What does it mean to go “above and beyond” to close a sale? For one broker, it was a matter of ferrying a buyer who, post-back surgery, needed a ride to the airport.

“The associate picked up her from her hotel, carefully helped her into the car and brought her to the airport to get the [closing] documents signed prior to the flight taking off,” said Nancy Klock Corey, Coldwell Banker’s regional vice president of Southeast Florida, who manages the Miami Beach office in addition to her regional role.

Chauffeur is just one of the many hats a broker might wear while working to close a deal. “There’s a hundred different things the sales associates face. Negotiations get difficult,” Corey said. “They start early in the morning and work late at night.”

In a market that is not as bustling as it once was — and which may see more sluggishness in the aftermath of Hurricane Irma — the residential brokerages that are doing better than the rest attribute their success to the resources they provide to their clients, like financing tools, and those they provide to agents — including coaching on sales techniques and exclusive intel on foreign markets, pricing and style trends. They also seek to cultivate in their brokers the sort of anything-it-takes attitude that earns the loyalty of a dwindling pool of buyers.

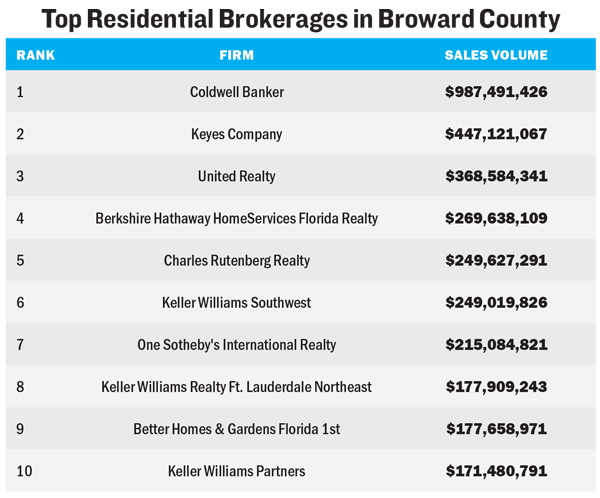

That approach seems to be paying off for Corey’s firm, Coldwell Banker. In Broward County, the firm was at the top of the heap, according to The Real Deal’s ranking of residential brokerages, with just over $987 million in sales in the county over the last twelve months.

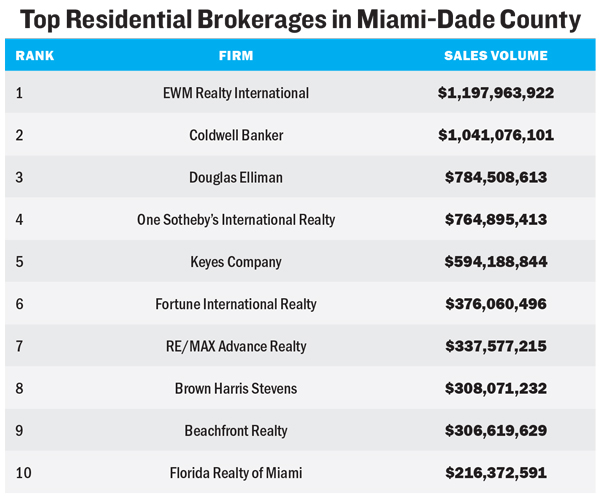

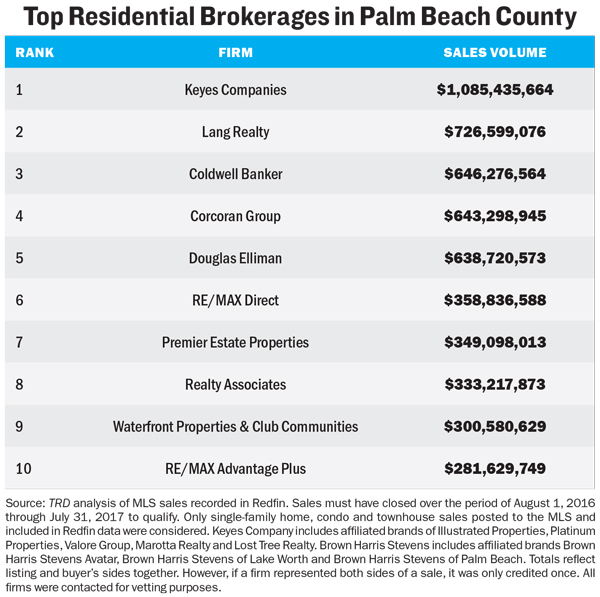

To rank the top brokerages of Miami-Dade, Broward and Palm Beach counties, TRD analyzed brokerages’ total sales volume over the last twelve months using data pulled from Redfin, which compiles MLS data. Only single-family home, condo and townhouse sales posted to the MLS were considered. Most new development sales, which are rarely put in the MLS, were not included, resulting in lower numbers for firms that heavily focus on new condo projects. Firms received credit for every sale they participated in, whether on the listing or selling side. However, when a firm represented both sides, each sale was only counted once. As a result, the sales figures in TRD’s ranking were lower than what appears on the MLS. All firms were contacted.

