For more than a year, nearly 850 construction workers have been furiously transforming 27 acres of once-abandoned lots in downtown Miami into one of the biggest developments in city history. Within the sprawling $4 billion Miami Worldcenter project, work crews have completed a 444-unit rental apartment tower called Caoba while putting the finishing touches on the 60-floor luxury condominium Paramount Miami Worldcenter and starting on the first phase of the development’s open-air retail and restaurant complex.

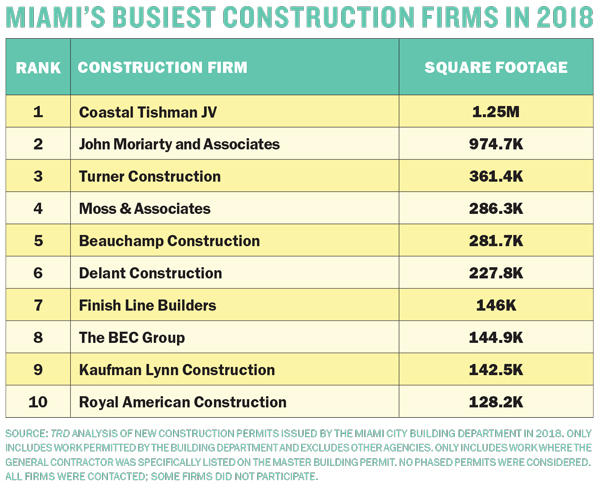

In total, they built about 1.25 million square feet of the Miami Worldcenter development last year, placing a joint venture between Coastal Construction and AECOM Tishman — the general contractors managing the massive project — first among construction firms that built the most square footage in Miami in 2018, according to The Real Deal’s ranking of builders operating in the city. Once completed, the massive project’s first phase will be close to 4 million square feet. It could possibly add 4 million more in subsequent phases on 10 city blocks owned by developers Art Falcone and Nitin Motwani — who have a number of partners that include CIM Group, Paramount developer Dan Kodsi, citizenM and others.

For the big construction firms like the Coastal-Tishman team, 2018 was a very busy year for erecting new buildings in Miami. From Brickell Avenue to Wynwood, the contractors worked on a slew of signature projects, including Brickell Flatiron, the SLS Lux Brickell, Wynwood 25 and the Bradley, to name a few. This month, TRD analyzed all new master building permits issued in 2018 by the city’s Building Department to determine which firms had the most work last year. Only master permits that specifically listed the general contractor were used in the analysis. No phased permits were considered.

Even though announcements for new condo projects have slowed since 2016, general contractors remain bullish about their prospects in 2019 and the following year. They point to a booming U.S. economy, a fairly recent slide in the price of materials and a shift to other real estate sectors aside from condo construction, such as bidding more on institutional, sports and mixed-use projects. However, with skilled labor in short supply and the cost of paying those workers climbing, the building industry could experience some headwinds by mid-2021, according to some general contractors

2020 and beyond

While builders have been busy, some say the pipeline for certain kinds of developments may soon dry up. Some luxury condo projects that have been on the drawing board for four years or more are getting tabled, said Tom C. Murphy, co-president of South Miami-based Coastal. “With the rising cost of construction and labor, something that was conceived four years ago, we can’t do it today,” Murphy said. “The numbers don’t make sense now.”

He is also concerned with how the overall global economy will fare over the next 12 months. “The strength of the international community that travels to South Florida is of great importance to us,” Murphy said. “It is something we are paying attention to.”

Michael Brown, Florida executive vice president and general manager for construction firm Skanska USA, said he expects the momentum from 2018 to barrel along through the end of this year. “The issue will be in 2020 in terms of how many new construction starts we will see,” Brown said. “We are seeing some slowing down on the residential side, particularly with multifamily.”

Brown added that interest rate hikes over the next two years could also deter developers from beginning projects. “All those things working together means we will see fewer construction starts in the second quarter of 2020,” he said. “By 2021, we may be seeing some decline.”

Construction firms had a lot of work in 2018 because those companies are building projects that have presold a significant number of units since launching sales at least two years ago, said Ed Easton, chairman of the Easton Group development firm. “That phase will definitely slow down by early 2020,” he added. “That will be a slower than normal year for construction.”

Coastal has been busy building luxury residential projects that are close to selling out units, Murphy said. The mixed-use Miami Worldcenter, for example, is the biggest construction site in Florida and will remain so until 2021, when the first phase is supposed to be finished. Paramount, the project’s condominium, has sold out 85 percent of its more than 500 units.

“We will see revenues and the square footage under contract increase in 2019, more so than in 2018,” Murphy said. “I still believe Miami is well-positioned. We are fortunate to be working on high-rise [condo] buildings where sales are continuing at a good pace.”

In addition to Miami Worldcenter, Coastal had more than 10 million square feet under contract throughout Miami-Dade County last year, Murphy said. The firm broke ground on the Estates at Acqualina in Sunny Isles Beach and is halfway through construction of Aston Martin Residences in Downtown Miami. In January, Coastal began work on MiMo Bay Apartments in Miami’s Upper Eastside and University Bridge Residences, a student housing apartment tower near Florida International University’s main campus.

