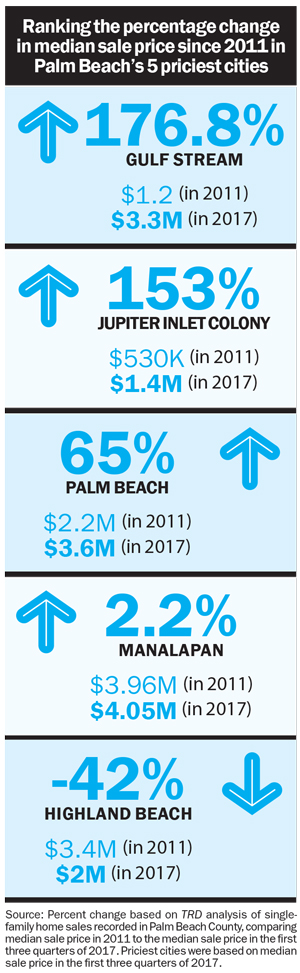

Local developers and brokers say the gold-plated bubble of Palm Beach real estate won’t pop any time soon, as the mega-wealthy continue to park their millions in the area, spurring both new construction and interest in pedigreed homes — or at least, the land they sit on — at the highest end of the market.

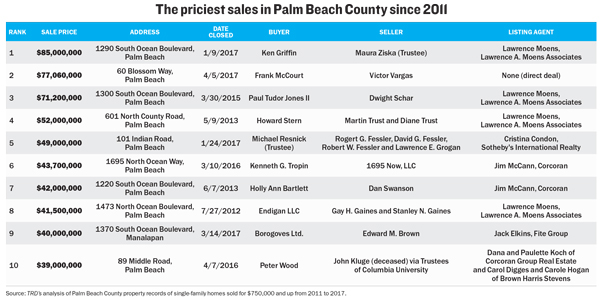

In this real estate cycle, spanning the years 2011 to 2017, buyers invested more than $540 million in the county’s top 10 priciest home sales alone. Notably, six of those top 10 deals closed between 2016 and 2017, including an $85 million off-market transaction involving the manager of one of the largest hedge funds in the world.

That January 2017 deal, in which Citadel founder Ken Griffin purchased property on South Ocean Boulevard, also made history as Palm Beach’s second-highest-priced single real estate transaction ever recorded. The number one Palm Beach County deal of all time — $95 million for an estate sold by a then-private citizen Donald Trump to Russian billionaire Dmitry Rybolovlev — took place in 2008, as the financial and housing markets were about to spiral into the Great Recession.

Despite the boom, bust and recovery cycle of past decades in South Florida real estate, demand for ultra-high-end estates isn’t raising fears of a precarious pricing bubble among the industry professionals The Real Deal spoke with this quarter. On the contrary, they said that the activity of luxury spec builders in the area and the big ticket sales of the past few quarters signal a healthy market that’s keeping a steady pace after the robust escalation of the past several years.

“Beginning in 2011, it was like someone turned the faucet on and all hell broke loose. There was a lot of pent-up demand and people basically waiting for the market to start to take off again,” said Corcoran Group agent Dana Koch, who co-listed the 10th priciest transaction on TRD’s ranking, 89 Middle Road in Palm Beach, which sold for $39 million. “This year there have been probably a dozen sales north of $30 million, so it’s pretty significant,” he added.

“Beginning in 2011, it was like someone turned the faucet on and all hell broke loose. There was a lot of pent-up demand and people basically waiting for the market to start to take off again,” said Corcoran Group agent Dana Koch, who co-listed the 10th priciest transaction on TRD’s ranking, 89 Middle Road in Palm Beach, which sold for $39 million. “This year there have been probably a dozen sales north of $30 million, so it’s pretty significant,” he added.

TRD analyzed deeds recorded in the county from January 1, 2011, through October 31, 2017, in order to rank the priciest home sales. Department of State records and news reports were used to determine the true owners, where available. In a few instances, the parties were obscured behind LLCs. Price per square foot for these top 10 properties ranged from $2,124 to a high of $6,774 for 89 Middle Road.

Ron Lennen, a broker associate with Premier Estate Properties and president-elect of the newly merged Realtors of the Palm Beaches and Greater Fort Lauderdale, said the single-family home ultra-luxury market in Palm Beach County is stable and should remain so “for at least the next year, unless anything drastic happens with world events.”

But despite the optimism on the ground, the market has seen at least one not-so-promising stat as of late for the Town of Palm Beach. A third-quarter report from Douglas Elliman showed that year-over-year, Palm Beach luxury — defined as the top 10 percent of the market — saw a 21 percent drop in median sales price, to $7.7 million. However, the number of deals was up 14 percent in the town that same period while the number of average days on the market was almost unchanged from the previous year. The ultra-luxury market is not tracked separately. Pascal “Pat” Liguori — another broker associate with Premier Estate Properties — said that over the past year or so, he’s seen luxury properties in Palm Beach County taking a bit longer to sell and noted that there’s more of a gap between list and sales prices, estimating anywhere from a 10 to nearly 15 percent difference.

“The market is leveling, stabilizing,” Liguori said. “If anything, it will stay this way for a couple years and then go up, not down. It’s maintaining a nice equilibrium between properties going on the market, properties going off the market.”

The relative abundance of inventory in the luxury market compared to lower price points requires realistic pricing as well as staging that mirrors the demand for contemporary homes with a “coastal, fresh, beachy feel,” Lennen said.

