UPDATED, June 18, 11 a.m.: Construction cranes are filling up pockets of South Florida like Midtown Miami, Wynwood, Coral Gables and downtown Fort Lauderdale.

UPDATED, June 18, 11 a.m.: Construction cranes are filling up pockets of South Florida like Midtown Miami, Wynwood, Coral Gables and downtown Fort Lauderdale.

But instead of the glittering condo towers that the region is known for, developers are turning their focus to creating traditional multifamily buildings.

By the end of this year, 7,500 new apartments will be completed in Miami-Dade, marking the most active year for such construction since at least 2003, according to a second-quarter report from Marcus & Millichap. And developers aren’t slowing down. If anything, they’re adding projects in less expensive areas just outside of the region’s urban cores.

Despite the increase in construction, brokers and developers aren’t concerned with an oversupply of rentals. But the addition of thousands of units in areas like Midtown is expected to keep rent growth down. “The elevated level of completions will temper rent growth this year as monthly rates are anticipated to advance at a pace more in line with the national average,” according to the Marcus & Millichap report.

As a result, the vacancy rate is expected to near 5 percent in southeast Florida, the brokerage said. In markets like West Palm Beach, though, the vacancy rate is expected to fall due to a limited supply of traditional apartments.

READ RELATED STORIES

— Russell the Relentless: Inside the Crescent Heights developer’s grand plans for Miami

— Tech startup that makes Nest for multifamily landlords raises $32M

— Newgard, Crescent Heights launch Airbnb hotel-condo project in downtown Miami

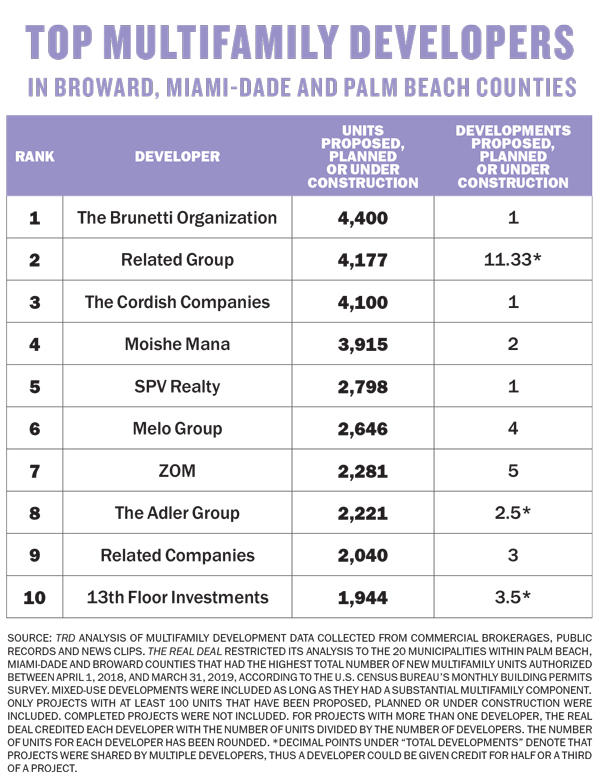

The Related Group, the developer with the second-largest number of units planned, proposed or under construction, according to a ranking by The Real Deal, has more than 11 projects with a combined 4,156 units.

The company is known in Miami as the city’s most prolific condo developer. Once that market began to crack, Related quickly pivoted to rentals, ultimately deciding to build its Icon Las Olas, a 44-story, 272-unit tower in downtown Fort Lauderdale, as multifamily rentals instead of condos.

“The condo market has slowed down quite a bit. The rental market has remained pretty steady, and we continue to grow jobs,” said Steve Patterson, president and CEO of Related Development, the company’s multifamily arm.

Over 30,000 units are in the works for just the top 10 firms in this ranking, which was restricted to the 20 municipalities in Miami-Dade, Broward and Palm Beach counties that had the most new multifamily units authorized by building permits issued between April 1, 2018, and March 31 of this year. The ranking excluded completed projects like Icon Las Olas. For projects that involve more than one developer, TRD credited each firm with an equal share of the total number of units in their shared project. When developers worked together, each got credit for half of the project.

