A real estate investor has pleaded guilty to stealing more than $3 million in a wire and fraud bankruptcy scheme, according to federal prosecutors.

Sean Tissue, 37, of Social Circle Georgia, engaged in a real-estate fraud scheme from 2015 to 2021, during which he convinced potential investors from outside the U.S. to invest in real estate in Michigan, Texas, and other locations, prosecutors said in a statement.

During that time, Tissue provided to investors false information — including fake deeds, wiring instructions, bank statements, lease and inspection documents, as well as a fake name (“Sean Ryan”) — to get them to invest in the scheme, which Tissue operated primarily in Michigan.

In addition, from 2017 to 2019, Tissue also committed bankruptcy fraud by withholding from his Chapter 7 bankruptcy trustee information pertaining to his assets and financial affairs.

Tissue, who owned numerous companies including The Centureon Companies LLC, Greystone Home Builders LLC, Sycamore Homes LLC, Lenovo Homes LLC, NROL Holdings LLC, Phillip Ryan LLC, Boardwalk Heights B2R LLC, NROL Property and Investment LLC, has been in federal custody since his arrest in 2021.

He faces penalties of up to 20 years in prison for wire fraud and up to five years in prison for bankruptcy fraud, prosecutors said.

“Sean Tissue orchestrated an elaborate scheme to defraud individual investors. He tried to avoid repaying those investors by declaring bankruptcy, and his lies and deceits continued in the bankruptcy proceeding,” U.S. Attorney Dawn N. Ison said in a statement.

Tissue isn’t the only person to recently find themselves in hot water with the feds over real estate.

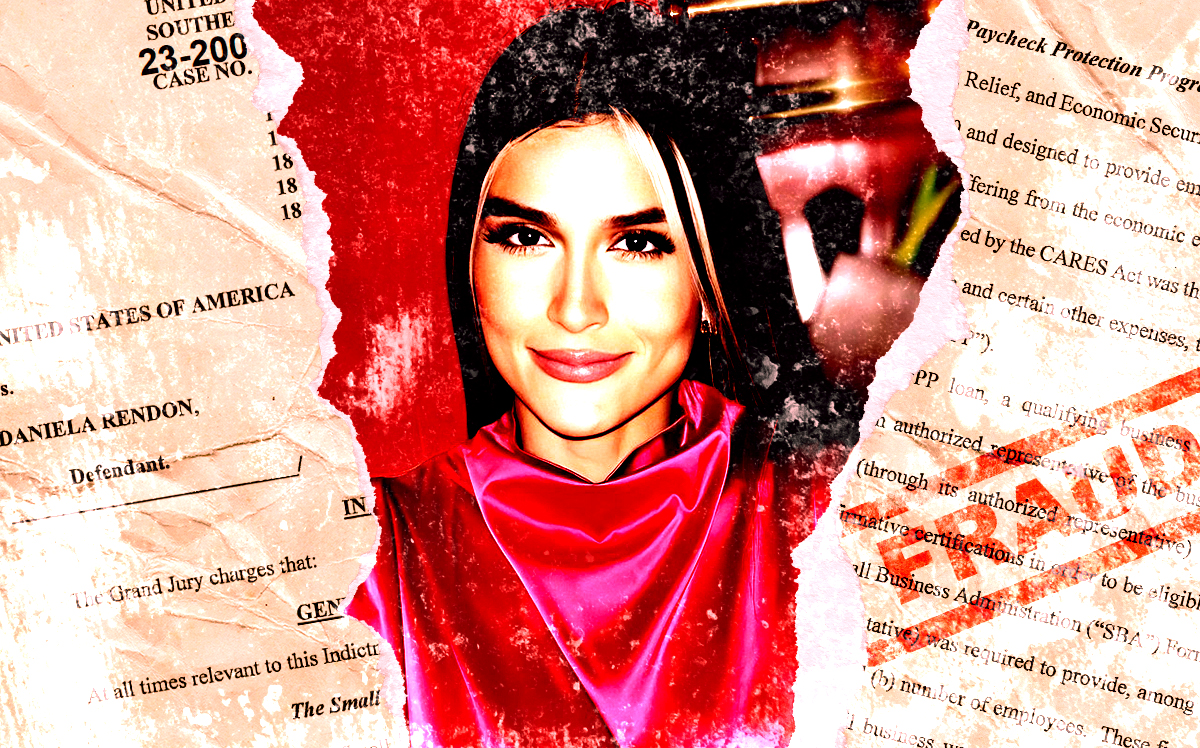

Miami real estate agent Daniela Rendon was charged last month with fraud and money laundering after being linked to $381,000 in Covid-19 relief funds that she allegedly used to pay for a Bentley, cosmetic procedures and a luxury apartment rental.

Rendon allegedly submitted fraudulent applications for Covid-19 federal relief funds to the Small Business Administration and Paycheck Protection Program by falsifying her revenue, payroll and IRS tax forms, according to a press release and the complaint from the United States Attorney’s Office Southern District of Florida.

Read more