Anxiety about the South Florida condo market is on the rise as members of the real estate community prepare for the winter buying season.

Developers, brokers and buyers are increasingly voicing concern that the next six months could be a pivotal time for the current condo construction boom that started in 2011 in the area east of Interstate 95 in Miami-Dade, Broward and Palm Beach counties. After all, the rule of thumb is that the typical real estate cycle lasts seven to 10 years, and thus some developers may be reluctant to embark on a three-year condo project if buyers are starting to shy away from purchasing.

A productive winter buying season from November through April in South Florida could mean that many of the new tri-county condo projects already announced will indeed be built as planned.

A disappointing season would likely have the opposite effect, prompting developers to consider delaying or even canceling previously announced South Florida projects.

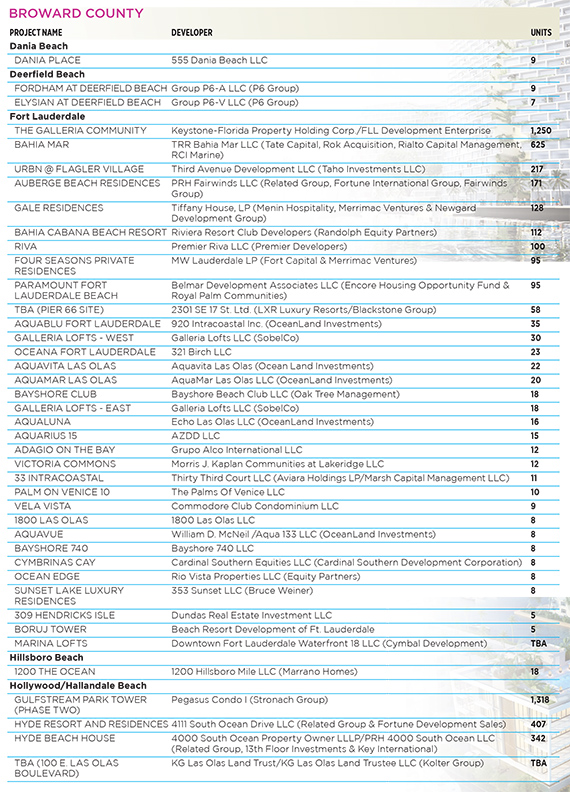

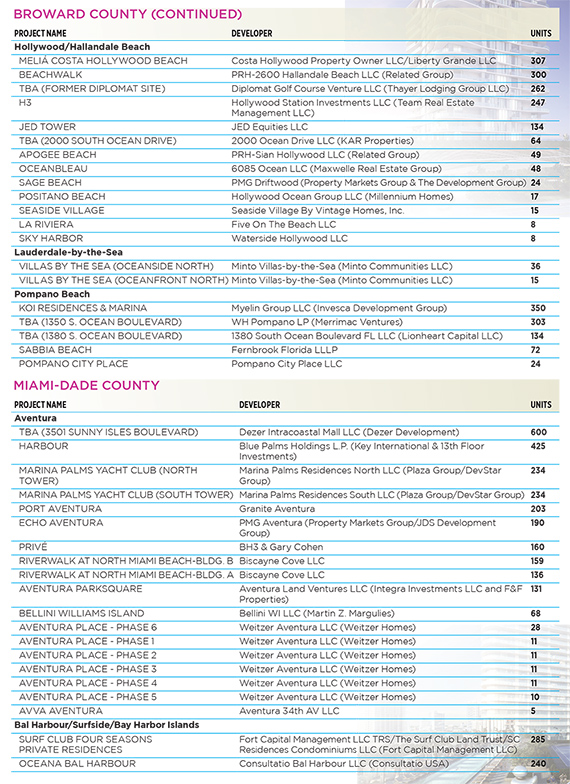

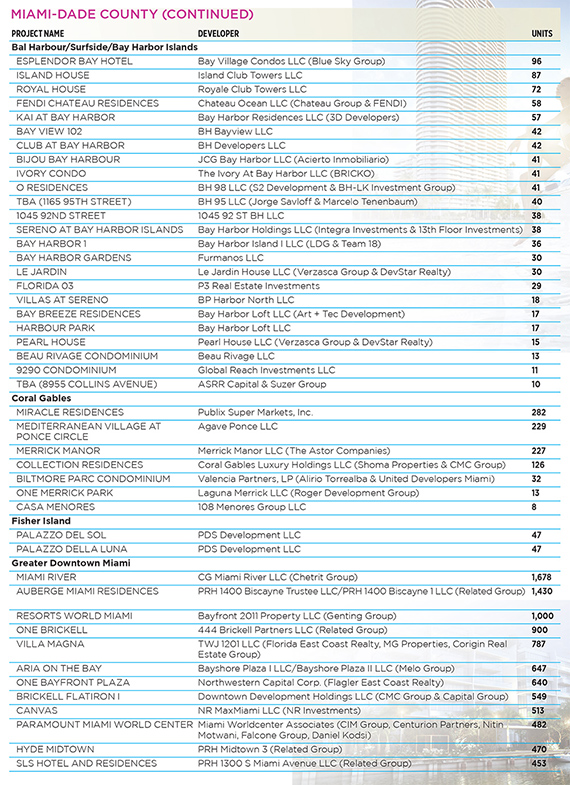

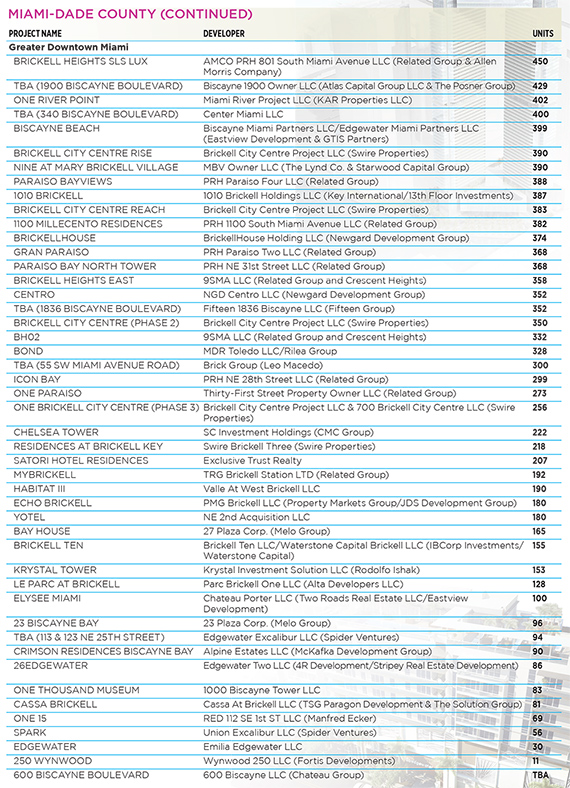

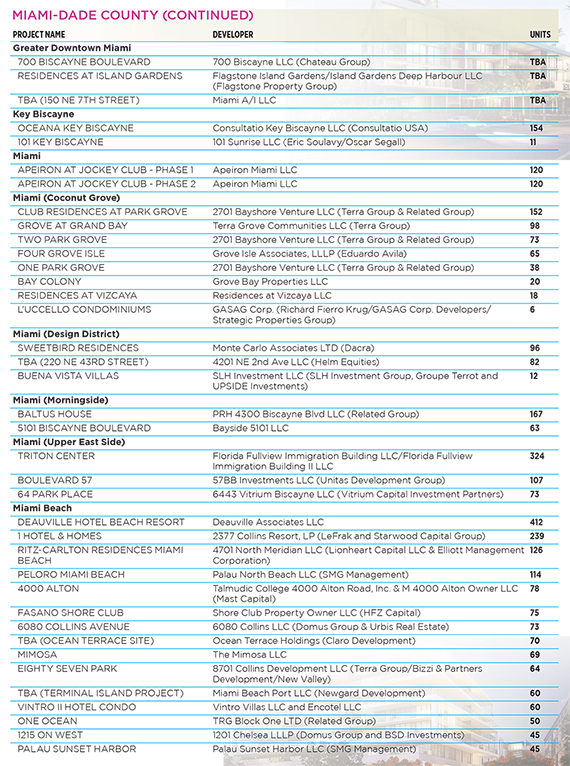

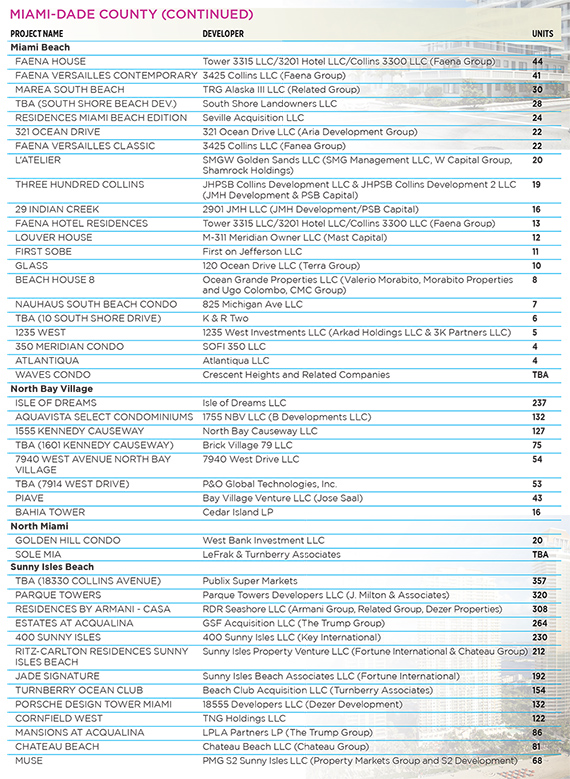

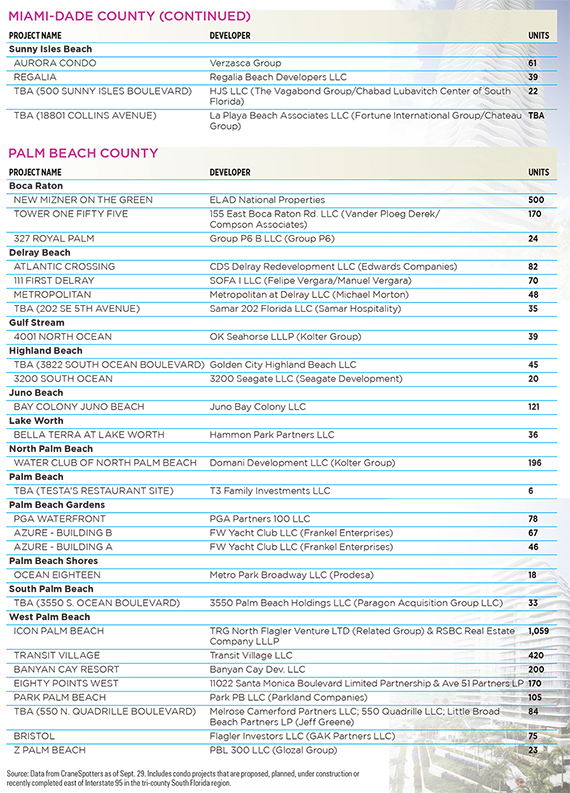

From 2011 through this year’s third quarter, more than 370 new condo towers — with nearly 45,000 units — have been announced, according to my company’s website, CraneSpotters.com.

Through this period, 43 new condo buildings with nearly 3,700 units have been completed. A total of 116 additional new towers with 11,500 units are under construction east of Interstate 95 in the tri-county region, according to the data. And an additional 214 new condo towers with a combined 29,550 units are in the planning or presale phase of development.