Over 30,000 units are in the works for just the top 10 firms in this ranking, which was restricted to the 20 municipalities in Miami-Dade, Broward and Palm Beach counties that had the most new multifamily units authorized by building permits issued between April 1, 2018, and March 31 of this year. The ranking excluded completed projects like Icon Las Olas. For projects that involve more than one developer, TRD credited each firm with an equal share of the total number of units in their shared project. When developers worked together, each got credit for half of the project.

The market’s muscle

Developers continue to cite rapid population growth, a favorable tax environment and weather in South Florida as reasons to continue building. According to U.S. Census data, more than 900 people move to the Sunshine State every day, a fact that developers like to throw around.

“I think South Florida in general has really grown since the last cycle into a major market in this country,” said Daryl Shevin, chief financial officer of 13th Floor Investments, which placed 10th in the multifamily ranking. “The reason why that’s relevant is because capital is the driving force. There’s confidence that capital will be attracted to the offer [if the new owner wants] an exit.”

A handful of huge sales underscore this point. In March, TGM Associates, a New York-based real estate investment firm, paid $136 million for Broadstone Harbor Beach apartment complex in Fort Lauderdale, marking the largest multifamily deal of the year. That was topped two months later by the Blackstone Group’s $209 million purchase of two newly developed and adjacent apartment complexes in Doral.

Miami-based 13th Floor, which has more than 1,900 units spread across 3.5 projects in the works, builds rentals in transit-oriented areas near central business districts or areas with major employment centers, Shevin said. It’s co-developing the Link at Douglas, a major mixed-use project with more than 1,400 apartments next to the Douglas Road Metrorail Station at 3060 Southwest 37th Court in Miami, with the Adler Group (ranked eighth on TRD’s list with 2,220 units in 2.5 projects).

The phased development will include a workforce housing component, 25,000 square feet of retail space, a 250,000-square-foot office building and a public plaza that connects to the Underline linear park. The developers broke ground on phase one in April.

Shevin said the growth in submarkets like Dadeland, Brickell and Wynwood has fueled the multifamily boom in South Florida. In Greater Downtown Miami, which includes Brickell, Wynwood, Midtown, Edgewater and other neighborhoods in the city’s core, the rental market — both condo and conventional — “has been much deeper than many expected,” according to the Miami Downtown Development Authority’s annual report, released in May.

Rents remain stable in Greater Downtown Miami, which the DDA said is the fastest-growing rental submarket in South Florida. For the first time this cycle, as of April 2019, multifamily completions (over 6,300 units) exceeded what is currently under construction (roughly 4,000 units) in Miami’s urban core.

Despite the strength of the market, some of South Florida’s top developers may not break ground on their projects this cycle. The Brunetti Organization, No. 1 on TRD’s ranking, plans to build 4,400 apartment units on the site of the Hialeah Park Racing & Casino at 2200 East Fourth Avenue, but it is unclear when that would happen.

The third-ranked multifamily developer is also planning to build on a casino property, as the supply of available land continues to shrink. The Cordish Companies, a Baltimore, Maryland-based development and entertainment company, has proposed building 4,100 apartments at Isle Casino Racing Pompano Park, at 777 Isle of Capri in Pompano Beach.

Moishe Mana, who has yet to make significant progress on his lofty plan to build Mana Wynwood, followed Cordish with 3,915 units planned, at Flagler Square and at the Wynwood mixed-use project, the first phase of which calls for 4.68 million square feet of office space, showrooms, retail, hotels and public space spread across 8.5 acres.

Making the numbers work

To build a financially successful rental project in South Florida, a number of developers are looking to markets outside of the urban core to avoid sky-high land prices.

“We’re finding that land prices are just very high for the development of apartments,” said Andy Hellinger, a principal at Urban-X Group. “Sellers still have the mentality that their property can or should be at a condominium value, and that puts stress on the ability to build market-rate or more affordable types of apartments.”