In several cases, the older palatial estates have undergone extensive renovations or been completely demolished after purchase to make way for modern updates.

In several cases, the older palatial estates have undergone extensive renovations or been completely demolished after purchase to make way for modern updates.

The number one property on TRD’s list, 1290 South Ocean Boulevard, was purchased by hedge fund titan Griffin, who paid his neighbors Linda and Paul Saville $85 million simply to continue assembling land along Palm Beach’s Billionaire’s Row.

Represented in his deals by Lawrence Moens of Lawrence A. Moens Associates, Griffin had already acquired contiguous properties in 2012 and 2015, spending roughly a quarter of a billion dollars to amass over 12 acres. According to news reports, Griffin will not live in the existing mansions but instead build “a large residential estate with a single-family home straddling three lots.” Moens, who was involved in four of the top 10 Palm Beach sales of this cycle, declined to comment for this article.

Two years after paying more than $71 million for the third priciest property on the list, Griffin’s neighbor Paul Tudor Jones II — founder of Tudor Investment Corporation — is reportedly pumping another $6 million into upgrades for his Casa Apava property at 1300 South Ocean Boulevard.

“People want new; they want state of the art,” Koch said. “The market that’s actually done the best is the new construction.”

When you factor in rising labor and material costs, Liguori said, new construction has a “drag effect,” helping to raise prices for the entire luxury market.

“Basically, the last couple years have been record years,” he said.

Koch agreed. “I’m more optimistic about this season than last season,” he said. “You can just see people’s attitudes and how the deals are coming together.”

Koch pointed to recent activity from prominent luxury spec home builders like Pat Carney and Mark Timothy, Inc. as further evidence for his confidence.

“There’s a handful of developers who are truly bullish on the speculative market,” he said. “They’re paying anywhere from mid-teens for land on the Intracoastal to in the $30 million-dollar range for oceanfront land, and they plan to put up spec houses there, so they have to be feeling pretty good with regard to the high end of the market.”

Carney developed the home that brought in the cycle’s sixth highest price point. Through a revocable trust, financier Kenneth Tropin, founder and chairman of the Graham Capital Management hedge fund, paid $43.7 million in March 2016 for 1695 North Ocean Way in Palm Beach.

Mark Pulte, of Mark Timothy, built two new contemporary-style homes in Palm Beach, one at 1330 South Ocean Boulevard and the other at 6 Ocean Lane. He sold the former for $36 million in September 2016. He sold 6 Ocean Lane — which he’d acquired for $12 million in 2013 — to former Fox News CEO and Chairman Roger Ailes for $31.6 million in March 2017, less than a year before Ailes’ death.

With the exception of 1370 South Ocean Boulevard in Manalapan, which sold for $40 million in March 2017, all of the top 10 priciest properties were located in the exclusive town of Palm Beach.

Developer and builder Todd Michael Glaser, a Miami Beach native, said he’s been going to Palm Beach since childhood, but until recently, he never imagined he’d buy property there. After making his career building mansions in Miami Beach and working on high-profile projects such as Zaha Hadid’s One Thousand Museum, Glaser told TRD he’s now looking at a “plethora of stuff” that could be renovated in Palm Beach. He said what’s available in the town reminds him of the golden opportunities he saw in Miami Beach in the ’90s, “when people who had bought in the 1970s began selling their luxury properties.”

Thanks to a wave of owners “aging out,” he said, a number of larger Palm Beach estates that hadn’t been available for decades,

if ever, began coming online around 2013. Glaser said significant “percolation” in Palm Beach in 2015 and 2016 has produced a solid “foundation of buyers” he believes will contribute to an uptrend.

The cycle’s top purchases, particularly those Griffin has been making, remind Glaser of the long-ago era when Vanderbilts and DuPonts erected estates in Palm Beach, except that yesterday’s industrialists have given way to today’s internet scions and investment royalty. “These are the wealthiest people in the world,” Glaser said. “They could have picked anywhere in the world to live. They’re building estates again for the first time in 100 years.”

But although some, including Griffin, have been accumulating estates, others have been strategically dividing them. Rybolovlev, who bought the record-holding $95 million estate at 515 North County Road in Palm Beach, ultimately demolished the mansion and subdivided his 6.26-acre property into three parcels, selling the largest plot in 2016 for $34.3 million, according to the Palm Beach County Property Appraiser.

British insurance tycoon Sir Peter Wood — who bought 89 Middle Road for $39 million in 2016 after the property had been listed for almost five years at $59 million — reportedly may subdivide his acreage for resale.

It’s a strategy that mirrors the times, Koch said. “Instead of building one large house and one large estate, it’s trended to be a little more manageable, a little smaller,” he explained. “People want to make their lives a little easier.”

In addition to putting down residential and professional roots in the area, noted billionaires have been building such permanent infrastructure as the high-tech schools founded by William I. Koch (no relation to Dana Koch) and Jeff Greene in 2011 and 2016, respectively, to benefit their own offspring and those of others in their community.

“The buyer pool has gotten significantly younger in Palm Beach, and we’re seeing a lot of younger families move here, especially from the Northeast,” Koch said, adding that he’d logged his highest annual sales volume to date already this year.

Depending on what happens with the federal tax plan, Koch believes more of the ultra-rich could be flocking to these parts. Already an attractive place to “land bank” money, he said aspects of the tax plan might give the ultra-wealthy in states with less favorable rules even more incentive to “jump ship and not only move their families but their businesses down to Florida — Palm Beach in particular.”