The world was still feeling the aftershocks of America’s subprime mortgage crisis when Julien Haccoun landed his MBA and became a principal of his family office in South Florida. The country’s unemployment rate was stuck at about 9 percent, and the housing market had yet to recoup.

Rather than returning to his native France after graduating in 2011, Haccoun moved into his family’s second home in Miami, where he witnessed hundreds of properties being sold off in foreclosure auctions on a weekly basis.

Seeing an investment opportunity, he and his brother, Adrien, raised money from their family, developed software to analyze potential deals and spent about $30 million buying up distressed condos in South Florida. Those assets turned into rental properties, which they still manage today.

“It was really an amazing investment,” said Haccoun, who studied entrepreneurship at the University of Chicago Booth School of Business. He noted that the condo units would be worth about four times more if he were to sell now.

Julien Haccoun, Steinmauer Family

That was a key entry point for the Steinmauer Family, a french family office founded by Julien’s father, David, who made his fortune when he sold his computer memory company to a Chinese conglomerate in 2009. Steinmauer, the last name of another family member, was chosen to help maintain privacy. Over the past decade, the family’s real estate investments have grown to about 50 percent of its holdings.

Haccoun declined to give the total value of Steinmauer’s portfolio, which also deploys money through private equity, venture capital and the stock market.

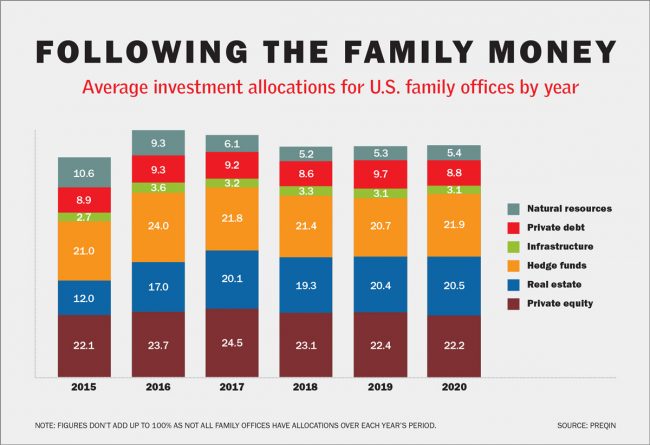

Family offices, private entities that manage the financial affairs of the high-net worth, have been allocating a larger chunk of their money to real estate in recent years, according to financial data provider Preqin.

On average, their share of investment in real estate — including residential, industrial, office, hotel and retail assets as well as raw land — has grown to more than 20 percent this year, up from about 12 percent in 2015. For comparison, the share of family office investment in natural resources, which was at more than 10 percent five years ago, fell to 5.4 percent in 2020.

“From a contrarian perspective,” few took advantage in the wake of the Great Recession, said DJ Van Keuren, of Evergreen Property Partners, who specializes in family office real estate investments. “They were sitting on the sidelines,” he noted.

Now with the pandemic and economic downturn taking their toll on real estate, many family offices are looking for a fresh chance to buy at steep discounts. In hindsight, family offices realize “that they missed out on some really good opportunities,” Van Keuren said. “They haven’t forgotten that memory.”

This time, however, residential properties are far from the cause or conundrum, leading some to approach with caution.

Private family affairs

As of last year, there were more than 7,000 single-family offices, serving one family per business entity, overseeing total assets valued at $5.9 trillion globally, according to an estimate by the advisory firm Campden Wealth.

“There has been significant growth in the family office space over the last decade,” said Rebecca Gooch, Campden’s director of research, who added that the number of family offices in North America alone rose by more than a third between 2017 and 2019 and now sits at roughly 3,000.

But because they are loosely regulated and tend to keep their dealings very private, the exact number of family offices is hard to quantify. In the U.S., for example, most are not required to register with the Securities and Exchange Commission, as long as they limit their financial advice to their own family clans.

Family offices also come in various shapes and sizes, and understanding them has become increasingly vital for brokers, asset managers and other real estate players as the sector grows.

Dan Bsharat of the Westchester-based real estate investment firm Hudson Hill Partners said family offices are starting to play a more essential role as they invest more directly in properties. And many of them are able to ride out various cycles due to their “long-term investment horizons,” he noted.

At the same time, the odds are against high-net-worth families in the long run, given that about “70 percent of the wealth is lost by the second generation, and 90 percent is lost by the third generation,” Van Keuren maintained.

Now, more families that generated their wealth through other industries are parking their money in real estate, allowing them to “create and maintain true generational and legacy wealth,” on top of the many tax benefits, he added.

Matthew Koelliker of M360 Advisors

Even with some significant tax overhauls expected under a new administration, physical property has become increasingly attractive for family offices as stocks and bonds become less reliable, said Matthew Koelliker of M360 Advisors, a California-based investment management firm.

Stalled pandemic plays

But while many family offices are ready to pounce on discounted properties, opportunities so far have been limited.

Koelliker, who works with single family offices, said the distress opportunities he had “anticipated at the beginning of the pandemic are taking longer to play out.” He added that it would likely take another three to six months for many to materialize.

