Completing Brickell Flatiron has become Ugo Colombo’s main mission. The Italian developer, who has been involved in South Florida real estate since 1983, intends to not only sell all 548 residences in his forthcoming 64-story luxury condominium tower, but to sell them without compromise. So if a buyer wants one of Brickell Flatiron’s future residences, Colombo told The Real Deal that he or she will pay full price.

“I have never discounted one penny on one unit,” he insisted.

On March 16, Colombo officially commenced construction on Brickell Flatiron, where residential units are being marketed for between $500,000 and $2 million. Colombo claims the project is already 50 percent sold. However, he began selling residences at Brickell Flatiron two years ago, when the South Florida real estate market was still riding high. Today, Miami’s condo scene is showing increased signs of inactivity. Colombo said he is well aware and not the least bit phased.

“I think it’s healthy that there’s a slowdown,” he said. “There can only be so much demand.”

Colombo is not the only one to notice that South Florida’s real estate market is changing. Several analysts, developers and brokers gave similar outlooks.

“It’s taking longer to do deals and I am seeing more price reductions,” said Jonathan Gerszberg, vice president of investments at Marcus & Millichap. “Most people are beginning to realize that we are on the other side of the race. I’m not saying we are crashing. We were moving at 110 miles per hour. We’re now moving at 90 miles per hour. Both are still good speeds, but we are slowing down.”

Flatiron Brickell

Already, a number of planned condo projects are disappearing from the South Florida landscape. Sales activity stopped at the 35-story Krystal Tower in Miami, the 27-story Gulfstream Park Tower in Hallandale Beach, and the 17-story Oceanbleau in Hollywood, according to recent reports from the real estate consulting firm and brokerage International Sales Group. A 68-unit mixed-use project in Miami’s Upper Eastside proposed by Vitrium Capital, 01 MiMo, is suspended as well, said Cyril Bijaoui of Westside Estate Agency.

Yet, South Florida is still in the midst of a building boom. In the last four years, millions of square feet of condos, apartments, hotels, retail and offices have popped up in the tri-county region.

The proliferation of condo projects has been particularly robust. Since 2011, 50,230 condo residences spread among 414 towers have been proposed, built, or are under construction in the tri-county region as of March 21, according to recent statistics from the research website Cranespotters.com. Of those projects, 59 towers, totaling 4,355 units, have been completed in the last five years. Another 132 condo buildings, with 14,288 units in all, are under construction.

The majority of those new or proposed South Florida condos, almost 75 percent, are in Miami-Dade County, according to Cranespotters.com. Greater Downtown Miami — which includes the neighborhoods Brickell, the Central Business District, Omni, Park West, Overtown, Edgewater and Wynwood — represents 45.5 percent of South Florida’s condo projects. In contrast, about 18 percent of new or proposed condos are in Broward County and 8 percent are in Palm Beach County.

What has made Miami’s ongoing condo spree all the more amazing is that it started during a time when banks were still reluctant to lend money following the fall of Lehman Brothers. During the financial crisis, the U.S. dollar traded at a favorable rate for foreign buyers, while Miami’s international popularity attracted rich condo buyers from Latin America and, to a lesser extent, Europe and Russia. It was these investors who were able to pay the 50 percent deposits developers began to demand — or even the entire cost of a unit outright. That enabled many sponsors to survive on smaller loans for their projects and, in some cases, cut banks out altogether.

“In addition to the favorable currency exchange rates, South American buyers were typically hedging against their own economies, which experience significant fluctuations due to political turbulence,” a February Miami Downtown Development Authority report prepared by Integra Realty Resources, stated.

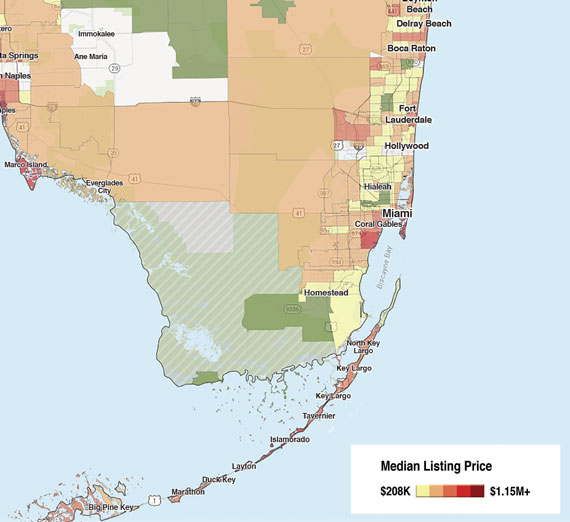

Residential listing prices are still red hot in Miami, according to data from Trulia.

