Now that a number of condo projects have been completed this cycle, developers are facing a new source of sales competition: their buyers.

In the first half of the year, real estate agent Ceiliah Epner represented the seller of two units at the Four Seasons Residences at the Surf Club, which Fort Partners delivered in March 2017. Both units sold at a discount compared to the developer’s remaining inventory, Epner said.

“We just looked at what inventory was available and priced it lower than the developer,” said Epner, a real estate agent with Miami Real Estate Group, referring to both deals. “They couldn’t match the pricing.”

Epner also threw in a bonus offer to the buyers’ agents: a 5 percent commission, higher than the developer’s standard 4 percent. Epner had volunteered to take only a 1 percent commission, but ultimately represented both sides in both deals. “I knew we needed to compete against the developer units in all aspects,” she said.

The seller of the two units would only accept full asking price and all cash for both, and the $7 million unit ended up sparking a bidding war, according to Epner. The other unit sold for $6 million. Despite receiving cash on both sales and closing quickly — which was the reason for pricing them so competitively — the seller still lost about $2 million on his investments.

Never mind those losses — the more troubling implications are for that developer, whose unit listing prices were undercut by the reseller, who still didn’t recoup their money.

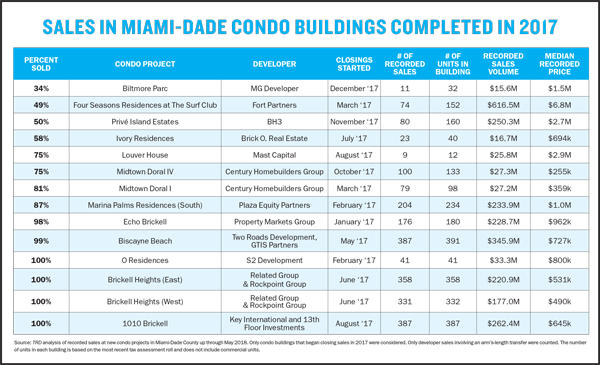

To understand just how many developers still have product to move ahead of the resellers, The Real Deal conducted an analysis of sales in condo projects that recorded their first closings in 2017 in Miami-Dade County.

The data shows that many of the biggest recently completed condo buildings in the county are at least 50 percent sold. TRD sourced the sales information from the Miami-Dade property appraiser, accounting for sales through May 2018.

Projects like Biscayne Beach, completed in May 2017 by Two Roads Development and GTIS Partners, and Related Group and Rockpoint Group’s Brickell Heights, delivered a year ago, are sold out, except for one remaining unit in Brickell Heights’ West Tower.

But others, from smaller boutique developments like Louver House in Miami Beach and Biltmore Parc in Coral Gables to the larger Four Seasons at the Surf Club and Privé at Island Estates in Aventura, still have sponsor units left.

At the Four Seasons in Surfside, Louise Sunshine — a strategic adviser to Fort Partners — said the 150-unit development is 85 percent sold with 18 units remaining. Property records show 74 closings have been recorded, which comes out to about 49 percent. The discrepancy between closed sales in property records and the developer’s sales figure can be attributed to the fact that some units are still being built out, Sunshine said, adding that those condos are expected to close within six months. She said that Fort Partners closed the sales center and is not offering any incentives on remaining units.

Mast Capital, too, is a luxury condo developer sitting on inventory, but also claims it is not considering offering buyer incentives. The Miami Beach firm completed Louver House — a 12-unit, four-story development — in August, and it’s 75 percent sold. Anna Sherrill, director of sales, said the three remaining units are priced from $2.3 million to $2.8 million.

As more projects get delivered in 2018 — like Jade Signature in Sunny Isles, Riva in Fort Lauderdale, the Harbour in North Miami Beach and the Paraiso District in Edgewater — developers will be faced with increasing pressure to sell out.

“Timing is everything. It’s not product. It’s not location. It’s timing,” said Peter Zalewski, founder of Cranespotters and director of acquisitions for Brickell Ventures, a real estate fund that targets underperforming properties.

