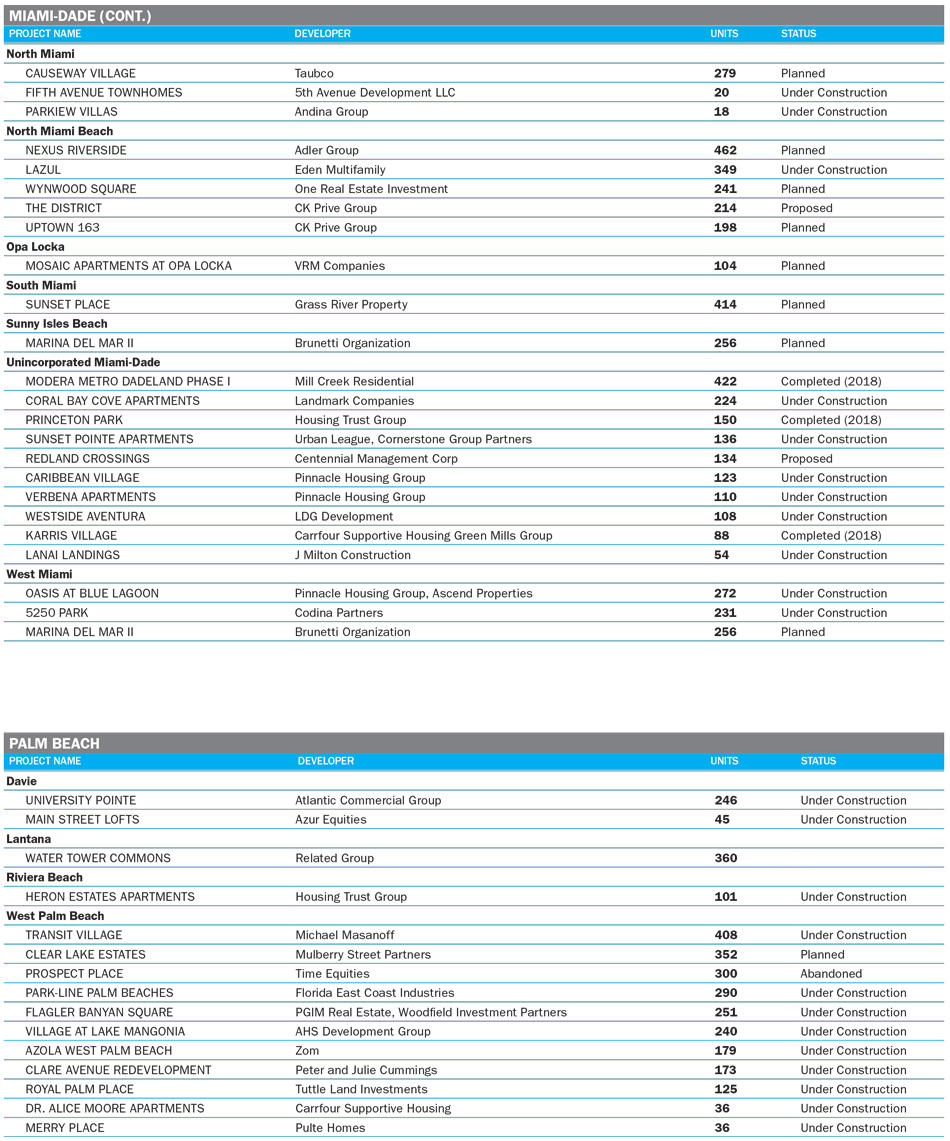

In total, there are now more than 51,000 apartment units in the pipeline in South Florida, according to an analysis by The Real Deal. This includes apartments that are proposed, planned or under construction.

Developers seem to be eyeing downtown areas in particular, banking on millennial professionals who are interested in living close to where they work. PMG’s under-construction X Las Olas project, a two-tower, 1,200-unit luxury apartment community in downtown Fort Lauderdale, is catering to this demographic’s preferences by offering co-working spaces as well as yoga and cycling studios.

The apartment development game is really a tale of two markets. There is the luxury market, where rents for one-bedrooms can reach over $2,000 and includes projects such as Florida East Coast Realty’s Panorama Tower. Then there is the workforce housing, where rents go for significantly less.

Some lenders and analysts have questioned the demand for these new luxury apartment buildings, as the area already has a reported six-year-plus supply of luxury condos. When these condo units can’t sell, many go on the so-called shadow market, putting these residences in direct competition with apartments.

Public policy experts and industry insiders across the board agree that the area needs more affordable housing. Related Group’s Liberty Square project on Northwest 62nd Street might be the most ambitious of these affordable housing projects. It’s expected to include a 40,000-square-foot grocery store, and more than 1,500 residential units, 15,000 square feet for local retailers, and a community and health center.

As interest rates continue to rise and home sales fall nationwide, some experts expect potential buyers to forgo buying altogether and to rent, which could be a huge boon to these apartment owners.

To create the list, TRD used county records and data from commercial brokerages including HFF and Colliers. Individual developers were contacted to confirm the status of their projects, but not all responded. Only properties with 10 or more units were included.