After raising another $370 million, the only thing standing between Compass and an IPO is time.

The New York-based brokerage — now valued at $6.4 billion — announced its latest round Tuesday, eliciting a new round of speculation as to when it may go public.

Robert Reffkin, CEO and co-founder of the firm, acknowledged Tuesday that going public was in the cards.

“Look, we’re likely going to have an IPO,” he said during an interview on CNBC’s Squawk Box. “But we’re fortunate, given our capital base, that we have flexibility in timing.”

It’s a line Reffkin has used before.

Launched in 2012, Compass has now raised more than $1.5 billion from investors. It’s used some of that money to recruit top agents across the country with bonuses and high splits, as well as acquire leading firms in gateway markets. That spending has attracted criticism that while the firm may be great at raising money, it’s not really building a sustainable business and is dependent on a constant stream of outside capital to stay afloat.

Squawkbox host Andrew Ross Sorkin made a point of asking Reffkin whether Compass had pivoted from its “straight-up” tech strategy, noting that its revenue gains have come from rollup acquisitions like Pacific Union International and Alain Pinel in California, and Stribling & Associates in New York.

“I think in the future you have to be both,” said Reffkin, describing a hybrid tech-brokerage model. “The future of this industry will be the first where there’s a place where you can search and do the transaction on one platform,” he added. “That’s what we’re building.”

A steady stream of hot companies going public have turned 2019 into what Fortune magazine dubbed “the year of the giant tech IPO,” prompting some to wonder if Compass’ investors may be ready to cash out now. As of mid-May, six venture capital-backed tech companies had gone public, raising $13 billion.

“There’s never been a better time to tap the IPO market,” said Zach Aarons, co-founder of MetaProp, a real estate VC fund and accelerator. “It’s one of the best IPO windows for tech companies I’ve seen in my career,” he added, describing the market as “ebullient.”

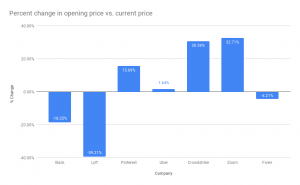

Despite Uber and Lyft’s disappointing debuts, several other tech IPOs have taken off. Pinterest is now trading at $28.27 per share, up 15.6 percent from its debut in April, while shares of the video conferencing company Zoom are up 32.71 percent and Crowdstrike, a cybersecurity company, are up 30.59 percent.

Compass’ march toward a public offering also reflects a maturing real estate tech sector. Investors that bet on real estate tech in 2012 and 2013 “are looking to have exits,” said Michael Beckerman, CEO of CREtech. “It’s a natural reflection of where we are in the cycle that companies are going to start to go public.”

For Compass, the catch could be the lackluster performance of rivals like Realogy, whose market cap has plummeted to $569 million, compared to $3.3 billion last year. As of midday Tuesday, Realogy’s shares were trading just above $5 – despite getting a temporary boost from an announced partnership with Amazon.

To avoid the same fate, Compass needs to sell itself as a tech company to Wall Street, Aarons said. Investors in the Series G round include Dragoneer Investment Group, a backer of late-stage companies, as well as the Canada Pension Plan Investment Board, SoftBank’s Vision Fund and the Qatar Investment Authority.

Compass said the new money will accelerate growth in product and engineering, as well as core products like Compass Concierge, which fronts the cost of home repairs for sellers.

But competition is picking up — and not just from traditional players. Tech-enabled brokerage firms like Side Realty and REX Real Estate are gaining steam.

Jeffrey Berman, general partner of Camber Creek Capital, said he’s seen a “marked uptick” in tech brokerages crossing his desk.

“As these companies mature,” he said, “It will be interesting to see what Compass’ competitive matrix looks like.”

Real estate firm Compass announces $370 million in new funding from CNBC.