Corey told TRD that Coldwell — which ranked second in Miami-Dade with just over $1 billion in sales and third in Palm Beach County with about $646 million in sales — communicates with its offices in countries like Italy and Turkey via Whatsapp to find out what’s happening and how that will impact the South Florida market, the brokerage and its agents. This is one of the advantages the large firm has over other brokerages, she said.

She’s also on the phone with her 19 South Florida offices on a weekly basis, tracking what’s selling and what’s not. “Sometimes, what’s moving is style — clean or modern — and some of it is price-sensitive,” she said.

In uncertain times, a wealth of data also helps EWM Realty International, which reigned supreme in Miami-Dade county, with over $1.19 billion in sales, according to TRD’s ranking.

As a self-described “numbers guy,” EWM President Ron Shuffield is forever tracking the absorption rates of inventory for both condos and houses in addition to keeping an eye on the price brackets that are selling best. He’s also quick to detail employment and population stats to help sell South Florida to buyers and agents.

Shuffield recently created a research position to look at the “big data picture.” Speaking before Hurricane Irma struck, Shuffield said he wasn’t fazed by the current slowdown. “We know how to prepare and when to make adjustments with pricing and marketing,” he said. “The markets change weekly. People get anxious.”

Support is key to quelling broker worries, he said. The company holds weekly sales meetings lasting about 45 minutes, and the company’s offices are staffed with managers who don’t sell real estate — for the most part — to ensure that they’re focused on helping EWM’s agents, not competing with them. The firm hosts lunch-and-learns and webinars for its brokers. It also publishes a monthly currency overview report internally, to show the brokers what’s happening in the minds of international buyers.

Coldwell Banker, too, focuses on boosting its agents’ skills. The brokerage offers long-term financial planning via webinars, one-on-one sessions and individual training. All new associates are put through a four-week training program. Top producers, like Jill Eber and Jill Hertzberg of the Jills, have access to a VIP program and a coach. Corey is also in charge of coaching the Jills, which includes pushing and redirecting them, as well as getting out of their way when needed.

On the flip side, firms that lack the heft of a national name brand use their boutique status to their advantage when it comes to attracting top talent. Beachfront Realty owner and broker Ed Roberts, for example is proud to distinguish his firm — ranked ninth in Miami-Dade with nearly $307 million in sales — from the larger players. Beachfront is “the opposite of a lot of major franchises like Keller Williams and Coldwell Banker,” he said of the company, which has three offices, including one on 41st Street in Miami Beach and one in Pembroke Pines.

Roberts said that he makes himself available to his agents seven days a week and claimed that Beachfront offers more one-on-one support than any other company. The brokerage “doesn’t really have meetings,” unless an annual party counts, he said. It sends out a Monday morning newsletter geared at informing agents of what’s happening in the market and at Beachfront, in addition to offering online training for contracts, listings, mortgage classes and more.

Roberts said he has at least 500 agents who have been with Beachfront for more than 15 years, and attributes their longevity to a balance of independence and support — if they need it. He’ll also give advances on commissions if an agent is down and out. “We treat [brokers] as customers. We need them, so we treat them accordingly,” he said. “They all love us because we don’t monkey with their money. We pay instantly. They walk in with a check, they leave with a check.”

Based in Aventura, Beachfront charges zero fees to its agents and does not recruit them, Roberts said. The firm takes on about 300 agents a year and is up to nearly 2,000 agents. “Everybody who joins us is by word of mouth,” Roberts said.

Attractive commission splits certainly sweeten the deal. Beachfront agents receive 90 percent commissions on most deals, which is higher than the industry standard of about 75 to 80 percent, he said. “I owned a Century 21 franchise in a prior life, so I understand the mentality of Realtors. They don’t like working their asses off and getting 75 percent,” he added.

United Realty Group, ranked third in Broward with over $368 million in sales, is among the few brokerages in South Florida that offer agents full commissions with a flat per-transaction fee. Charles Rutenberg Realty, ranked fifth in Broward with just under $250 million in sales, offers full commissions as well.

