Eight years after launching one of the first co-working spaces in Miami-Dade, Michael Feinstein is under pressure. As deep-pocketed national competitors have aggressively moved into his territory, the founder increasingly sees the need to expand his brand, Büro, beyond the county line. Since 2015, New York City-based WeWork has taken up more than a quarter million square feet of office space in Miami-Dade, close to five times the square footage Büro occupies at its five locations, which range from 10,000 to 20,000 square feet.

Early in the first quarter of 2019, Feinstein will open the doors to Büro’s sixth co-working space — its first in Broward County — with a bet on a once-forgotten corner of Hollywood that is slowly emerging as an arts and culture hub. The South Florida co-working space pioneer is in the process of transforming an Art Deco building there, a former Holocaust education center and museum at 2031 Harrison Street.

Feinstein teamed up with Ecuador-based investor group Hanoy Holdings to purchase the three-story seafoam-colored structure in August 2017 for $1.15 million from the Hollywood Community Redevelopment Agency. “We feel it makes more sense for us when possible to own our space,” Feinstein said. “We are also working on owner-operator agreements with landlords similar to hotel owner-operator deals.”

Buying a building strictly for use as a co-working space reflects how this sector is evolving and trending nationwide. As the gig economy continues to expand and global Fortune 500 corporations seek office space on flexible terms, co-working companies like Büro are looking to own real estate or get into management-type leasing deals with South Florida commercial landlords. And in the past three years, high demand for co-working spaces has led to more competition in the tri-county region, as Büro and other local firms such as Pipeline are now vying against national players like WeWork and CIC as well as traditional executive suites providers such as Regus and Quest Workspaces.

“I still think there is room for growth,” Randy Carballo, a vice president for JLL, said. “We still have a little bit of runway. I don’t think we are overbuilt in the co-working space by any means.”

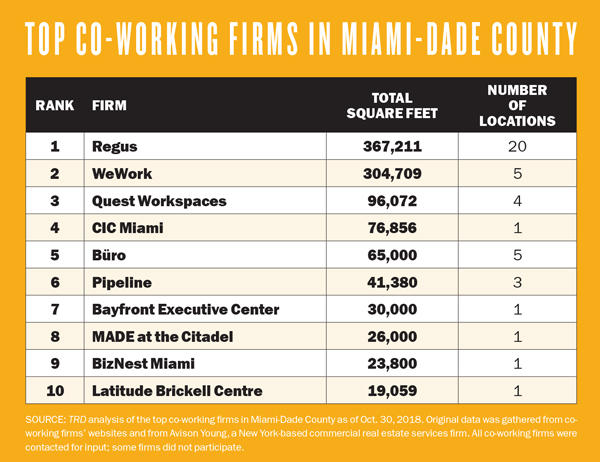

An analysis by The Real Deal of the top co-working firms by square footage in Miami-Dade County as of Oct. 30 shows that Regus takes the crown for most square footage, offering both co-working space and traditional executive suites. The company has 20 locations in Miami-Dade with a combined 367,211 square feet of space.

However, since opening its first location on Lincoln Road just three years ago, WeWork has been on an insatiable leasing binge. The firm came in second with five sites encompassing 304,709 square feet.

Quest Workspaces took the third slot with four locations totaling 96,072 square feet. CIC came in fourth with one 76,856-square-foot location, and Büro was the only Miami-based provider to crack the top five, with 65,000 square feet spread across five locations.

With WeWork muscling its way into Miami-Dade, Regus is countering with the rollout of its co-working brand Spaces. The first location will open in Q1 2019 in a 20,000-square-foot space inside MiamiCentral, the mixed-use project in downtown Miami that serves as the final stop for the high-speed train Brightline (now known as Virgin Trains USA), according to Carballo, whose JLL team represents Regus in South Florida.

In addition to MiamiCentral, Carballo said, Spaces has also inked deals for square footage at Cube Wynwd, an eight-story office building at 222 Northwest 24th Street in Miami being developed by RedSky Capital, and Las Olas Square, a mixed-use project at 501 East Las Olas Boulevard in Fort Lauderdale.