Urban-X’s developers Hellinger and Coralee Penabad are building the $425 million River Landing Shops & Residences, which will have 528 apartments, retail and office space at 1600 Northwest North River Drive in Miami. The project is outside of downtown Miami but part of the city’s Health District, a major employment hub. Apartments will be priced below Brickell rents, Hellinger said.

Estate Investments Group, which has six projects totaling 1,785 units, also targets secondary markets like the Health District.

To compete, the company focuses on building units with “attainable rents,” said Jeffrey Ardizon, a principal at the firm. Across South Florida, the firm has some 3,400 units planned or under development in the Blue Lagoon neighborhood of Miami, West Miami, Palmetto Bay, Downtown Miami and Spring Garden.

“We believe the supply that’s out there now is just beginning to reach the demand,” Ardizon said.

The developer builds smaller units than others, which allows the firm to pack more into one project and lower the rents by about $200 to $300 a month. “That differential is a car payment,” he said. “Price sensitivity in this market is extremely important.”

Ardizon acknowledged that there are fewer opportunities in Miami, and said the company is looking to build outside of Miami-Dade County.

Melo Group, which ranked sixth with 2,646 units in the pipeline, has a similar strategy, rent-wise, building towers with one-bedroom units priced as low as $1,600 in Miami’s Arts & Entertainment District. Martin Melo, a principal at the family-owned firm, doesn’t see the market slowing down. The company hopes to break ground on Downtown 5th, a 1,042-unit, 55-story rental skyscraper at 501 North Miami Avenue, before the end of the year.

Conversely, the Related Group’s Patterson said his firm is focusing on lower-cost apartment development but at a lower density: “Most of our activity right now going forward in South Florida is in Palm Beach County. Palm Beach County happens to have more low-density land than Broward and Dade.”

Related is also busy with new rental projects in Tampa, Orlando, Atlanta, Phoenix, Houston and Austin. “Going forward, 40 percent of our production will be outside of Florida in the next 12 months,” he said.

Timing it right

Related and other developers are banking on a looming slowdown in the U.S. After a decade of economic growth, economists are warning that the country may be on the brink of a recession.

Patterson expects the rental market will be strong for the next several years, taking into account slow home sales.

Jerome Hollo, executive vice president of Florida East Coast Realty, said there’s a wide range of people renting, from young families to older couples. The development firm completed the ultra-high-end Panorama Tower, an 85-story mixed-use building with 821 luxury apartments, in 2018, and it is now about 70 percent leased.

Rents are on the higher end of the spectrum, ranging from $2,400 to almost $9,000 a month, Hollo said.

Now Florida East Coast Realty is looking at building a 600-unit rental development at 1771 Northeast Fourth Avenue in Miami, near Margaret Pace Park and Opera Tower, a condo building the firm developed. It also has a roughly 300-unit project planned for Hallandale Beach and is looking at building a smaller-scale rental project in the Coral Gables area.

While the firm is eager to move forward with its rental developments, it is taking a wait-and-see approach to its condo projects, like most other developers that have condos in the works. Florida East Coast Realty will co-develop The Towers by Foster + Partners, an 81-story, 1,049-foot tower at 1201 Brickell Bay Drive, along with Corigin Real Estate Group and McCourt Global Properties. The two-building development could include 660 luxury condos, along with a pedestrian plaza with shops, restaurants, and art galleries.

But Hollo said he has no idea when that project will move forward. “The market is going to dictate that,” he added.

In addition to Hollo, developers like Property Markets Group and Melo aren’t holding their breath waiting for the condo market to return.

Ryan Shear, a principal at PMG, is under contract to purchase an apartment site in Wynwood and has rental projects in Downtown Miami and Las Olas Riverfront in Fort Lauderdale.

“Miami had no multifamily 10 years ago, like zero, so we’re playing catch-up,” Shear said. “There might be a period of time, six months to a year [when there’s oversupply], but the population is only growing. And the city is moving from a pure condo city to a more balanced condo and multifamily city.”

Clarification: This article has been amended to reflect that Coralee Penabad is part of Urban-X Group.