After a hot start in the first two months of 2020, the market for commercial mortgage-backed securities came to an abrupt halt in March with the arrival of the coronavirus pandemic. Issuance of new CMBS deals has gradually ramped up, but is still a far cry from the heights it reached in 2019.

Total CMBS issuance for 2020 is now projected to total up to $55 billion, according to a new report from Kroll Bond Rating Agency — well short of the $95 billion that its analysts had predicted last fall.

And next year’s deal volume may only be marginally better, held back in part by hobbled hotel and retail properties.

Commercial real estate recoveries have “typically lagged economic recoveries, and we expect this cycle to be no different,” Kroll analysts wrote in the report. “While the virus is expected to remain a significant headwind to issuance volume, there are factors that may support the pipeline including GDP growth, effective vaccine distribution and low interest rates.”

Within the broader commercial real estate lending space, CMBS loans accounted for just 4 percent of all loan originations in the third quarter according to CBRE, in contrast to 17 percent in the same quarter a year prior.

Loans on retail and hotel properties, the two sectors most hard-hit by social distancing measures, represented one-third of CMBS issuance last year, and the continued struggles of those sectors in 2021 is likely to put a damper on overall CMBS activity.

“However, the record low interest rate environment combined with continued interest in asset classes including industrial, essential retail, multifamily, and certain pockets of office — such as single-tenant properties with good credit — will help spur activity,” the report said. Activity is expected to pick up as the year progresses, especially if a vaccine becomes widely available, it said.

One CMBS sector that is poised for a modest comeback in 2021 is single-asset/single-borrower (SASB) deals, and Kroll predicts that total SASB issuance could reach $30 billion next year, up from $26 billion in 2020 but down from $46.2 billion in 2019.

“Given the current environment, the [SASB] market may continue to benefit from pullback by competing insurers and banks that often lend to trophy properties and high quality portfolios,” the report said. It noted that the securitization market has the ability to finance large loans that other types of lenders cannot.

The SASB market has produced some of 2020’s biggest refinancings, including loans for Brookfield’s One Manhattan West and Grace Building in Manhattan, and Blackstone and Hudson Pacific Properties’ Hollywood studio portfolio in Los Angeles.

Read more

Meanwhile, the CRE CLO (collateralized loan obligation) sector has held steady despite the pandemic, with total issuance predicted to total $10 billion both this year and next, a slight improvement from 2019.

Kroll attributes the steady performance of CRE CLOs, which are generally shorter-term bridge loans for transitional properties, in part to “loan structures in place related to the business plans contemplated at loan origination.”

“Many nonbank lenders plan to increase their bridge loan programs in response to the pandemic,” the report said. “However, even prior to the virus, the growing field of bridge loan lenders hampered many firms’ ability to hit volume targets — which may impede an individual issuer’s ability to timely originate sufficient loans for a CRE CLO securitization.”

The rating agency has not downgraded any CRE CLO transactions to date, although it notes that things could change “as temporary relief measures expire and reserves … are depleted.”

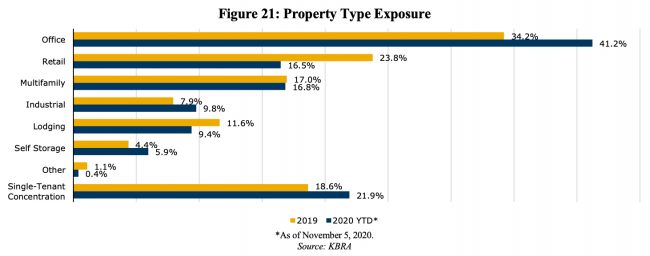

The pandemic has also had a clear impact on the types of properties included in CMBS transactions this year, as the above graph shows. Loans on retail properties saw the biggest drop in their share of total volume, falling behind multifamily for the first time since 2012, and continuing a downward trend that started before the pandemic.