Courting corporate tenants

The co-working concept was founded on the principle of independent collaboration between freelancers and work-at-home professionals. But in recent years, in major markets like New York City, co-working spaces have increasingly been taken over by multinational corporations and Fortune 500 firms. CBRE, which closely tracks the co-working space industry, divided its rapid growth into three distinct phases: the “executive suites market” that predates 2009, the “birth of co-working,” which took off in 2012, and the “rise of enterprise,” which began in 2016.

For corporations, leasing space from co-working providers allows them to bypass rigid commercial leases, said Jaime Sturgis, CEO and founder of Fort Lauderdale-based Native Realty. “It’s a great way to minimize overhead with no long-term lease commitments,” he said. “It is also a good way for large companies to recruit and maintain talent.”

WeWork, for example, has made no qualms about aggressively pursuing “enterprise clients,” or companies of at least 1,000 employees, which account for a quarter of the New York City-based co-working space provider’s memberships and revenue, according to TRD’s reporting. Knotel doesn’t have a presence locally, but in New York City, San Francisco, London and Berlin, the firm has a high concentration of co-working space. Knotel never embraced the independent contractor model, and 95 percent of its customers are companies with multiple offices and more than 100 employees.

Even publicly traded brokerage firms and prominent landlords are getting in on the action. Tishman Speyer, one of the world’s biggest commercial property owners, has launched a co-working brand called Studio, putting it in direct competition with some of its own co-working tenants, including WeWork. In October, CBRE announced it was launching Hana, its own flexible management division.

While co-working’s proliferation may benefit corporate hubs like the Big Apple, the nature of South Florida’s workforce is different. In May, Fiverr, a marketplace for independent contractors and freelancers, released a study showing that the Greater Miami area — which in the analysis includes Broward and Palm Beach counties — has the largest share of self-employed workers, in terms of their contribution to metro GDP, of the 15 markets surveyed. Fiverr found that Greater Miami’s contingent of freelancers grew by 23 percent between 2011 and 2015 compared to 11 percent growth across the 14 other metro areas.

And in 2017, the Stephen S. Fuller Institute at Virginia’s George Mason University published a report that found the Miami-Fort Lauderdale metropolitan area leading the nation both in the growth and number of firms that don’t have employees. Between 1997 and 2015, the number of nonemployer establishments in the Miami metropolitan area rose 142 percent, more than twice the national average of 58.6 percent, the report found.

As a result of South Florida’s small business and independent contractor landscape, most shared workspace providers still largely rely on nimble professional services firms as clients. But major corporations are growing their presence in the region by opening satellite offices in co-working spaces, according to several brokers and co-working firm owners who spoke to The Real Deal.

“You have local players like Pipeline and Büro that have done a good job housing very local firms and some Fortune 500 companies,” Carballo said. “If you go into WeWork or Spaces, you will see Google, Spotify and Microsoft mixed in with tech startups and entrepreneurs.”

Pipeline owner Philippe Houdard said his member base is a broad cross-section of industries. “It is highly diversified,” Houdard said. “Some are well-known companies, like Postmates and HP. We also have the Latin American headquarters for Wendy’s. Then you have smaller businesses made up of lawyers, architects and other professional services.”

Wendy’s has been leasing space in Pipeline Doral for the past three years, and Postmates is located in Pipeline’s Coral Gables space, Houdard said. He said that while Pipeline doesn’t disclose lease terms, the company works with all its members individually based on their needs and requirements.

There’s a misconception in commercial real estate circles that co-working space providers only cater to startups looking to move out of a garage, opines Feinstein, Büro’s CEO. “Miami in particular has never been about tech startups, but really about smaller, successful companies like a three-person magazine or an eight-person architecture firm,” he said. “We cater to creative agencies. The corporate user is less interesting to us.”

That’s not to say Büro shuns corporate giants. The company has provided space to Uber, Airbnb and the Huffington Post, among other big brands. “But it is usually teams of five to 10 people, not 100,” Feinstein said. He declined to discuss how long the two tech companies have leased space at Büro and whether both are still tenants.

