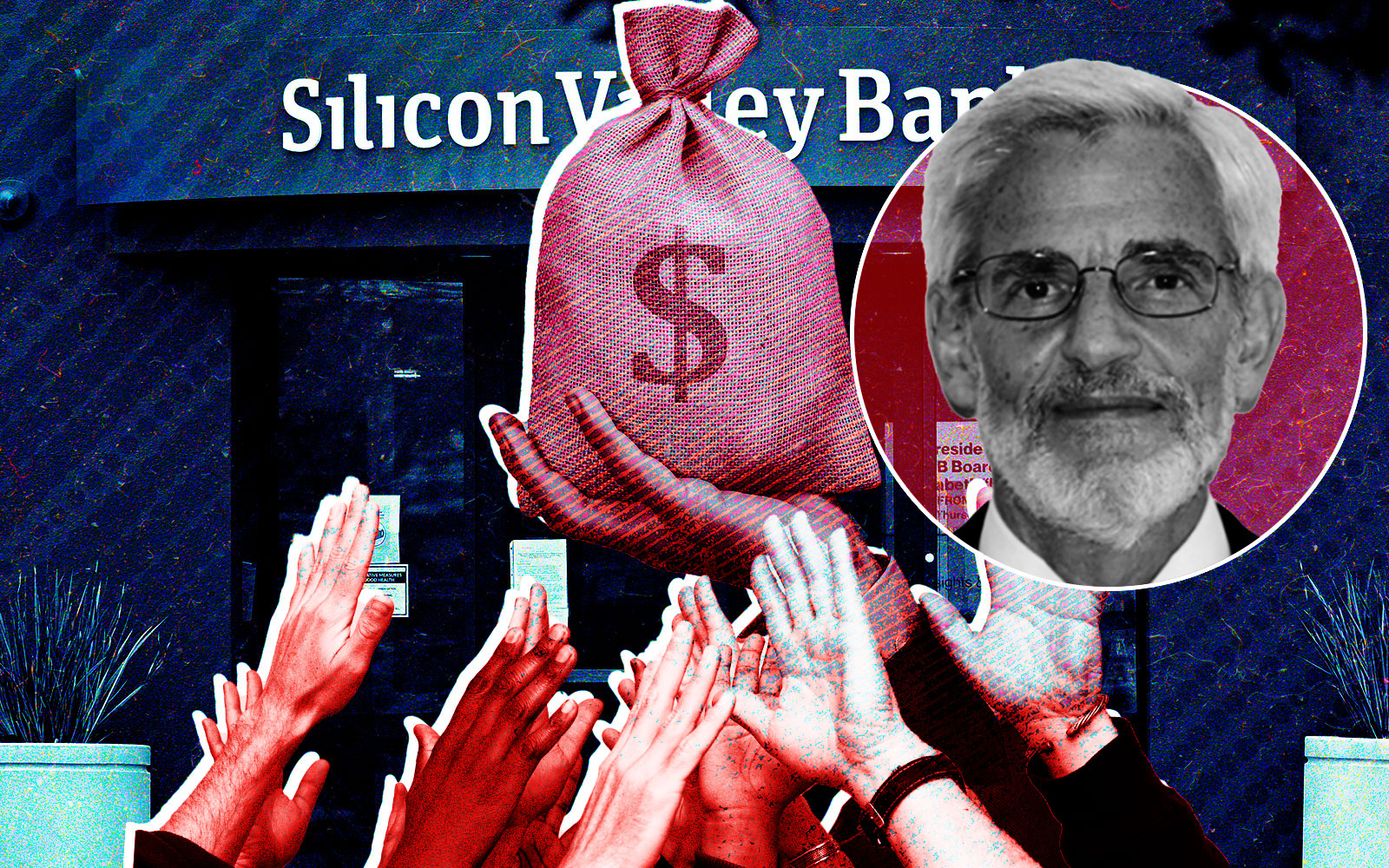

First Citizens Bank has agreed to purchase the deposits and loans of Silicon Valley Bank, which sent shockwaves through the economy upon its collapse this month.

First Citizens is set to assume $72 billion in loans and $56 billion in deposits, Bloomberg reported. The North Carolina-based bank snagged the $72 billion in assets for the deeply discounted price of $16.5 billion, according to a statement from the Federal Deposit Insurance Corp, which took control of the bank this month.

Roughly $90 billion in securities and assets are remaining with the FDIC. The institution also agreed to equity appreciation rights in First Citizens, which could be worth up to $500 million.

The buyer will operate more than a dozen branches of SVB as divisions of First Citizens. Customer accounts aren’t expected to see significant changes right away.

Valley National Bank was among the other institutions that bid for SVB. First Citizens also submitted a bid to acquire the failed bank earlier in the aftermath of its collapse. The Raleigh-based firm was the 30th largest commercial bank in the country by assets at the end of last year, but has experience buying other FDIC-assisted banks since the global financial crisis.

Only last week, the former owner of SVB received approval to spend up to $100 million as it tries to sell the bank holding company’s assets.

The bank went into receivership on March 10, becoming the second largest bank failure in the nation. At the time of its collapse, SVB had $10.9 billion of real estate loans on the books.

Read more

The SVB collapse was quickly followed by the collapse of New York-based Signature Bank. Signature’s three founders may still be eligible for severance pay, but they combined to lose $285 million in stock. New York Community Bank agreed to acquire most of Signature’s deposits.

Since the two failures, both the FDIC and the banking industry have been working to shore up rivals like First Republic Bank in an effort to prevent contagion from spreading across other institutions.

— Holden Walter-Warner