The Federal Trade Commission is gearing up to challenge the owner of the New York Stock Exchange’s deal to merge with a mortgage data firm.

The FTC plans to challenge Intercontinental Exchange’s acquisition of Black Knight, Politico reported. Three sources with direct knowledge of the situation told the outlet a case could be filed some time next month.

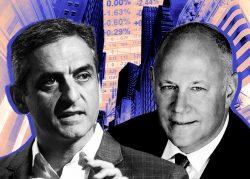

Intercontinental Exchange — which owns the New York Stock Exchange — agreed last year to acquire Black Knight for $13.1 billion. The deal was expected at the time to close in the first half of this year.

The transaction was designed to create “a true end-to-end solution” in mortgage services, ICE CEO Jeffrey Sprecher said after the deal was announced. Black Knight provides software, data and analytics for real estate and housing finance markets.

The companies previously said the acquisition would increase automation and efficiency to lower the cost of obtaining a mortgage. They also said it would provide data to help homeowners reduce monthly payments and default likelihood.

The FTC, however, is reportedly concerned the deal would deliver ICE too much power and higher prices across the mortgage data and services industry.

While ICE operates a number of exchanges, including the NYSE, the Atlanta-based firm has been looking to play a bigger role in the mortgage market. In 2020, it agreed to acquire mortgage software firm Ellie Mae for $11 billion. That acquisition brought the firm Encompass, its loan origination offering.

ICE later bought out Merscorp, an operator of a national electronic registry of mortgages.

The companies have offered to sell Black Knight’s loan origination platform, Empower, to allay antitrust concerns, and Black Knight has even hired bankers to sell the product. That may not appease the FTC, which remains weary of how much control over data and technology the combined company would have.

Neither company commented to the outlet about the FTC’s potential challenge.

— Holden Walter-Warner

Read more