It is worth noting, however, that more than 15 new South Florida condo towers with at least 2,700 units have been canceled or significantly revised due to changing market conditions experienced in the last year.

Many of the biggest factors affecting the South Florida condo market have less to do with local developers than international financial markets. Many foreign investors have considered the tri-county region a safe haven for their money.

Yet economic conditions and investor sentiment today are much different than they were in 2011, when many countries in Latin America — a key source of buyers for South Florida condos — were enjoying strong economic growth based on record high commodity prices for their raw materials. Back then the outlook for South Florida real estate, especially new and existing condo units, looked attractive to foreign investors who had strong currencies in contrast with the weak dollar.

The fortunes of these countries in relation to the economy of the United States have changed, thereby making South Florida condo units more expensive for foreign investors when real estate price rises are combined with currency changes.

Consider Brazil, a key source of investment in South Florida condos. Its currency, the real, has recently dropped dramatically in value. On Sept. 30, 2011, one real traded for $0.54 in U.S. dollars. By Sept. 30, 2014, its had value declined to $0.41. As of Sept. 30 of this year, one Brazilian real was worth $0.24.

The change in global economic conditions this year has forced South Florida developers to pivot their sales efforts away from investors in Latin American markets to concentrate on buyers inside the U.S. and previously untapped foreign markets such as China.

