It was a good year for Opportunity Zones.

More than $12 billion was invested in Opportunity Funds by the end of August, Bloomberg News reported, citing the most recent data available from Novogradac.

The tax deferral program, which was formalized in the Tax Cuts and Jobs Act of 2017, got off to a slow start partly because the regulations were unclear. Thanks to the rules finalized in December 2019, along with the strong rebound of the stock market last year, investors took advantage of the tax-deferral measure to reinvest their capital gains into Opportunity Zone projects.

“We actually turned away capital,” said Robert Morse, executive chairman of Bridge Investment Group, one of the major Opportunity Zone investors focusing on real estate. The firm’s investment amounted to nearly $2 billion — twice as much as in 2019 — and he expects to pour about $1 billion more into Opportunity Zones this year.

The tax deferral program aims to give developers incentive to invest into economically deprived neighborhoods. By investing their capital gains in Opportunity Zone projects, property owners and developers are allowed to delay paying capital gains taxes until 2026. If they keep the investments for more than a decade, the tax liability disappears.

But critics have argued some of the designated zones didn’t need any incentives to attract investors or were not poor areas, while others said they enrich developers without any evidence or metrics to show their Opportunity Zone projects benefit the neighborhoods they are in.

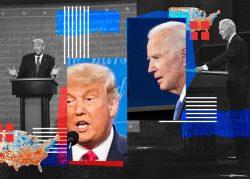

President-elect Joe Biden has suggested reforms to the program, including incentivizing developers to partner with community organizations, and a more robust system for reporting on the impacts of developers’ investments.

[Bloomberg News] — Akiko Matsuda

Read more