Another top 10 firm, Fortune International Realty — which ranked sixth in Miami-Dade with about $376 million in sales volume — accentuates its broker support as a factor that distinguishes it from other firms. “We’re just not a big company or big franchise that doesn’t know their agents. I know them personally, my wife knows them personally,” President Edgardo Defortuna told TRD.

The company has weekly office meetings and lunches, and it hosts focus groups for its 800 agents. In a slow market, Fortune doesn’t have time for agents who “treat this as a part-time job,” Defortuna said.

And to better compete with the likes of Coldwell Banker and EWM, which are owned by Realogy and HomeServices of America, respectively, South Florida’s homegrown brokerages like Fortune International Realty are beefing up their extra services.

Fortune partnered with Rialto Capital Management this year to launch a private bridge lending firm. “Anything that makes their decision to buy easier,” Defortuna said, stressing the importance of this in a slowdown.

Fortune and Rialto are about to hit the $100 million mark on loans since launching Vaster Capital in the spring. Defortuna said the joint venture is filling a need for foreign buyers seeking bridge loans due to weakened currencies in their home countries. “The one-stop shop is very important for the buyer,” Defortuna said. “We have to really cater to every potential buyer because the urgency to buy is not there anymore.”

Fortune, which is also one of South Florida’s biggest condo development and marketing firms, also offers property management services. On the brokerage side, the majority of its business comes from preconstruction.

But even the bigger firms are feeling the need to make moves that will keep them at the front of the pack. The rush of acquisitions by competitors like One Sotheby’s International Realty (ranked fourth in Miami-Dade with almost $765 million in sales and seventh in Broward with $215 million in sales) and Douglas Elliman (ranked third in Miami-Dade with about $785 million in sales and fifth in Palm Beach County with close to $639 million) has led Fortune International Realty to consider buying smaller firms (see TRD’s story on brokerage acquisitions on page 32).

But even the bigger firms are feeling the need to make moves that will keep them at the front of the pack. The rush of acquisitions by competitors like One Sotheby’s International Realty (ranked fourth in Miami-Dade with almost $765 million in sales and seventh in Broward with $215 million in sales) and Douglas Elliman (ranked third in Miami-Dade with about $785 million in sales and fifth in Palm Beach County with close to $639 million) has led Fortune International Realty to consider buying smaller firms (see TRD’s story on brokerage acquisitions on page 32).

However, Defortuna said that ultimately, Fortune would rather grow organically because the expense associated with acquisitions can outweigh the benefits.

But if you can’t acquire other firms wholesale, some good old-fashioned broker poaching works. Corcoran Group, a powerhouse in the New York City market, ranked fourth in Palm Beach County with over $643 million in sales but does not operate in Miami-Dade or Broward. The firm, while owned by Realogy, is independently managed and run by CEO Pamela Liebman. It focuses mostly on waterfront condos and homes in Boca Raton east of Interstate 95.

Bill Yahn, a Corcoran regional senior vice president, said he reaches out to top agents at other firms “every day.” The firm, which has about 140 full-time agents, is considering opening a third office in Palm Beach County. Yahn declined to provide commission splits but said they’re in line with the market.

He added that the firm is fortunate that “most of our clientele for Palm Beach County is ultimately coming from the New York City area.”

On the island of Palm Beach, Yahn said, its biggest competitor is Sotheby’s International Realty. In the coastal markets of the county, Premier Estate is Corcoran’s toughest rival, he said.

In Palm Beach County, Premier ranked seventh with over $349 million in sales, while Sotheby’s didn’t make the top 10. Leading the ranking was the Keyes Company, with $1.09 billion, followed by Lang Realty with nearly $727 million. (Keyes’ self-reported sales numbers in the three counties were higher than those found using TRD’s methodology.)

In addition to mergers and acquisitions, Keyes has remained a top competitor by offering the industry’s slate of services – mortgage, title, property management and insurance — said Keyes’ owner, Mike Pappas. The brokerage purchased Illustrated Properties about a year ago, propelling Keyes right to the top of TRD’s ranking of firms in Palm Beach County.

The industrywide trend toward ever-increasing commission splits is what made Keyes start gobbling up smaller brokerages over 15 years ago, Pappas said, going on to explain that “100 percent companies” have thousands of agents and have stripped out all of the components of a branch, offering full or nearly full commissions with basic services and flat fees. “The admin staff and rent is minimal. They’re attracting the lower producers,” he said.

But the firms that continue growing via acquisition don’t pose any kind of threat to local firms, EWM’s Shuffield said: “Unless UPS is going to start shipping houses, you’re still going to need some people.”

— Harunobu Coryne provided research for this article.