Almost 11 million households were behind on rent or mortgage payments during the first three months of the pandemic.

Nearly 6 million of those households were renters, who reported either missing, delaying or paying reduced rent during the second quarter of the year, according to a report from the Mortgage Bankers Association. Just over 5 million households were homeowners that missed or deferred at least one mortgage payment.

Read more

The effect on multifamily property owners and mortgage lenders was in the billions, the report found. Unpaid rent cost landlords about $9.1 billion in revenue, while missed mortgage payments totaled an estimated $16.3 billion.

The report, produced by MBA’s think tank, Research Institute for Housing America, attributed missed payments to the spike in unemployment and reduction of work hours, but said that despite 11 million troubled households, most renters and homeowners were “largely successful” weathering the first three months of the pandemic.

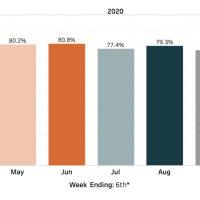

“Data from other sources reveal that this trend has continued through August,” Gary Engelhardt, one of the report’s authors and an economics professor at Syracuse University, said in a statement.

The MBA report shows that property owners and lenders offered more assistance than tenants and homeowners actually used in the quarter.

Fifteen percent of renters were given permission to defer or reduce their rent, while only 37 percent of those offered this break took advantage of it.

A total of 10.5 percent of renters surveyed missed payments at some point during the quarter. Only 6.7 percent of those that missed payments did not receive landlords’ permission.

Around 20 percent of homeowners with a mortgage received permission from their lender to delay or reduce payments, and 31 percent took the offer.

Of those homeowners who didn’t receive a break from their lenders, only 3.3 percent missed a payment.

Engelhardt noted that a new federal stimulus package would be essential to help prevent more households, particularly renters, from running into difficulties paying their housing costs.

“Particularly for renters, the combination of those who missed a payment — or were offered and did not take it — is substantive enough to suggest real risk to their ability to make upcoming payments,” said Engelhardt.