That demand helped propel the average price of a Miami-Dade condo unit to $875 a square foot, said condo analyst Peter Zalewski, the founder of Cranespotters.com and a TRD columnist. By comparison, a new condo in Palm Beach County averages $808 a square foot, while a new condo in Broward County averages $468 a square foot, Zalewski said.

After 2014, the U.S. dollar began to trade at a higher rate and, as the Miami DDA report noted, “The advantageous buying power of foreign investors diminished significantly.”

In response, some condo developers lowered their deposit requirements from 50 percent to 30 percent. A few builders lowered their prices, too. The Related Group, for example, is accepting reservations for Auberge Residences & Spa, a proposed 60-story, 290-unit condo in Miami’s Omni neighborhood for $575 a square foot.

Anthony Graziano, a senior managing director at Integra Realty Resources, acknowledged that sales velocity in the condo arena has slowed, but insisted that the market is still strong — especially in Miami’s downtown area. “The product that’s being built is performing very well,” he said. “It’s 85 percent pre-sold.”

But that may change after June, Zalewski predicted, when it’s wintertime in South America and South American investors head north to Miami for warmer weather. During that time, some condo owners will seek to cash out and sell their units, driving prices down further.

When the time comes, Zalewski said he’s “bullish” that some developers will do the right thing — “fall on their swords” and not build for three or four years until condo prices rise once again. If they don’t, “there will be too much inventory” and the pain of a condo dip will be protracted, he argued.

Krystal Tower

Philip Spiegelman, co-founder of International Sales Group, insisted that the market would weed out projects unsuited to withstand any new economic realities. “We’re not overbuilding and we have a number of projects that are moving forward,” he said. “The real issue is, what is the landscape for 2016? The strong dollar has affected international markets and the psychology of the international buyer.”

In such an atmosphere, Spiegelman said, only seasoned developers with years of experience building in South Florida will be able to launch new condo projects.

Carlos Melo, a principal of the Melo Group, said he sees the slowdown signs. The local developer, who is building the 53-story Aria on the Bay in Edgewater, is postponing plans to build another condo tower on Miami’s waterfront until there’s more “equilibrium” between supply and demand, he told TRD.

“It’s good for the market to not build something that’s going to be a problem in the future,” said Melo.

Additionally, two developments once associated with Colombo are in limbo: Collections Residences and the site of a to-be-announced tower around 1,000 feet from Colombo’s Brickell Flatiron.

The 10-story, 270-unit Collection Residences in Coral Gables was suspended following a dispute between Colombo and his partner in the venture, Masoud Shojaee. This past January, Shojaee sued Colombo for breach of contract. Colombo declined to talk about the litigation.

He said that starting Collection Residences one or two years from now “will not make much of a difference” in the project’s success, due to the limited number of condo properties in Coral Gables.

The site near Brickell Flatiron is now under the complete ownership of another former partner of Colombo: Russian billionaire Vlad Doronin. Under a recent land swap deal, Colombo gave Doronin complete ownership of 0.8 acres of land at 830 Southeast First Avenue. In exchange, Doronin gave up his interest in Brickell Flatiron. Representatives for Doronin’s Moscow-based company, Capital Group, did not return a request for comment by email.

While some projects blink out, others are being bought and repurposed.

Plans to build a 58-story Edge at Brickell died after Rafael Aragones sold his land by the Miami River to Brazilian businessman Leo Macedo. A 60-story, $200-million condo hotel will be built at that site instead, Macedo told TRD last July.

Privage in Fort Lauderdale became 321 at Water’s Edge after Michael Bedzow sold the waterfront 0.6-acre parcel at 321 North Birch Road — which he purchased at short sale for $2.5 million in 2012 — to Jeffrey and Samuel Sobel last May for $10 million. The Sobels are now taking reservations for their future 11-story, 23-unit condo project where residences range from $2.1 to $3.6 million.

