Soft, challenging, slow, tough. Those are the adjectives describing South Florida residential sales of late, as external forces and oversupply at the high end cooled down the previously red-hot market.

As the market settled into its “new normal,” agents and sellers began putting their own spin on a relatively dismal reality. Email blasts and social media posts now proclaim “Massive $1,500,000 reduction,” “Major Reduction” and “Seller motivated. Bring offers!!!”

And the agents themselves are publicly acknowledging the market shift and the economic realities related to it: worries about the Zika virus, the continued strength of the dollar, the chaotic presidential election and a pileup of available high-end homes. Urged on by brokers, sellers who were attached to the peak prices of 2014 and 2015 but looking to finally close a deal began to slash their asking prices in 2016, albeit begrudgingly.

But while prices have adjusted, there’s still more inventory in the multimillion-dollar market in Miami than ever before, according to Ron Shuffield, president of Esslinger Wooten Maxwell Realty International. Sales are still down in both single-family homes and condos. “You don’t hear many people talk about months of supply … but it’s the most critical number in our industry,” noted Shuffield.

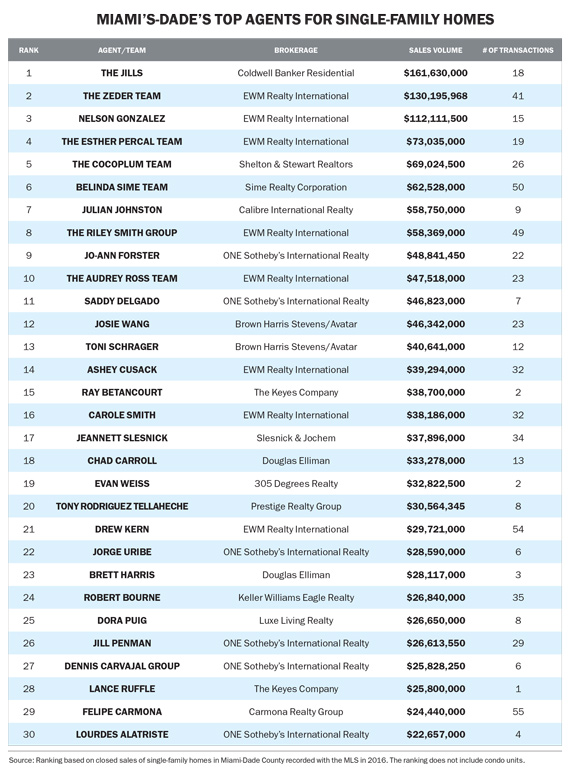

EWM broker Nelson Gonzalez, who ranked third on The Real Deal’s list of top residential agents based on volume of single-family-home sales in 2016, said the key to getting his sellers to bring down their prices is to keep them educated. “Obviously, everyone thinks their house is the Taj Mahal and they’re sitting on a gold mine,” he said.

At the top of TRD’s ranking are the Jills, Coldwell Banker’s power duo, Jill Eber and Jill Hertzberg, with nearly $162 million in sales volume over 18 deals. In second is EWM’s the Zeder Team, with $130 million of single-family-home sales spread across 41 deals.

The priciest residential closings of 2016 included a $25.8 million Coral Gables estate at 110 Arvida Parkway, which was listed for $35 million, and the Cocoplum home at 9 Tahiti Beach Island Road, listed for $28 million and sold for $23.5 million. Lance Ruffe of the Keyes Company listed the Arvida Parkway house, while Judy Zeder listed the latter.

Gonzalez closed 15 sales for single-family houses in 2016 totaling more than $112 million. Included in that is the $34.6 million sale of a Coconut Grove estate known as La Brisa, which had sat on the market since 2014. Ransom Everglades School, which lies adjacent to the waterfront property, was the buyer. La Brisa was originally listed with former Coldwell Banker agent William P.D. Pierce for an eyepopping $65 million. Gonzalez dropped the price to $47.5 million upon obtaining the listing in November 2015, then to $39.5 million before it closed in June of last year.

