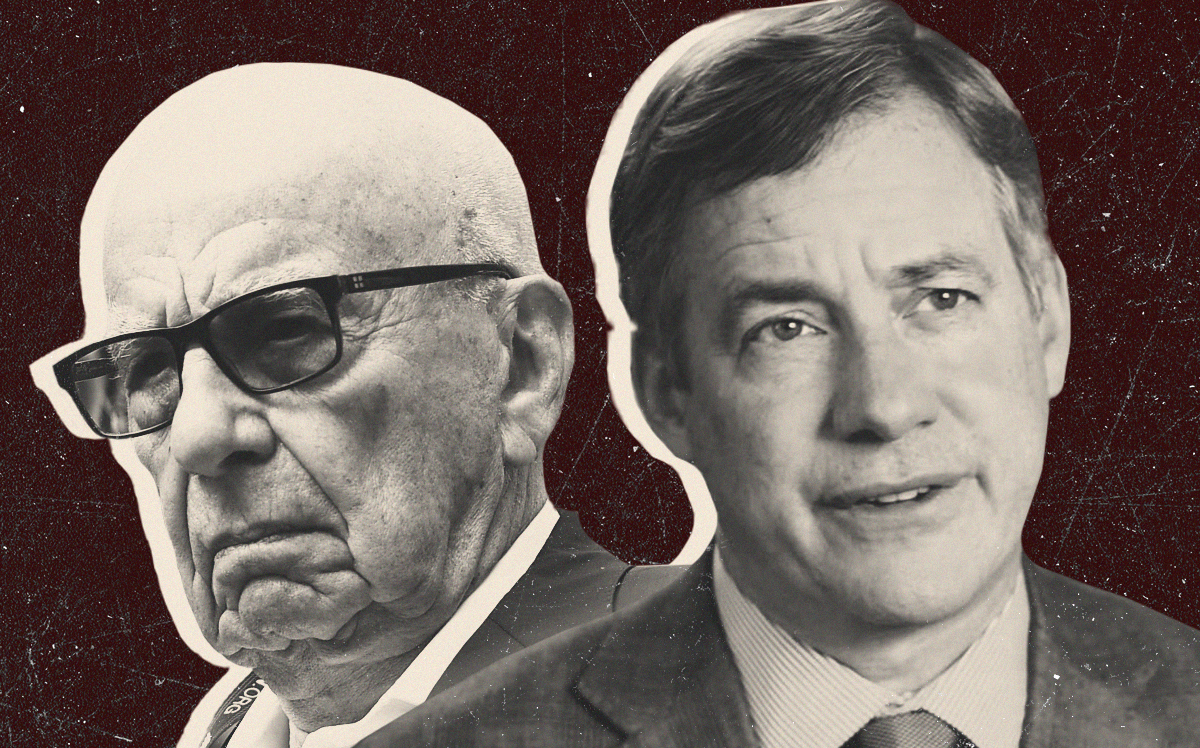

CoStar Group’s potential deal with Rupert Murdoch’s News Corporation for Move, Inc. could mean major changes for stakeholders and brokers alike.

The commercial real estate behemoth has spent more than $2 billion on its entry into residential real estate over the last decade, beginning in 2014 with Apartments.com and later acquiring Homesnap in 2020 to launch Citysnap as a competitor to Zillow’s StreetEasy brand.

But despite its growing market share, the company is missing a crown jewel like Move’s Realtor.com.

A regulatory filing reported last week only confirmed the companies are in talks for the parent company, which the media mogul’s company paid $1 billion for in 2014. But the news poses the potential for a major power shift among the largest rivals in residential.

An acquisition would deliver a profound enough glimpse into the residential market to compete with Zillow’s Flex program. Known in New York as StreetEasy’s Expert program, the service sells curated leads to brokers in exchange for a substantial cut of the commission when a deal closes.

More capture data could mean the company could finally give Zillow a run for its money, according to The Real Brokerage CEO Tamir Poleg.

“Competition always creates more favorable pricing for users,” he said. “For agents, it might actually be good news.”

Since Realtor.com’s 2018 acquisition of lead-generation startup OpCity, the platform offers brokers leads for a 30 to 35 percent commission. Analyst Mike DePrete estimated that model earned Zillow Flex a 200 percent annual bump in revenue in the first quarter of last year.

The model could come up against CoStar CEO Andy Florance’s professed approach to business.

“I’ve had plenty of time to take a commission; I’ve had plenty of time to do iBuying; I’ve had plenty of time to do a referral fee,” Florance told RisMedia in December. “I’ve had all kinds of time to do those things that people don’t like and we’ve chosen to never, ever do them.”

In addition to Realtor.com, a sale would bring CoStar a handful of domains that would allow it to track transactions across the homebuying process, including Upnest, a broker ranking site, Doorsteps, a rentals website, and moving.com, a site that connects consumers with moving companies.

That kind of insight could allow it to attach services, like escrow and title insurance, to transactions, something Zillow and Compass are aiming to do as soon as possible to boost returns.

CoStar’s market cap has more than doubled since 2018 to $32 billion, compared to listings giant Zillow’s $10 billion. But the company has room to grow in residential: Filings show it made $19 million, or just under 4 percent of its third quarter revenue, from the sector.

Read more

Steve Murray, a residential brokerage analyst and co-founder of Real Trends, said he isn’t convinced a sale would have a meaningful impact for brokerages, unless CoStar can overcome the Achilles heel of proptech companies: failing to fundamentally change the way consumers find brokers and shop for homes.

“They keep thinking if they control the information they’ll control the distribution of buyers and sellers to agents and change the economics to where they’ll be getting a bigger share of the commission dollar,” Murray said. “I suppose all those things are possible, but Zillow hasn’t been able to pull it off.”

As for Zillow’s take on the potential deal, CEO Spencer Rascoff reacted publicly at an event for Inman this week, saying the rumored $3 billion price tag seemed “a little low.”

A person familiar with the talks told Bloomberg a deal could be announced within days. If the companies agree on a sale soon, it could be an indication that CoStar thinks the residential market is bottoming out.

“It seems like CoStar is taking advantage of difficult market conditions to do an acquisition at a favorable price,” Poleg said. “If they’re pulling the trigger now versus in three months or six months, maybe they believe the value in three to six months will be higher.”

That playbook could open the door for more deals. After months of income diversification plays, dives in stock value and widespread layoffs, DelPrete predicted acquisitions could continue if market conditions don’t improve.