UPDATE, Wednesday, July 25, 11:00 a.m.: After months of damning headlines, Realogy chief Ryan Schneider finally has something positive to talk about.

The firm’s blockbuster partnership with Amazon, announced Tuesday, sent the ailing conglomerate’s stock price up a whopping 19 percent. But Jeff Bezos isn’t the white knight that can save the massive brokerage from its many woes, industry insiders say.

Realogy is covering the costs for the new program, “TurnKey,” which offers homebuyers access to its agents in 15 U.S. cities and up to $5,000 in Amazon home services and products if they close. In exchange, Realogy would benefit by the leads generated through its partnership with the ubiquitous e-retailer.

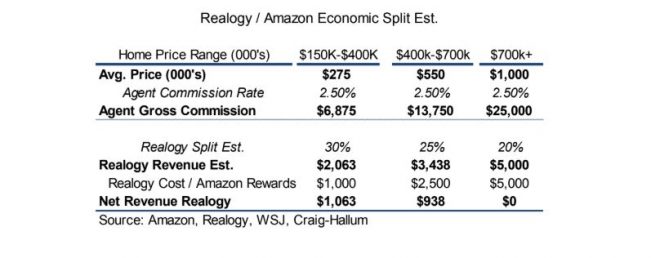

Analysts have been quick to perform a cost-benefit analysis on the program, and conclude that Realogy is on the losing side of a deal in which they eat the cost of the Amazon products by deducting it from their split of a commission.

Brad Berning, a senior brokerage analyst at Craig-Hallum Capital Group, cast doubt on the value of the leads TurnKey could generated for Realogy in a research note published Tuesday. “We estimate the cost of the program should pretty much wipe out Realogy’s commissions on these homes and net them close to zero,” said the analyst, who follows Zillow Group and RE/MAX.

“For Amazon, this is a free way to experiment with attracting customers,” Berning wrote. “For Realogy, we believe this is desperation to improve their broker platform which has structural headwinds and a levered balance sheet.”

Schneider, who has worked to modernize Realogy since joining as CEO in 2018, said the costs wouldn’t hurt the brokerage’s bottom line. “We like the economics of this. It’s not going to change the margins in our business in a negative way,” he said.

Credit: Craig-Hallum Capital Group, reported sources: Amazon, Realogy, Wall Street Journal, Craig-Hallum

Barclays’ analyst Matthew Bouley praised Schneider for TurnKey.

“He’s been trying to do different things to right the ship,” he said, noting Realogy’s change to commission splits in a few markets and its new “a la carte” suite of agent services. “[TurnKey] is probably the biggest step in the offensive direction.”

But Bouley also saw some flaws. He described Realogy’s allocation of its commission split into Amazon services and products as “probably not sustainable,” and said TurnKey’s lead generation through Amazon was unlikely to reel in the clients “that matter the most to Realogy.”

Realogy’s brokerages, he said, historically pursue higher-end transactions, which dwarf the program’s apparent target audience, stated on its website, of $150,000 to $700,000. (TurnKey’s Amazon benefits grow until the home price hits $700,000 and then they stay fixed for all higher sales. Realogy’s participating brokerages include Sotheby’s International Realty, Coldwell Banker, Century 21, Better Homes and Gardens and ERA Real Estate.)

“[High-end buyers] are not out shopping on Amazon for Alexa and someone to put their furniture together,” he said.

In response, Realogy’s head of strategy, Eric Chesin said the company was confident that TurnKey would have broad appeal.

Other analysts following Realogy weighed in with expectations that TurnKey would boost leads and potentially transactions.

Schneider has high hopes. “I’m not going to put numbers on those today but we can’t think of many opportunities that could be bigger than this,” he said.

But, as Berning noted in his report, Amazon’s investment in TurnKey doesn’t come with guarantees.

“Amazon is notorious for throwing ‘spaghetti at the wall and seeing what sticks,’” he said. Berning pointed to the eCommerce giant’s short-lived “Hire a Realtor” initiative as an example.

Barclays’ analyst Bouley also noted that generating more leads and teaming up with Amazon would not change the ultra-competitive brokerage landscape that Realogy is up against.

As commission splits are pushed higher for agents, and aggressive competitors like Compass continue to scale up, Bouley said it would take market acceleration, or competition subsiding, to ease these challenges.

“I don’t know if there’s a great endgame,” he said. “It’s hard to say that this model as it stands is a sustainable model.”

Clarification: The companies Craig-Hallum Capital Group analyst Brad Berning covers were added.