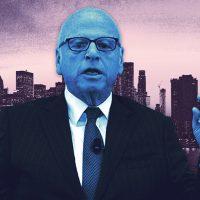

As CEO of newly spun-off Douglas Elliman, Howard Lorber will receive an annual salary of $1.8 million, a recent filing shows. But instead of that being tacked on to what he makes already as Vector Group CEO, it will be subtracted from his Vector compensation package.

That figure could go up: Lorber can get a cost-of-living adjustment, and the board of directors of Douglas Elliman has the power to increase — but not decrease — his salary. He’s also entitled to an annual bonus of 150 percent of his base salary.

His other executive perks include a car and driver provided by Douglas Elliman, a club membership and dues, use of a corporate aircraft, and a $3,750 per month allowance for lodging and related business expenses.

Read more

Elliman’s separation from Vector was announced in November. One rationale was to allow investors to buy shares in the brokerage without also buying a tobacco company.

Vector Group investors have complained in years past about Lorber being paid too much. In 2020, a majority at Vector’s annual shareholder meeting rejected executives’ 2019 compensation, including $11.7 million for Lorber.

Vornado Realty Trust CEO Steve Roth, by comparison, received compensation of $11.1 million in 2019, less than Lorber despite Vornado’s greater size and market capitalization. One retail investor called Lorber’s pay “excessive.”

Douglas Elliman’s numbers have been pretty good since. The firm spun off from Vector Group before debuting publicly on the New York Stock Exchange late last year. The move came after the firm’s successful quarter, powered by a boom in home prices and strong sales.

The firm’s net income more than doubled annually to $25.1 million. Closed sales volume was $12.6 billion, up from $7.8 billion the year before.