For multifamily, office landlords, worst is yet to come: Moody’s

For multifamily, office landlords, worst is yet to come: Moody’s

Trending

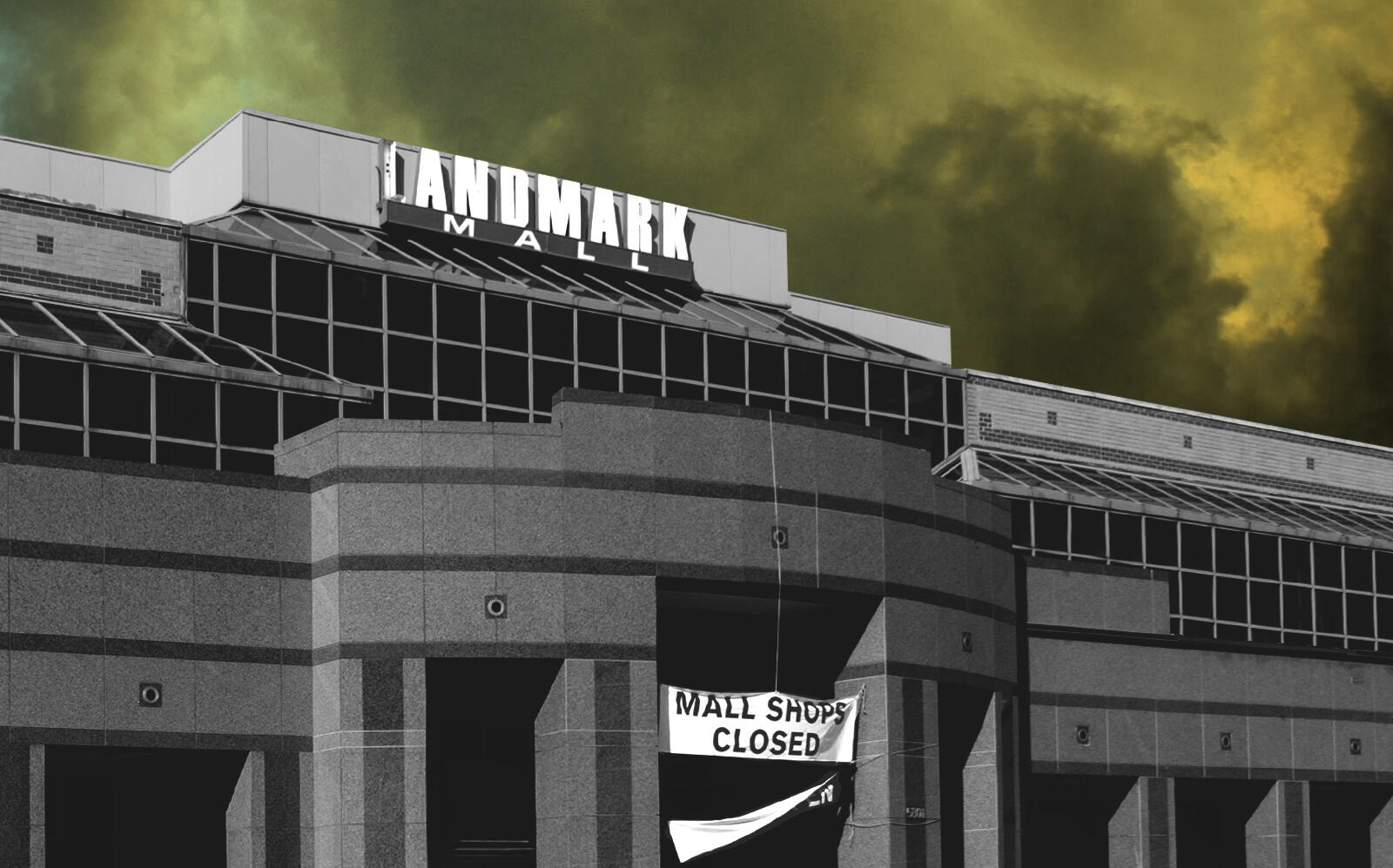

Mall vacancy rate hits all-time high

Stores sit vacant as retail sector claws back from pandemic

It’s not just office and residential landlords who need to worry about soaring vacancy rates.

The vacancy rate for regional and superregional malls hit 11.4 percent in the first quarter of 2021, the highest it’s ever been. That’s up from 10.5 percent in the fourth quarter of 2020 — an increase of 90 basis points in a single quarter, according to a report by Moody’s Analytics.

“Retail is slogging through the evolutionary process that started well before the pandemic,” the report reads. “Malls are of more concern than neighborhood centers, but even then, it is unlikely that we will close down every single mall in the U.S.”

For malls, heightened vacancy rates are especially terrifying as the closure of certain stores, or a large number or stores, can trigger co-tenancy clauses, which allow other tenants to lower rents or exit leases.

Read more

For multifamily, office landlords, worst is yet to come: Moody’s

For multifamily, office landlords, worst is yet to come: Moody’s

Office sector to keep sinking until 2024, Moody’s predicts

Office sector to keep sinking until 2024, Moody’s predicts

As a whole, the retail sector is still trying to claw its way back from the early days of the pandemic. The vacancy rate is at 10.6 percent — although that’s only a 0.4 percent decrease from the same time last year.

Effective rents — those that include some kind of incentive from the landlord — and asking rents have both fallen, to $18.58 per square foot and $21.32 per square foot, respectively. That’s a 1.5 percent and 1 percent year over year decrease respectively.

Of the 77 metro areas that Moody’s tracks, 40 recorded a decline in effective rent in the first quarter. Still, the report notes, that’s a decrease from the 60 metro areas that saw rents decline in the previous quarter.

But there may be some hope on the horizon. A Placer.ai analysis of foot traffic at 50 malls across the country found that visits last month were just 24 percent below those in March 2019 — using that year, instead of 2020, as it shows what a normal period should look like. Though that may not seem great, that gap is the lowest since the pandemic began.