News Corp responded to a drop in revenue last quarter by confirming ongoing talks about a sale of Move Inc. and plans to slash jobs.

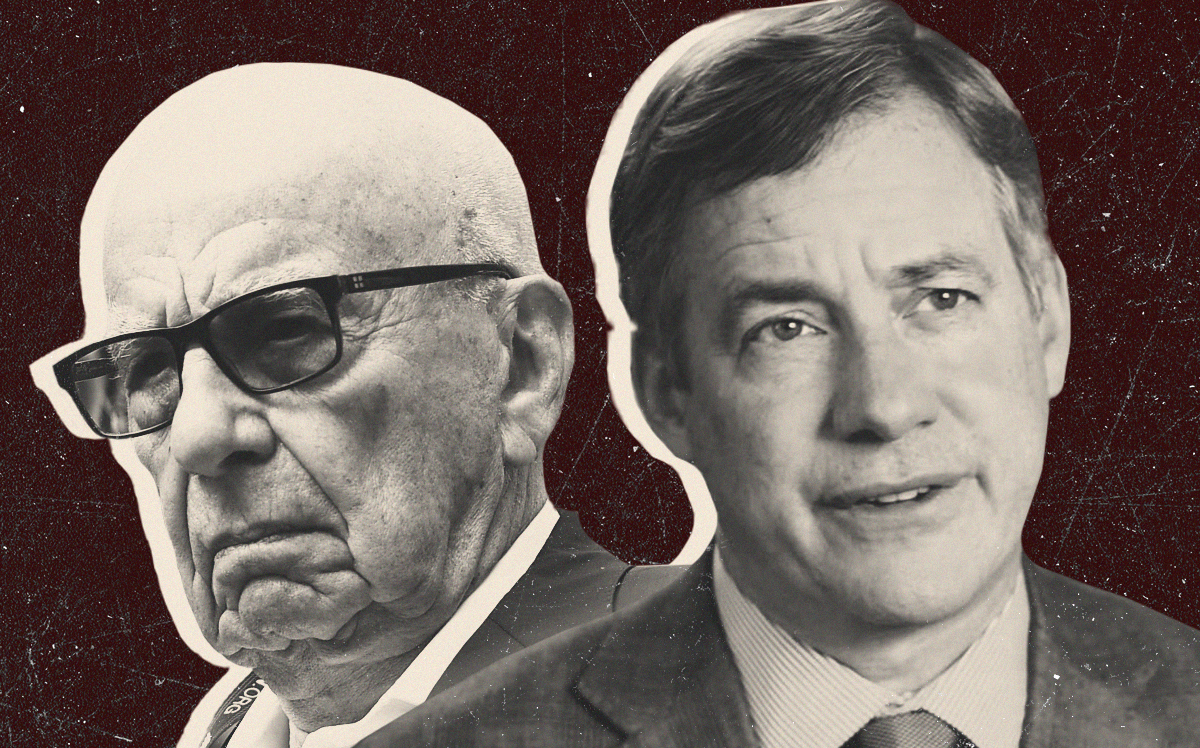

Rupert Murdoch’s company will cut 1,250 jobs, Inman reported. The company didn’t specify in its fourth-quarter earnings report where the cuts would have the deepest impact and if they involved Move, the parent company of listings giant Realtor.com.

Real estate appears to be the driving force behind the layoffs. In the fourth quarter, Move revenue fell by $23 million because of the broader slowdown in the real estate world. Revenues from real estate sales and referrals declined during the quarter.

Nevertheless, News Corp CEO Robert Thomson expressed optimism during last week’s earnings, saying he believed that rates had peaked. Thomson also said revenue per lead grew and Realtor.com would aim to increase revenue from sell-side listings.

For the time being, that will be happening under News Corp’s large umbrella. News Corp confirmed during its earnings it was “actively engaged in discussions” about selling Move to CoStar. It did not put a timeline on those talks or guarantee a sale would take place.

The potential sale would further entrench CoStar in the residential space following its acquisitions of Apartments.com and HomeSnap, along with providing an escape valve for News Corp as slow real estate activity hinders revenue for Move and Realtor.com.

News Corp paid nearly $1 billion to acquire Move in 2014. The potential CoStar deal could reportedly value Move around $3 billion. News Corp owns 80 percent of Move; the rest is owned by REA, a digital real estate subsidiary also controlled by News Corp.

Move’s revenue in the fourth quarter declined to $146 million. The company reported $678 million in earnings for the year. In the year prior to News Corp’s acquisition, the company’s revenue was $227 million.

A CoStar acquisition could mean major changes for industry stakeholders and brokers alike. More data could mean the company could finally give Zillow a run for its money, Tamir Poleg, head of the Real Brokerage, told The Real Deal.

“Competition always creates more favorable pricing for users,” he said. “For agents, it might actually be good news.”

— Holden Walter-Warner

Read more