Amid an oversupply of new condominiums and an abundance of cranes scattered across Miami’s skyline, big banks are becoming more selective about which projects they will provide construction financing for, while some developers are choosing alternative lenders in the absence of traditional financing.

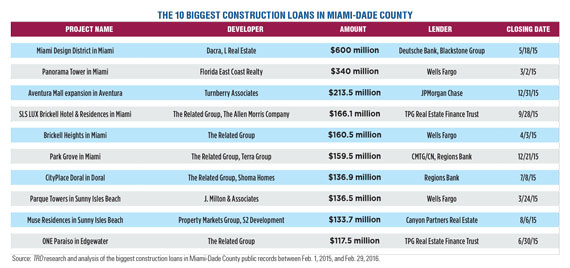

Still, there is plenty of capital for the right project. The Real Deal looked at the biggest construction loans in South Florida from January 2015 to February 2016, as documented in public records. The 10 largest were all in Miami-Dade County.

A $600 million construction loan for the Miami Design District took the No. 1 spot. Craig Robins’ Dacra, L Real Estate and minority partners General Growth Properties and Ashkenazy Acquisition closed on the senior portion of financing from Deutsche Bank, Crédit Agricole, Bank of China and Blackstone Group last May. Robins has spearheaded the area’s transformation into a luxury retail destination, with the loan going toward the development of 10 square blocks with more than 120 luxury stores, a boutique hotel, showrooms, public art displays, restaurants, galleries and residential condos.

Wells Fargo was the lead lender on the second largest construction loan — a $340 million note for Panorama Tower in Miami’s Brickell neighborhood. Wayne Hollo, executive vice president of the tower’s developer, Florida East Coast Realty, told TRD that the firm has a low loan-to-value cost, making it attractive as a borrower. Panorama will contain 821 apartments, a Hyatt hotel, retail and restaurant space, a recreational deck, as well as medical office space and a medical teaching facility.

Wells Fargo worked with six other lenders, including PNC Bank and TD Bank, to provide the$340 million, due to the sizable amount of debt.

Panorama Tower

“We’re looking for sponsors that have been steeped in the industry,” said Patrick Ramge, a senior vice president at Wells Fargo, who oversees commercial real estate lending in Florida for the bank. “For the right sponsors, condo construction financing is still available.”

Ramge said the financing model for a preconstruction condo project has changed dramatically since the last cycle. “As we’ve come out of the downturn, a lot of the traditional banks that used to lend pulled out,” he noted, citing the void that was filled by lenders like Blackstone.

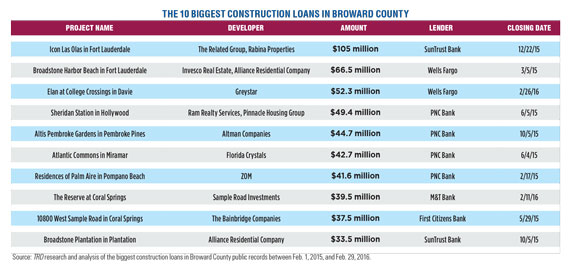

And while the top two debt deals in the past year were for mixed-use projects, the Related Group reigned supreme among the biggest borrowers with a total of$845.5 million in financing for six projects, most of which are condominiums. Five of those are located in Miami-Dade with one in Broward County.

Ben Gerber, Related’s vice president of finance, said the company works with five to seven lenders on different projects in different neighborhoods. “They probably don’t want to do a deal across from each other,” he said in reference to other developments that may be adjacent to or located near one of Related’s projects.

Gerber said the development firm prefers to use the same group of lenders “rather than negotiate with five different lenders to save 25 basis points.” Related has pre-negotiated contracts with those capital providers, which saves the company time and money, he noted.

Since January 2015, the nonbank lenders TPG Real Estate Finance Trust and CMTG/CN, an affiliate of New York-based Mack Real Estate Credit Strategies, have provided some of the largest construction loans to Related and its partners. Related, led by Miami’s “condo king,” Jorge Perez, also works with traditional banks, including Wells Fargo, SunTrust Bank and Regions Bank.

Among the many changes in South Florida’s commercial real estate and condo finance market, 50 percent deposits have become the norm in the current cycle, said Joe Hernandez, chair of the real estate practice group at Weiss Serota Helfman Cole & Bierman. “Before the crash, the standard used to be 20 percent,” he told TRD.

And while an increase in cash is a good thing, Hernandez said it’s not as profitable for lenders. For one, developers are funding construction with loans at later stages, which means the debt will accrue less interest than before.

Construction loans also need to be monitored on a monthly basis. “The cost to put all of that in place is quite high,” Hernandez said. “If your money is not outstanding very long, collecting interest, then it’s not as profitable.”

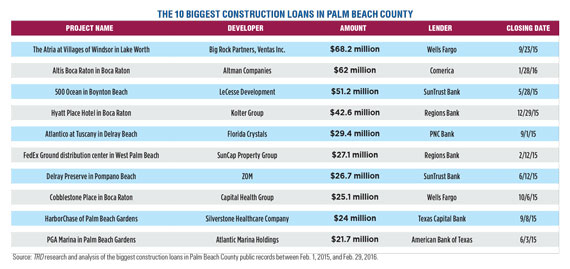

Financing condo projects remains the most difficult, while capital is more readily available for multifamily and industrial developments, industry insiders agreed. As a result, more foreign lenders may step in to fill the void for large condo developments in need of debt. In January, David Martin’s Terra Group closed $90 million in construction financing for Eighty Seven Park, a luxury condo project in the North Beach neighborhood of Miami Beach. Terra secured the loan from Singapore’s United Overseas Bank.

Meanwhile, Property Markets Group landed a $134 million loan in August 2015 from Canyon Real Estate Partners to build Muse Residences in Sunny Isles Beach.

PMG Principal Ryan Shear said that working with a nontraditional lender like Canyon allowed the developer to borrow more, albeit at a higher cost. “Some funds have the mind of a developer,” he said. “They think like us.”

He agreed that it is a difficult market for condo developers to obtain financing — especially compared to a year ago.

“A lot of capital markets think Miami is a saturated market,” Shear said. “I would be very surprised to see small developers or first-time developers get condo financing right now.”