Decision time could be rapidly approaching for those developers who are taking part in the current South Florida preconstruction condominium boom that began in 2011.

Decision time could be rapidly approaching for those developers who are taking part in the current South Florida preconstruction condominium boom that began in 2011.

In the thick of slowing presales and shifting sentiment about the strength of South Florida’s condo market, developers may face the precarious decision of whether to soldier on with their proposed projects or pivot toward revising their plans and schedules by spring 2017.

April marks the end of the latest South Florida winter buying season, which has become increasingly important for the condo markets in Miami-Dade, Broward and Palm Beach counties while the U.S. dollar remains strong.

With the arrival of springtime, buyers and investors north of the Equator historically shift their attention away from subtropical South Florida as the humidity levels and temperatures there become more unbearable for those who reside in cooler climates.

Over the next six months, South Florida will become a getaway destination primarily for visitors from the commodity-dependent Southern Hemisphere — where current economic and political conditions are generally less than encouraging due to the slowdown in the global economy.

As a result, the bulk of South Florida developers, who rely heavily on out-of-town buyers, will assess the results of the ending winter buying season before recalibrating their strategies for what’s to come. That could very well lead to a rush to build and finish a number of new condo towers with buyer deposits of up to 50 percent of the contracted purchase price.

In turn, investors and developers may need to think about the broader market as much as, if not more than, their bottom line. The big takeaway that emerged from the previous South Florida winter buying season is that some of the projects that did not perform as expected were ultimately revised, delayed or even canceled by their respective sponsors.