While there are certainly opportunities with hotel properties, which have been among the hardest hit during the pandemic, Van Keuren said family offices aren’t pulling the trigger as much as he had expected. “The amount of money that has gone into buying distressed hotels isn’t to the level that you would think,” he noted.

With the growing need for housing around the U.S., multifamily rentals still remain the preferred property type for the bulk of family offices, according to industry experts.

Just before the pandemic hit, Van Keuren surveyed roughly 120 family offices about their real estate investments. Nearly 80 percent said their portfolios included multifamily properties, followed by 57 percent with investments in office buildings. And when asked what types of real estate they would be interested in adding to their portfolio in 2020, the majority picked multifamily and industrial assets. (Most of the families surveyed picked more than one asset type.)

Haccoun said that, if anything, the pandemic has discouraged his family from investing in hotels. “We’ve been looking to invest in the hospitality sector for a long time,” he noted. “We haven’t done so yet. And I think, right now, we’re going to wait. We are not very optimistic in the near future. Coming back to normal will take time.”

Instead, Steinmauer’s real estate arm is developing a 70-unit workforce housing complex on a site about 20 miles south of downtown Miami. Additional developments include a shopping center in Texas anchored by a grocery store, and other projects in Europe where Steinmauer works with European families.

One emerging trend among family offices is to invest in real estate through debt rather than equity plays, said Richard Wilson, founder and CEO of the Family Office Club, a wealth management trade association. That allows the family offices to collect fixed interest payments without having long-term stakes in specific projects.

“More people want income coming in right now, and want to make sure that there’s steady return of capital to put it to the next opportunity,” Wilson said.

Since the onset of the pandemic, banks have pulled back on lending for many ground-up development projects, and family offices are stepping in to help fill the void, Bsharat noted. “We’re seeing more development projects that have lapses in capital … so that’s starting to happen to a degree,” he said.

Wilson said his organization’s members also have been busy with “blue wave planning,” trying to figure out what to do with capital gains and estate planning after Joe Biden proposed significant changes to tax laws on the campaign trail.

“There’s been a lot of planning going on over the last six months, just preparing for this moment,” Wilson said of the election. “A lot of it is around making sure that things get structured now versus [next year].”

Direct business

A growing number of family offices prefer to directly act as landlords or co-developers rather than pour their money into real estate investment trusts or mutual funds.

In almost every one of our projects … we keep a certain allocation for family offices.

One prominent deal grabbed headlines in October when Cascade Investment — the primary family office of Bill Gates — teamed up with Singapore’s sovereign wealth fund GIC to acquire stakes in StorageMart, one of the country’s largest self-storage chains. The deal was valued at about $2.7 billion, according to media reports. Cascade did not respond to requests for comment.

Bill Rudin, Rudin Management (Getty)

And though they may not technically call themselves “family offices,” some prominent real estate firms effectively play the same role as they directly invest their family wealth into their real estate holdings.

Rudin Management, for example, operates the blue-blooded Rudin family’s own real estate portfolio, including 36 residential and commercial buildings in New York. Bill Rudin, the firm’s co-chairman and CEO, declined to comment.

Silverstein Properties has a separate family office led by Lisa Silverstein, the company’s vice chairman and one of the daughters of its founding chairman Larry Silverstein.

But the Silverstein family office invests outside of real estate — in industries like technology — to avoid any potential conflicts, said Tal Kerret, president of Silverstein Properties and the husband of Lisa Silverstein. All of the family’s real estate investments go to the company’s own projects, he said.

More broadly, Kerret acknowledged that family offices are upping their stakes in real estate. And a handful have remained longtime partners over the years.

Lisa and Larry Silverstein, Silverstein Properties

“In almost every one of our projects … we keep a certain allocation for family offices,” Kerret said, noting that those investors get the same terms as the company’s own family members.

“It’s more about the relationship than anything,” he added, “because financially, it’s easier to only deal with institutional investors.”

Collective efforts

While pandemic deals are still few and far between, according to industry sources, distressed condo projects in New York are gaining more attention from family offices.

Seth Weissman, a managing partner at the real estate investment firm Urban Standard Capital, said he’s putting together a bulk purchase of condos in a new development on the Upper East Side for his family office clients.

Before the pandemic, the development was priced at $1,750 a square foot, and Weissman’s family office clients are pooling their money to buy a bunch of unsold units at about $1,100 per square foot, he noted. Those units would be rented out until the price goes up to the point where investors could sell them at a profit. Weissman declined to give the property’s address because he said the deal hasn’t been finalized.

A growing number of family offices are teaming up to invest in those kinds of opportunities because they share the similar long-term investment horizons.

“They want to be working with people who say: ‘This is generational, and we’d like to be invested in things for the long term,’” Bsharat said. “So that’s often why they pool their capital together.”

That’s also been the case for Steinmauer, which teams up with other family offices to invest in real estate.

Haccoun said his family’s main objective is to prosper beyond the third and fourth generations, “which are the most difficult in a family office.”

“We are here on a long-term basis,” he said, noting that Steinmauer plans to stay invested in its real estate holdings for 10 years or more to help preserve the family’s wealth. “We keep on growing this part of the portfolio because we believe it’s an amazing asset to transfer to the next generation.”