“When you have good relationships with experienced developers, you will always have good work,” Murphy said. “Instead of looking to build everything in one particular segment of the market, we diversify by working with good developers in any space.”

In the mix

The big general contractors have learned how to quickly shift to other sectors since the 2008 recession, said Peter Dyga, Florida East Coast chapter president and CEO of the trade group Associated Builders and Contractors, or ABC. “I can’t find a single member who is concerned about this year,” Dyga said. “They all universally say it is strong in terms of the amount of work they have and that the mix of projects is good.”

According to a 2019 construction outlook report by Dodge Data and Analytics, U.S. construction starts for 2019 will be $808 billion, essentially the same as it was in 2018. The Dodge report predicts multifamily and commercial building construction will dip by 8 percent and 3 percent, respectively, compared to 2018. Dodge also said that the construction of offices, warehouses and hotels will also fall back, while the building of educational, health care, public works and amusement-related facilities will experience slight increases.

Bob Moss, CEO and chairman of Moss and Associates, is among the ABC members who are bullish about 2019. “Miami is still a very robust market,” Moss said. “Yes, we will see fewer condo starts, but there are still plenty of other projects to get excited about. We are doing a lot of university work, most of it in housing areas and laboratory spaces. And we are doing quite a bit of medical building work and continue to work in the sports sector.”

Among the projects that made Moss and Associates the No. 4 firm for square footage in 2018 was SLS Lux Brickell, a 57-story luxury tower by the Related Group. Moss finished construction in April. Nine months later, Moss and Associates topped off Brickell Flatiron, Ugo Colombo’s 64-story condominium two blocks south of SLS Lux. Outside Miami’s city limits, Moss and Associates completed the 235-unit Harbour condominium in North Miami Beach and finished construction of the tennis facility at Hard Rock Stadium in Miami Gardens. The facility is the new home for the Miami Open.

“With so much competition in Miami-Dade, we strive to provide strong, effective project management teams and leadership,” Moss said. “We deliver on our promises and maintain close relationships with our clients.”

According to the TRD analysis of permits, John Moriarty and Associates, a New England-based company that does work throughout Florida, took second place by completing 974,700 square feet in 2018. Third-place finisher Turner Construction completed 361,400 square feet. Fort Lauderdale-based Moss and Associates and Miami-based Beauchamp Construction round out the top five with 286,300 square feet and 281,700 square feet, respectively. Executives for John Moriarty, Turner and Beauchamp did not respond to requests for interviews.

Parts and labor

Another indicator that bodes well for the construction industry is the cost of construction materials, ABC’s Dyga said. While construction input prices increased 1.6 percent year over year in 2018, the last three months have shown a decline in prices, according to the association’s most recent analysis of U.S. Bureau of Labor statistics released

in February.

In a statement, Anirban Basu, ABC’s chief economist, said the average price for steel and softwood lumber, two products impacted by U.S. tariffs implemented by the Trump administration last year, decreased by 1 percent and 0.8 percent, respectively, in January. Prices for natural gas and unprocessed energy materials slipped 32.2 percent and 19 percent, respectively, Basu added. That puts builders on a better footing than where they were at this time last year.

“In early 2018, contractors and their customers were being hammered by rapid increases in materials prices,” Basu said. “Not only were prices rising, but there were concerns about the availability of certain precious commodities, including domestically produced steel.”

By the second half of 2018, the global economy softened, helping to push down the prices for oil, copper and other key construction-related commodities, Basu explained. It has also helped that President Donald Trump continues to delay increasing tariffs to 25 percent from 10 percent.

“For contractors, this helps sustain profit margins at a time of rapidly growing worker compensation costs,” he said. “For consumers of construction services, this should help lead to more favorable bids and greater likelihood that projects, whether publicly or privately financed, will move forward.”

Yet if the construction industry doesn’t figure out how to recruit more skilled laborers into the fold, it could spell trouble. Skanska’s Brown said finding enough construction workers at a time when business is strong is his biggest concern. “There is no doubt, labor is a big issue,” Brown said. “When the market does well, it creates upward pressure on costs and challenges in finding people to do the work.”

Dyga, ABC’s Florida chapter president, concurred. “Going forward, any labor shortage can negatively impact the market more than anything else,” he said. “Nationwide, we are short about a half million skilled labor workers. We are only seeing a 2 percent annual growth.”

To attract new workers into construction trades, general contractors will have to increase wages, which in turn means projects could become more expensive to build. “It could lead to either a slowdown or an inflation in construction prices,” Dyga said.

The construction industry could tackle labor shortages through technology. “In the past we have been guilty of being slow adopters,” Dyga said. “But I think the adoption of robotic building and other technology to counter the labor crunch will accelerate.”

In addition, Dyga said, ABC is working on ways to recruit and retain the industry’s future workforce. For example, the trade group is engaging in a public relations campaign to promote construction apprenticeships as being just as good as a four-year degree, Dyga said. “Historically, we have not done a good job promoting quality jobs in construction,” he said. “As a result, we don’t have enough skilled folks to do the work.”