Thus an increasing number of South Florida developers have expanded their territory beyond Miami (previously favored by international investors) to areas northward in the hopes of attracting domestic buyers. U.S. condo buyers have tended to seek out Fort Lauderdale and markets to the north in the tri-county region.

Nearly 50 new condo towers (with more than 3,100 units) have been announced from 2011 through this year’s third quarter for the downtown Fort Lauderdale and adjacent Beach markets. Only 15 new condo buildings, with fewer than 800 units, were announced for Broward County from 2011 through the summer of 2014.

The volatility in the stock market over this past summer — and the increase in chatter about a possible end to the recent bull run for equities — is being viewed by a growing number of industry watchers as a possible catalyst for driving domestic investment into the South Florida condo market.

Consider that the Dow Jones Industrial Average declined nearly 9 percent over the first nine months of this year. Investors historically purchase lower-risk assets, such as bonds, precious metals and public utility stocks, in times of uncertainty. South Florida real estate may once again be considered a lower-risk asset for domestic investors. But whether the pool of domestic buyers willing to consider South Florida condos will be large enough to replace the foreign investors who have exited the picture still remains to be seen.

Peter Zalewski is a real estate columnist for The Real Deal who founded Condo Vultures, a consultancy and publishing company, as well as Condo Vultures Realty and CVR Realty brokerages and the Condo Ratings Agency, an analytics firm. The Condo Ratings Agency operates CraneSpotters.com, a preconstruction condo projects website, in conjunction with the Miami Association of Realtors.