Beyond educating buyers, Gonzalez has had to get more creative in order to sell a house. “Until we burn off some of this inventory, we need to drop prices. Even 20 percent drops are still above the beginning of 2015 and 2014,” he said.

He’s negotiating a $10 million-plus deal for a Miami Beach property that comes with 800 bottles of wine likely worth several hundreds of thousands of dollars, and “they’re not taking any of this stuff back to Brazil,” Gonzalez said.

The general price slowdown has also meant that some previously overlooked areas, such as Lower North Bay Road and the Venetian Islands, have been rediscovered, Gonzalez said. He’s been selling more in the $5 million to $15 million range and said the very high end of the market is really lagging behind.

The price had better be right

The listing price has become the key selling point, regardless of a particular property’s location. Hertzberg said big price negotiations are “almost passé. Bring the price to where you want to sell it. People who are doing it are getting better results.

“We have to constantly be educating our sellers, providing them comparable sales and what’s happening … Because we had almost five years of the market going up, up, up.”

The Jills, who consistently have the highest sales volume in Miami, are also the agents for three of the top five most expensive lingering listings — properties that have been sitting on the market for more than a year. Of those, the priciest is 1 Casuarina Concourse in Coral Gables. South Florida auto magnate Alan Potamkin hired the Jills to sell the 3.6-acre waterfront estate in 2015, at the time listed for a considerable $67 million. The property, complete with a 1,500-bottle wine room, two built-in saltwater aquariums and an aviary, was reduced to $47.5 million in September but has yet to sell. The Jills declined to address rumors of the home being under contract, but even if it sold at its current price, it would mark a 29 percent haircut from the original list price.

But Hertzberg, Eber and others on the list all agree that there’s been more action in the market post-election.

“No matter who gets elected, there’s uncertainty in the market; buyers tend to wait,” Gonzalez said. “Normally in election years, that happens, but this year especially, we got a very good pop — five or six deals between Nov. 8 and the end of the year.” Call it the “Trump bump,” he said, using a phrase oft employed in the industry these days.

And maybe the upturn will turn out to have legs: Casa Clara, at 212 West Dilido Drive, sold this February for $22 million. While it was a record for the Venetian Islands (the previous was a $14 million sale in 2013), the house sat on the market for over a year before it closed at a nearly 40 percent discount off of the original $35.9 million asking price.

Nearby, in Miami Beach, a Barry Brodsky-developed mansion at 4555 Pine Tree Drive was finally sold in February for $22.6 million. The property, complete with a second-floor waterslide, had been on the market since January 2016 for $34 million.

Gonzalez and other luxury agents say despite Trump’s rather bumpy first few weeks in office, foreign buyers have taken things in stride. He’s working with a Mexican buyer who “could not be more insulted by President Trump” but still sees the U.S. —Miami, in particular — as a safe haven.

Buyers from Russia may also be empowered by a Trump presidency to again start buying property in South Florida. The Miami Association of Realtors reported this year that Russia had risen to the top of the list of countries looking for South Florida properties using the organization’s website in November — a first since the organization began tracking the metric in 2009.

The Jills noted that 2016 had “the perfect storm” of challenges before the election. “We still have foreign buyers, but not like before,” Eber told TRD. “A lot of our market was Brazil, Venezuela, Argentina, and so that kind of turned off. We really started dealing with domestic buyers.”

Last year, a large swath of Miami Beach was temporarily declared a Zika zone, which struck nearby hotels, restaurants and retailers with a vengeance. “I actually think Zika affected our market more than the campaign,” Eber said. “Because people were fearful.”

Last year, a large swath of Miami Beach was temporarily declared a Zika zone, which struck nearby hotels, restaurants and retailers with a vengeance. “I actually think Zika affected our market more than the campaign,” Eber said. “Because people were fearful.”

