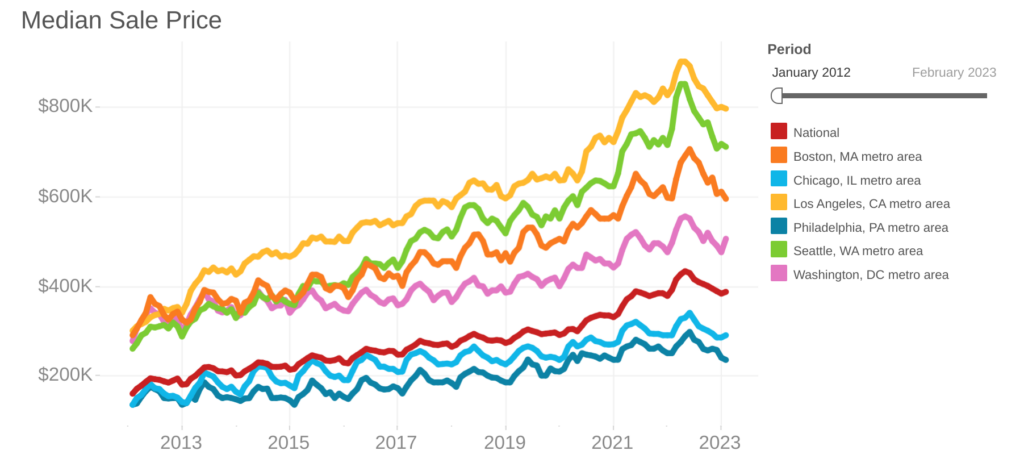

How long has it been since the median U.S home price fell year-over-year?

Hint: Gotye’s “Somebody That I Used to Know” was the top song, Superstorm Sandy caused more than $60 billion in damage and mass shootings in Connecticut and Colorado traumatized America.

The answer is 2012 — or was, until last month, when the median sale price dropped 1 percent from February 2022 to $386,700, according to Redfin.

“Buyers are struggling because higher interest rates have increased the cost of homeownership, and sellers are struggling because they’re still adjusting to the fact that their home won’t sell for what their neighbor’s did a year ago,” Redfin agent Andrew Vallejo said in a press release.

Other factors include less than robust household formation, which reduces demand for homes; fears of an economic downturn, which hasn’t happened despite repeated interest rate hikes by the Federal Reserve; and buyers waiting for mortgage rates to fall and for-sale inventory to rise.

Vallejo’s turf of Austin, Texas, suffered the second largest median sale price drop, 12.4 percent, of the 91 metropolitan areas in Redfin’s report. San Jose, California, was No. 1 (or No. 91, depending on your perspective), with a 13.1 percent annual decrease.

Austin’s price plunge can be explained by a nation-leading increase in supply, as active listings in the Texas tech hub were 79 percent more numerous last month than they were a year before. Nashville (up 72 percent), Fort Worth (69 percent) and Tampa (63 percent) also had big inventory jumps.

For real estate agents, mortgage brokers and others in the home-sales industry, prices are not the problem so much as sales, which fell off dramatically after low interest rates and the pandemic set off a buying frenzy in mid-2020.

The number of sales in February fell 44 percent in Miami from a year earlier, more than in any other metro area that Redfin analyzed. New York was second worst with a 40 percent drop, followed by San Jose and Baton Rouge at 38%, and Long Island at 37.

Read more

The smallest drops in closed sales were in Dallas (-1 percent), Richmond (-8 percent) and Fort Worth (-10 percent).

The price and sales data are a lagging indicator, as they reflect contracts largely signed in December and January.

Redfin noted that the biggest drops in prices and sales were inexpensive coastal markets and pandemic boomtowns. They were the most stable in affordable areas; Pittsburgh, Oklahoma City and Cleveland.