Stephen Rutchik, an executive vice president at Colliers International, represented WeWork in leasing 35,000-square-foot in an office building at 2222 Ponce de Leon Boulevard. He declined to reveal the lease terms, but said the company had no problem landing tenants for its fifth location in Miami-Dade since opening it this past February.

“They quickly filled up to 100 percent occupancy,” Rutchik said. “It is a healthy 50/50 mix of local tenants and corporate America enterprise users.”

Bobby Condon, general manager for WeWork’s Southeast division, said Fortune 500 companies represent about 30 percent of its South Florida member base. “That’s up from 20 percent in 2017,” Condon said. “The enterprise users see it as an amazing flexible platform to scale their business. They see it as an opportunity to be part of our community and the environment we create.”

As WeWork and Spaces plant outposts in South Florida, local firms are expanding farther afield in the state. In the first half of 2018, Pipeline opened sites in Orlando and Tampa, bringing its total number of locations to six since it opened its first space in Brickell six years ago.

“We are pretty close to capacity in our Miami-Dade locations,” Houdard said. “Orlando is going pretty well. We are at about 75 to 80 percent occupancy. And Tampa is in the ramp-up phase.”

Büro is also looking at expansion possibilities beyond Hollywood, Feinstein said. “Our model has been to open a new Büro every year since 2012, when we opened our second location,” Feinstein said. “We like to be in creative, mixed neighborhoods. And we are on the best corners. That is our model moving forward.”

Shifting moods among landlords

How landlords view co-working spaces’ tenants is a mixed bag. Some owners and commercial brokers said landlords are more than enthusiastic about signing leases or cutting management agreements with co-working firms. However, others believe there’s little room for continued growth in the sector. The landlords that had the most co-working space within their properties in Miami-Dade, including Allianz Real Estate of America (which, according to TRD’s analysis, has over 68,000 square feet dedicated to co-working space in the county) and Turnbridge Equities (with 95,000 square feet of co-working space in the county) did not respond to requests for interviews.

Pipeline Gables is currently home to logistics firm Postmates.

Co-working firms can provide many advantages and benefits for landlords, Colliers’ Rutchik said. For instance, clients of co-working space providers create foot traffic into an office building. “It seeds an office building in big way,” Rutchik said. “Hopefully, those tenants in a co-working space grow and expand even if they are not a direct tenant.”

Having a co-working space with an interesting mix of companies increases a building’s marketability, Houdard adds. “It is not uncommon for landlords to come in and show prospective tenants the Pipeline space,” he said. “And for companies that outgrow their Pipeline space, they may want to take space in the same building.”

In some cases, co-working firms are highly sought-after by the owners of major mixed-use developments, said JLL’s Carballo. “The smart landlords want a co-working service in their building,” he said. “If you look at all new construction, all new buildings or any buildings with major blocks of space available, they are targeting these big co-working space players.”

Still, some commercial property owners are starting to think the co-working trend in South Florida is nearing its peak, Carballo warned. “Because there are so many of these co-working players, some landlords are hyper-focused on credit,” he said. “That has affected the smaller, local shops. And some landlords are pretty risk-averse … They are not convinced of their long term-viability.”

And then there is the issue of pricing. Laura Kozelouzek, CEO of Quest Workspaces, said that with office rents in the Greater Miami area at an all-time high, her firm is taking a more conscientious approach to expansion. The average asking rents in Miami-Dade reached peak levels at $39.17 per square foot, according to JLL’s Q3 2018 Office Insight report.

In the last two years, Quest has only opened two sites, for a total of four locations in South Florida. Each site has about 30,000 to 35,000 square feet, and the company has 96,072 square feet in Miami-Dade, putting Quest behind Regus and WeWork in total square footage.

“It’s quite possible you end up paying rates at the height of the market, which is a precarious position to be in should the market drop,” Kozelouzek said. “Operators in the co-working or executive suites space need to be mindful of real estate price. It is very much a landlord market at this point.”