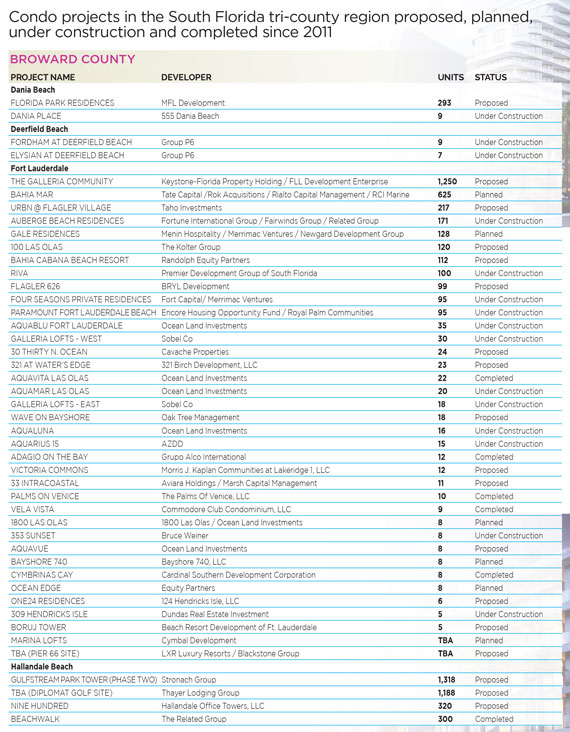

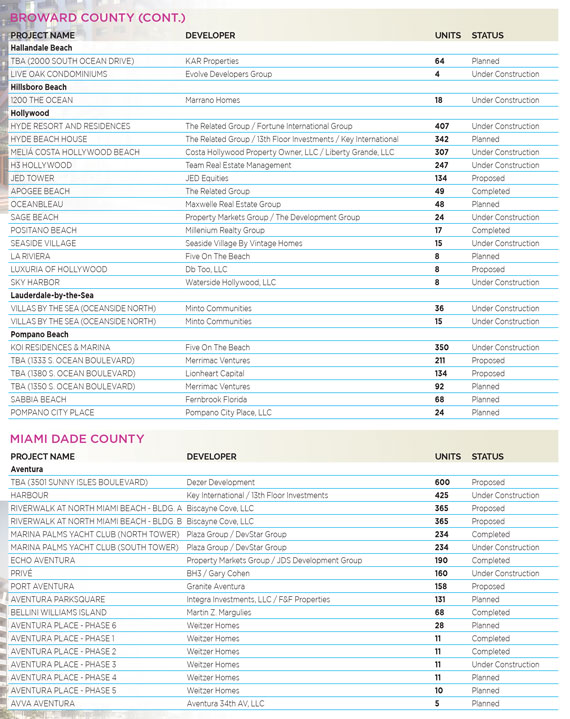

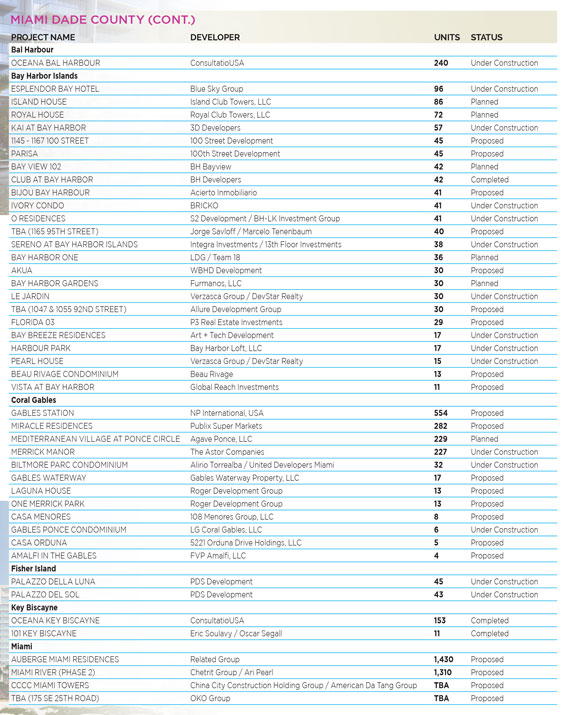

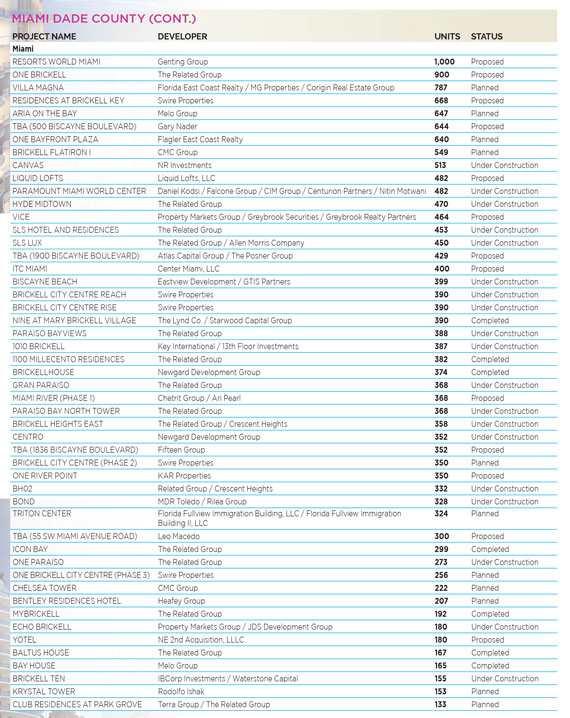

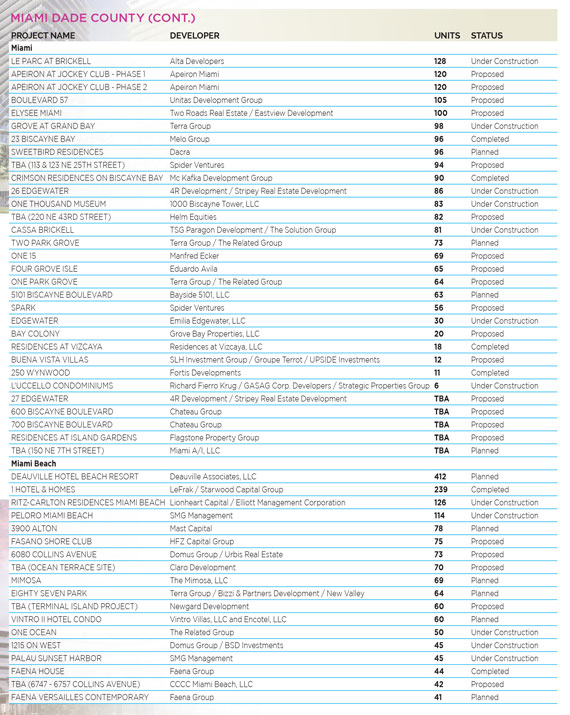

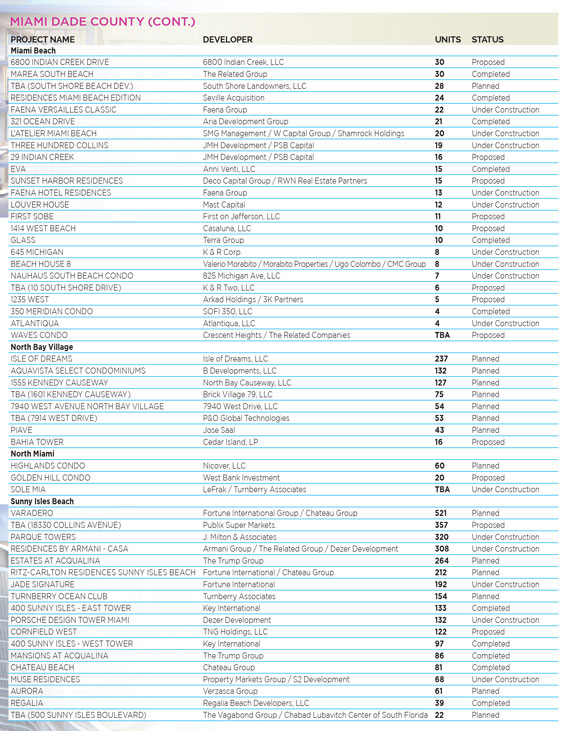

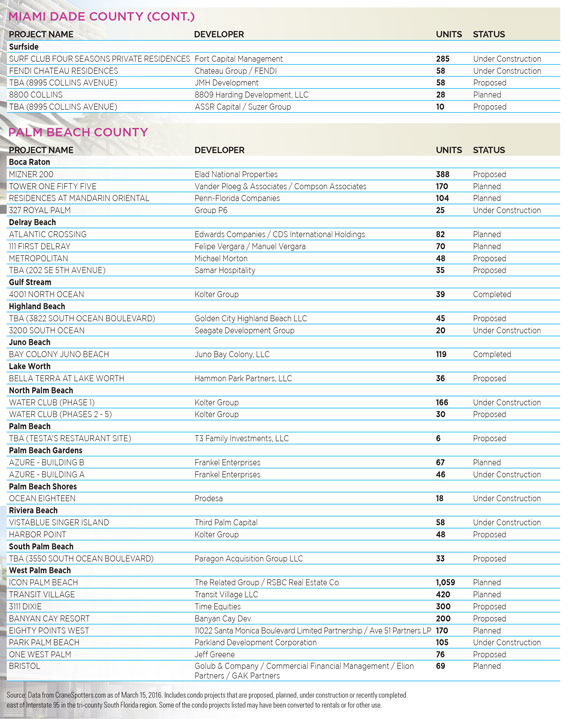

As of March 14, developers have already changed the original plans of at least 22 condo buildings with more than 3,100 units east of Interstate 95 in South Florida. Barring a sudden global economic revival, the number of revised South Florida preconstruction condo projects dependent upon international buyers purchasing units is expected to only further increase this summer, according to an analysis by CraneSpotters.com. (For disclosure, my firm operates the condo research website.)

This could set the scene for a make-or-break 2016 to 2017 winter buying season for South Florida’s preconstruction market, beginning next November.

With at least 190 new condo buildings and more than 18,000 units currently under construction or recently completed, the developers who have not yet started to build their proposed units are likely to control the fate of the overall South Florida market during the remainder of this real estate cycle, which began more than five years ago.

To understand how large a group this is, consider that nearly 225 new South Florida condo buildings with more than 31,800 units are still in the planning or presale phases of development as of March 14.

Put a simpler way, the amount of new condo construction activity today in South Florida represents only about one-third of the announced units that are currently in the pipeline for the region, according to the data.

