The top-tier asset class that was supposedly immune to hardship is now at risk, too.

Distress is coming for Class A offices, according to the Wall Street Journal. Much of the sector was already struggling with softening demand for space and depreciating property values. Rising interest rates, however, have looped in some who have remained above the fray.

In the fourth quarter, Class A space leased in central business districts across the country dropped for the only time last year, according to Moody’s Analytics. That same quarter, nearly 19 percent of high-end office space was available in Manhattan, according to Savills, higher than the availability rate for Class B and Class C buildings.

“Any property owner that says ‘Oh we’re fine’ is a little bit fooling themselves,” Moody’s Analytics Senior Economist Thomas LaSalvia, told the Journal.

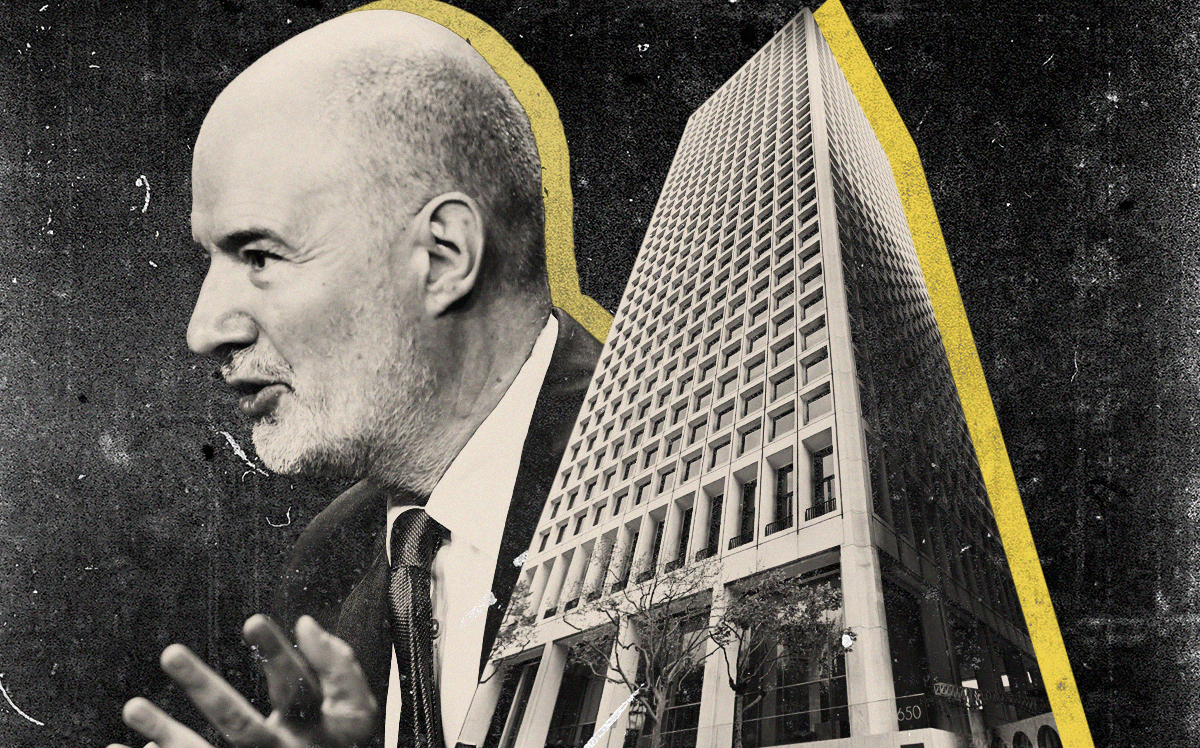

As vacancies and interest rates creep up, so do defaults at the top of the office sector. Brookfield Asset Management recently defaulted on more than $750 million in debt backing two Los Angeles buildings, including the 52-story 777 South Figueroa Street property downtown. Columbia Property Trust also recently defaulted on $1.7 billion in office loans.

Read more

Since the start of the pandemic, office tenants have largely put a premium on high-end buildings, ones that feature all the bells and whistles an employee would expect from a modern space. In the first years of the pandemic, 76 percent of Manhattan office occupants who moved either switched Class A buildings or moved from Class B to Class A, according to an analysis by CompStak.

The ability of Class A office space to withstand the pressures facing the rest of office stock already appeared to be weakening, though. In Manhattan, the gap is narrowing on the demand generated between Class A and Class B space. In the last quarter of 2021, Class A office rents cost an average of 27.3 percent more than older offices — for the most recent fourth quarter, the difference was down to 24.7 percent.

— Holden Walter-Warner