Storefronts are filled with new tenants, office occupancy rates are rising and new buildings are under development as Palm Beach County’s commercial real estate sector bounces back from the brink, experts say.

“Commercial real estate in Palm Beach County has recovered to near pre-recession levels,” Don Ginsburg, president of Fort

Lauderdale-based RMA commercial brokerage, told The Real Deal.

The commercial sectors in the suburban enclaves of Boca Raton, Delray Beach, Boynton Beach and Wellington, in particular, are rebounding, he said, following strong growth in the suburban residential markets.

“Retailers need rooftops and traffic counts to do development,” Ginsburg said. “They are reinvigorated to follow the residential population growth.”

That has translated into declining retail vacancies and new commercial development both under construction and in the planning stages, he said.

One example Ginsburg noted is Delray Marketplace in Delray Beach, which was completed during the downturn and is now thriving.

By the end of 2014, the development was showing strong occupancy of 90.4 percent, according to Brian Hector, regional manager of leasing for Kite Realty Group in Orlando, which handles leasing for the property.

Commercial activity is also on the upswing in the urban core of West Palm Beach, said Brad Capas, president of CapasGroup Realty Advisors, based in Fort Lauderdale.

“I think this will be a transformational couple of years for Palm Beach County, and downtown West Palm Beach in particular,” Capas said.

Rental complexes are under construction, and the few existing Class A office buildings in that area are at or near 100 percent occupancy, he said.

Demand is coming from both suburban relocations and new entrants from outside the region as financial services firms and other companies seek the South Florida lifestyle, and its attendant tax advantages, too.

Investors are also taking note. City Tower Place, an office building in West Palm Beach, set a new record for the city when it sold for more than $500 per square foot to an institutional investor in fall 2014, according to Capas. A new convention center and Hilton hotel are also under construction in West Palm Beach.

Meanwhile, downtown Boca Raton is going through a renaissance, with new apartment buildings in the works. A rental complex is also proposed for downtown Delray Beach.

“Residential is leading the recovery and creating the critical mass of people able to support the commercial development that we think will follow,” Capas said.

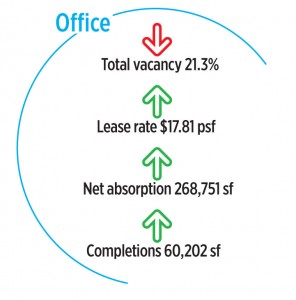

As a key indicator of the commercial sector’s rebound, office space absorption surged during the fourth quarter of last year, said Jonathan Satter, principal and managing director of Avison Young in Palm Beach County. “There is an acceleration in the appetite for office space,” Satter said.

Absorption resulted in vacancy rates as low as 14 percent across all classes at the end of the year, he said. That’s a sharp decline from late 2011, when vacancy rates approached 28 percent, according to figures from CBRE. Without much new space coming on line, Class A and Class C space have shown the lowest vacancy rates of all.

That, in turn, has caused tenant incentives — and options — to nearly disappear.

“If you wanted Class A waterview space in downtown West Palm Beach, your choices would be very limited,” Satter said. “Two years ago, there were a lot more choices.”

Absorption is also picking up speed in the suburban office markets. And now that vacancy rates are down to a “manageable level,” Satter said new office developments are emerging in places like Palm Beach Gardens, Boca Raton and Wellington.

“We’re certainly back to a timeline of 2004 or 2005,” he said. “We’re in a stronger marketplace today.”