Compass’ pitch to investors is all about its agents.

The company’s S-1 — a prospectus that details its financial performance and business strategy filed ahead of an IPO — kicks off with a founder’s letter from CEO Robert Reffkin, who said he started Compass to build better tools for real estate agents like his mom.

“The brokerage model was originally designed to be a one-stop shop for everything an agent needed,” he wrote. But the business hasn’t progressed past the pre-internet era, something Compass is trying to change.

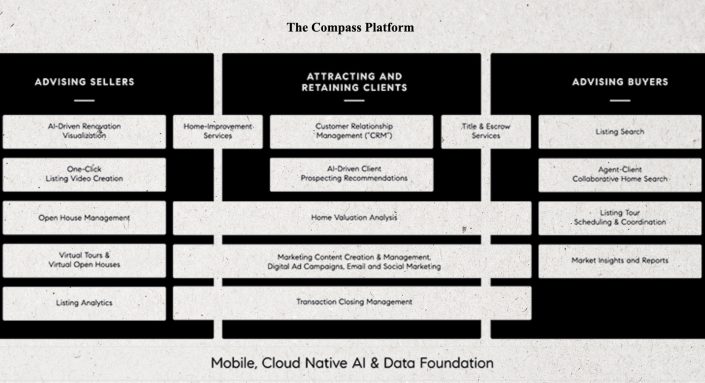

“We are replacing today’s complex, paper-driven home-buying and selling process with an all-digital, end-to-end platform that empowers real estate agents,” Reffkin wrote.

Although Compass has touted its technology as a key differentiator from other residential brokerages, the prospectus describes the agent as remaining central to buying and selling real estate.

“Despite various ‘agentless’ models such as iBuying and for-sale-by-owner, nearly 90 percent of sellers and buyers in the U.S. work with real estate agents,” Reffkin wrote. Last year, more than 5.6 million homes were sold in the U.S., representing $1.9 trillion in value. “We believe that real estate agents are an underserved group of business owners,” he said.

Sticking with the empowerment theme, Reffkin said Compass aims to provide its agents with tools to serve clients and grow their businesses. “At Compass, we are agent-obsessed,” he wrote. “When agents succeed, Compass succeeds.”

The filing also shows where Compass believes it can make its profits, much of which it accredits to its software platform.

Here are six key financial takeaways from the prospectus.

Ramping up revenue

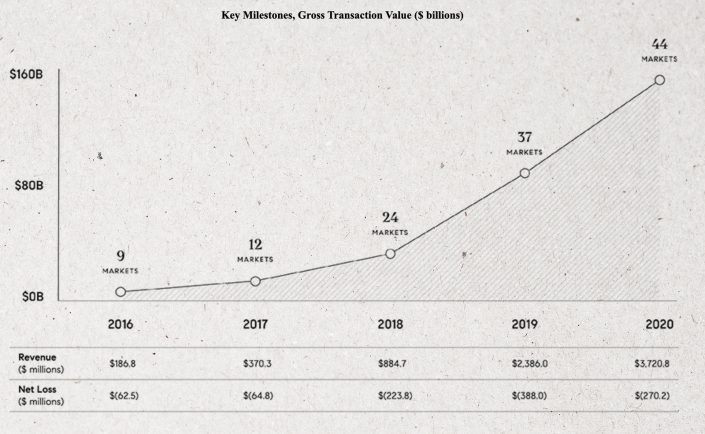

Compass’ revenue more than doubled between 2018 and 2019, as the firm broke into new markets and expanded through acquisitions of other brokerages. The firm generated $884.7 million in 2018 and $2.4 billion in 2019. Bolstered by the hot U.S. housing market in 2020, Compass’ revenue hit $3.7 billion in 2020, up 56 percent year-over-year.

Deals, deals, deals

Compass’ gross transaction value

Compass’ sales volume jumped 55 percent last year to $151.7 billion, up from $97.5 billion in 2019. (In 2018, sales volume was $33.7 billion.) The number of transactions rose 66 percent between 2019 and 2020 to 144,784.

How many agents?

Of its 19,385 agents, Compass considered about 9,368 “principal agents” — meaning they are team leaders or work independently — as of Dec. 31, 2020. Compass said it has retained 90 percent of principal agents over the last three years; 30 percent of them are enrolled in “Compass Anywhere,” meaning they’re fully mobile and don’t have a designated desk.

The bottom line: 88 percent of agents use the Compass platform at least once a week and 66 percent use it daily.

Internal measures

Compass’ S-1 also disclosed an internal metric called “net platform contribution retention,” which measures its platform’s ability to make the company money year-over-year. “Platform contribution” is defined as revenue after expenses — in other words, how much money Compass keeps after paying agent commissions. The contribution grows as a result of increased commission dollars, “enhanced economics” with agents, and when agents and clients pay for additional services like title and escrow.

The Compass Platform

Per the filing, Compass’ “net platform contribution retention” was 105 percent in both 2018 and 2019. It jumped to 118 percent in 2020, due to agents who joined in 2018 and were counted for the first time. (A key caveat is the calculation includes only principal agents who have been using its platform for at least five quarters.)

About the losses

In the S-1, Compass disclosed $1.1 billion in cumulative losses as of Dec. 31, 2020. But on an annual basis, the losses narrowed last year. Compass lost $223.8 million in 2018, $388 million in 2019 and $270.2 million in 2020. It cut at least $10.3 million in costs due to the Covid-19 pandemic, including slashing 15 percent of its staff.

Where’s the spend?

Sales and marketing was the big-ticket item in 2020, accounting for $407.9 million worth of expenses, up from $382.8 million in 2019 and $174.3 million in 2018. That bucket includes advertising, employee compensation, agent acquisition incentives and costs associated with programs like Compass Concierge, where the brokerage fronts sellers money for home repairs. Its R&D spend in 2020 was $146.3 million, up from $56.7 million in 2018. Its lease costs were $110.2 million last year.

Read more