Brickell City Center

Then there’s the 15-story Bath Club Estates, which ceased to exist after Washington, D.C.-based developer R. Donahue Peebles sold his 1-acre oceanfront parcel in Miami Beach to the Chinese Construction Company and American Da Tang Group for $38.5 million in October. Peebles sold the land, which he bought for $4.6 million in 2010, as part of a general withdraw from Miami-Dade. In addition to the former Bath Club Estates, Da Tang now owns 2.4 acres of property in Brickell and is looking to invest in the Northwest Seventh Avenue corridor in North Miami.

Angie Ki, chief business development officer for American Da Tang, said a future condo project would soon be marketed to potential buyers from China. Ki said she is bullish on building in Miami-Dade as long as the project is funded by Chinese money. Wealthy Chinese investors nervous about the slowing pace of China’s economy are eager to invest in South Florida property, she added.

Though Spiegelman doubted the time is right for Chinese investors to start buying condos in South Florida, given the recent devaluation of the yuan, Zalewski said foreign buyers with less cash on hand have more affordable alternatives for investment outside of Miami-Dade.

“That’s why I see the condo market shifting from Dade to Broward,” he said.

All the while, South Florida’s multifamily and commercial markets are growing at a healthy pace.

Rosendo Caveiro, a senior director at Cushman & Wakefield, said he expects to see the development of 14,000 new apartment units across South Florida in 2016. Driving that development are young professionals who either don’t want to be tied down with homeownership or simply can’t afford it, he said.

As for retail, the sector is thriving in many of the area’s denser pockets. Luxury boutique stores continue to get built in the Miami Design District, while Brickell City Centre’s 500,000-square-foot-shopping center is nearing completion. The owners of Aventura Mall, Bal Harbour Shops and Sawgrass Mills intend to expand their shopping centers significantly and several mega-developments, including the proposed $4-billion SoleMia in North Miami, envision significant retail components.

Unlike the condo sector, there are no obvious signs of contraction for the majority of South Florida’s commercial sector and financial institutions are willing to help it grow. Sean Barrie, a research analyst at the real estate data firm Trepp, said the delinquency rate for commercial mortgage-backed securities in South Florida in February was 3.2 percent, compared to a national delinquency rate of 4.2 percent for CMBS loans.

“Miami is one of the top performers in the country and it’s one of the best performing markets,” Barrie said. “I would say that the market outlook is pretty good for the area.”

But Gerszberg of Marcus & Millichap said that while South Florida’s commercial sector remains “extremely strong,” it has dipped from market highs. That means there will be fewer “record deals” for land and building transactions, he said, noting that asking prices will be adjusted downward as well.

“From what I’m seeing, we reached the peak,” he said, noting a “mild correction” in the works.

Paramount Miami Worldcenter, inset, Nitin Motwani

That correction may be affecting plans for Miami Worldcenter, the massive mixed-use project within 27 acres in Park West. In an effort to obtain financing more quickly, MDM Development Group, the developer of a future $525-million Marriott Marquis Miami Worldcenter Hotel & Expo, is building the project in two phases — a 1,100-room hotel and a 600-room hotel. The original concept was a single hotel tower with 1,800 rooms. At the same time, the Forbes Co. and Taubman downsized their Miami Worldcenter retail plans from 760,000-square-feet to 400,000-square-feet.

Nitin Motwani, a managing principal of Miami Worldcenter Associates and a partner in the retail venture, said the retail redesign was about switching from an enclosed mall to a “high-street” scheme similar to Lincoln Road. “This is more aligned to where retail is going,” Motwani said. “This high-street retail, coupled with the Downtown Miami location and with all that density, has created a very unique opportunity.”

On the condo side, Motwani said presales for the 55-story Paramount Miami Worldcenter, which he is co-developing with Daniel Kodsi, is doing well. PMW broke ground on the project on March 3 and the condo tower is roughly 50 percent sold with buyers from 30 different countries signing “hard contracts” totaling $250 million so far, he told TRD.

“I think what we are seeing is a strong continued interest in South Florida from all parts of the globe,” Motwani said. “Currency has had impacts and certain projects may not move forward or may be put on hold, but great projects with great loans are all moving forward.”

In spite of the slowdown in the condo market, Motwani said he hasn’t had to offer discounts for the 470 future residences, which start at $700,000. Just as Colombo remains certain he won’t have to compromise on pricing for Brickell Flatiron, which averages around $750 a square foot. “I’m very confident,” Colombo said. “If I wasn’t confident, I would not start a big move forward and break ground.”

The market, however, will have the final say, Zalewski noted. “Markets dictate price,” he said, “not developers, sellers or realtors, despite their best marketing efforts.”