Miami-Dade accounts for about three-quarters of the entire tri-county preconstruction condo market pipeline during this current cycle. The balance of the announced developments are located in Broward County, with 18 percent, and Palm Beach County, with 8 percent, the CraneSpotters.com analysis shows.

Despite the relatively small percentage of overall building underway — compared to the overall South Florida new-unit pipeline — presale deposits are being reduced, preconstruction commissions are being increased and resale supply is rising to levels that favor buyers.

What is not being discussed publicly is the quiet pressure the industry is increasingly putting on developers to slow the pace of new projects in the tri-county region. That pressure comes from a fear of flooding the market with an excess supply of new condo developments at the expense of the overall South Florida residential market’s well being.

The unanswered question going forward is whether developers in this cycle will have the financial wherewithal and business acumen to place the South Florida condo market ahead of their own personal objectives in hopes of avoiding a repeat of the previous tri-county boom and bust of 2003 to 2010.

Peter Zalewski is a real estate columnist for The Real Deal who founded Condo Vultures LLC, a consultancy and publishing company, as well as Condo Vultures Realty LLC and CVR Realty brokerages and the Condo Ratings Agency, an analytics firm. The Condo Ratings Agency operates CraneSpotters.com, a preconstruction condo projects website, in conjunction with the Miami Association of Realtors.