Julian Johnston, owner and broker of Calibre International Realty, said he closed more than $105 million in sales in 2015. Last year, he sold just under $59 million of single-family homes, spread across nine deals. That puts him at No. 7 in TRD’s ranking, preceded by the Belinda Sime Team at Sime Realty Corporation at more than $62.5 million last year and the Cocoplum Team at Shelton & Stewart Realtors at No. 5 with $69 million.

Johnston believes the sales activity for luxury homes is starting to pick up. Anything new that comes on the market is “actually getting priced correctly,” and even if a property is too expensive, asking prices are always negotiable. Even so, he’s diversified and started a side business, a fast-casual restaurant group based in Miami Beach.

While many say sales are picking up as pricing acclimates, there are some properties that seem to simply refuse to move. Among the biggest price reductions of 2016 was the $6 million haircut — a 32 percent reduction — for 94 La Gorce Circle, also known as Lil Wayne’s house. Originally listed in 2015 for $18 million, the Miami Beach mansion has not been able to sell. Ty Forkner of One Sotheby’s has the listing, now priced at $12 million.

Also included in the top 10 price reductions of last year was 16 Palm Avenue in Miami Beach. That hit the market in March of 2015 with Luxe Living Realty broker Dora Puig, who listed it for nearly $25 million. It’s now asking $21.9 million, down 12 percent.

And then there are the super-lingerers, the mammoth listings that just aren’t selling. In addition to the Potamkin estate, there’s “Nena’s Villa,” a Star Island home that hit the market about two years ago for $40 million, then was reduced to $37 million with the Jills. The 1.34-acre property, at 1 Star Island Drive, includes a main house that was built in 1940 and a guest house built in 1995. Gloria and Emilio Estefan own the home, which they used to entertain guests. (They live down the road at 39 Star Island Drive.)

Teresita Shelton, Tere Shelton Bernace and Consuelo Stewart of the Shelton & Stewart Cocoplum Team

Like Gonzalez and the Jills, Zeder said it takes time to educate buyers. Some will take their properties off the market if they aren’t getting the price they wanted. Some will stick to a price they want and move on to another agent. “They think there’s new magic there, somebody else can do it,” she said.

“When did a buyer buy? Have they had the house a long time? Did they overpay for the house? A lot of times, the sellers have more in their home than what it’s worth today. That’s a tough conversation to have with anybody,” Zeder added. “They don’t want to hear it, and then they list it with someone else, and they wonder why it’s not selling.”

Better together?

Business slowdowns tend to foster consolidation across any type of business, and South Florida’s realtors are not immune. In late 2015, One Sotheby’s International Realty acquired SBI, Barclays was purchased by Compass in December 2016, and Brown Harris Stevens bought Avatar Real Estate Services in January of this year.

Other mergers in recent months include that of Keyes and Illustrated Properties, Douglas Elliman’s dual acquisitions of Turnberry International Realty’s Bay Harbor Islands office as well as Delray Beach firm Tauriello & Co. Real Estate, and One Sotheby’s acquisition of Bay Harbor Islands-based Crescendo Real Estate.

Calibre’s Johnston told The Real Deal that within the past two years, he met with SBI Realty, Barclays Real Estate Group and Avatar Real Estate Services to discuss joining forces as one large firm, but they all declined.

Johnston said he wouldn’t sell, but he thinks individual teams are gaining value over brokerages. Commission splits are competitive at the top of the market, most agents said, though they declined to provide specifics.

But that doesn’t seem to have translated into the top agents’ moving from brokerage to brokerage. Of the top 20 agents, the only ones to have switched firms are Josie Wang and Toni Schrager, both of whom are now with Brown Harris Stevens/Avatar following the acquisition.

Indeed, the Jills have been Coldwell Banker’s top-performing team in Florida for 13 years and top sales team for the entire brokerage for the fifth consecutive year.

“Companies like Sotheby’s and Douglas Elliman are becoming less important. The brokerage really doesn’t do anything,” Johnston claimed. “Big agents are building teams. Even the best at Douglas Elliman and Sotheby’s are teams.”