Buyers of preconstruction condos typically try to flip their units, he said. But there’s little benefit in doing so if the building begins closing sales when the market is flooded with inventory, as it is now. “I always tell my clients, ‘Buy preconstruction because you believe in the project, you like it and you wouldn’t mind owning it for a while,’” said Andres Asion, founder of Miami Real Estate Group. “Don’t buy it to flip it. You might get very disappointed when the time comes to sell it.”

When owners aren’t able to sell, “the next hustle is to rent it,” Zalewski said.

Next up: bulk buys?

Behind closed doors, some developers are negotiating deals of handfuls of units to investors, sources said. Sometimes it’s before a building is completed and starts recording closings, as part of a push to finally wrap up presales. Other times it’s months after a project opens its doors.

“Some of these developers realize the jig is up, and they want to get out sooner than later,” Zalewski said, referring to those who offer discounts for packages of units.

Michael Internoscia, director of sales at Marina Palms, expects “the bulk guys” to fully descend on South Florida’s condo market within six to eight months.

Fund managers are already heading down to South Florida to scout opportunities, Zalewski said. “Typically, it takes one move to sort of trigger it all. Once one deal trades and resets the entire market, everyone piles in and rushes in,” he added.

TRD took a closer look at some of the projects that began recording closings in 2017, tracking where sales stand and what developers are — and aren’t — willing to offer to achieve a sellout.

Privé at Island Estates

Privé at Island Estates

At Privé at Island Estates, sales suffered due to lawsuits between the developer and neighbors who have opposed the project’s construction since 2013. While only 50 percent of the building’s sales have been recorded, the project is about 85 percent sold, according to senior sales agent Adriana Vargas Hernandez.

About 20 units went under contract or sold in 2018, she said. In February, developers BH3 and Gary Cohen secured a $50 million condo inventory loan for 41 units, or about a quarter of the building.

Hernandez said the developer hasn’t discounted units because it’s priced well for the market at about $950 per square foot. Few units are being rented, and there haven’t been very many resales, she said.

Marina Palms Yacht Club and Residences

Most projects completed last year have been selling since 2014 and 2015. At Marina Palms in North Miami Beach, where sales launched in 2014, owners are having more success with their units than the developer is with its remaining inventory.

Plaza Equity Partners built the 468-unit, two-tower project in two phases. The North Tower was completed in 2015 and is sold out. The South Tower was delivered in February 2017 and was 87 percent sold as of this May, according to property records.

Mike Internoscia, director of sales at Marina Palms, said there have been about 45 resales and 30 rentals at the waterfront project. The developer is discounting units on a case-by-case basis but is not doing so in bulk — at least not yet. It’s sold about eight units so far this year. Plaza Equity Partners is renting about five or six developer units to offset its carrying costs but hasn’t rushed to sell out the second building. Prices for remaining units start at about $815,000 for a 2,000-square-foot, two-bedroom condo. Most resales have closed for slightly more or slightly less, Internoscia said.

Biltmore Parc

Biltmore Parc

Over in Coral Gables, MG Developer recently unveiled an initiative aimed at enticing buyers to pull the trigger at Biltmore Parc, a five-story, 32-unit condo building at 718 Valencia Avenue. Fortune International Realty announced in April that they would allow buyers to put only 10 percent down. The remaining 90 percent of the purchase price would be due within 12 months.

Only 11 of 32 units closed in county records since the project was delivered in December. Daniel Guerra, vice president of development sales at Fortune, said that four units went under contract since the developer began offering that incentive in April, but none of those buyers are taking advantage of the offer. He said Biltmore Parc is actually about 60 percent sold.

Echo Brickell

Property Markets Group is not and will not be renting out remaining inventory.

Ryan Shear, a principal at the development firm, said renting erodes the value of the unit. But he’s not against offering a good discount. Shear said about four units in Echo Brickell are left — the same number of units remaining when the developer completed the 57-story, 180-unit tower at 1451 Brickell Avenue in November. Property records show that 176 units have closed.

“We’re flexible on price,” Shear said. “Some people come in and buy multiple units, but there are no bulk trades. In any condo development, there’s some form of a discount being offered.”

In the meantime, his firm is working on building thousands of rental units in South Florida. Shear would not comment on when PMG plans to launch two high-profile rental projects, one at 300 Biscayne Boulevard and the other at 400 Biscayne Boulevard.