The construction industry’s recent boom may reverberate across the real estate industry to stifle interest rate cuts.

Construction’s record year is perceived as fuel in the Federal Reserve’s fire to raise interest rates to clamp down on inflation, the Wall Street Journal reported. The industry is a bellwether for the larger economy because it is usually the first sector to see jobs hit the fan when borrowing costs rise.

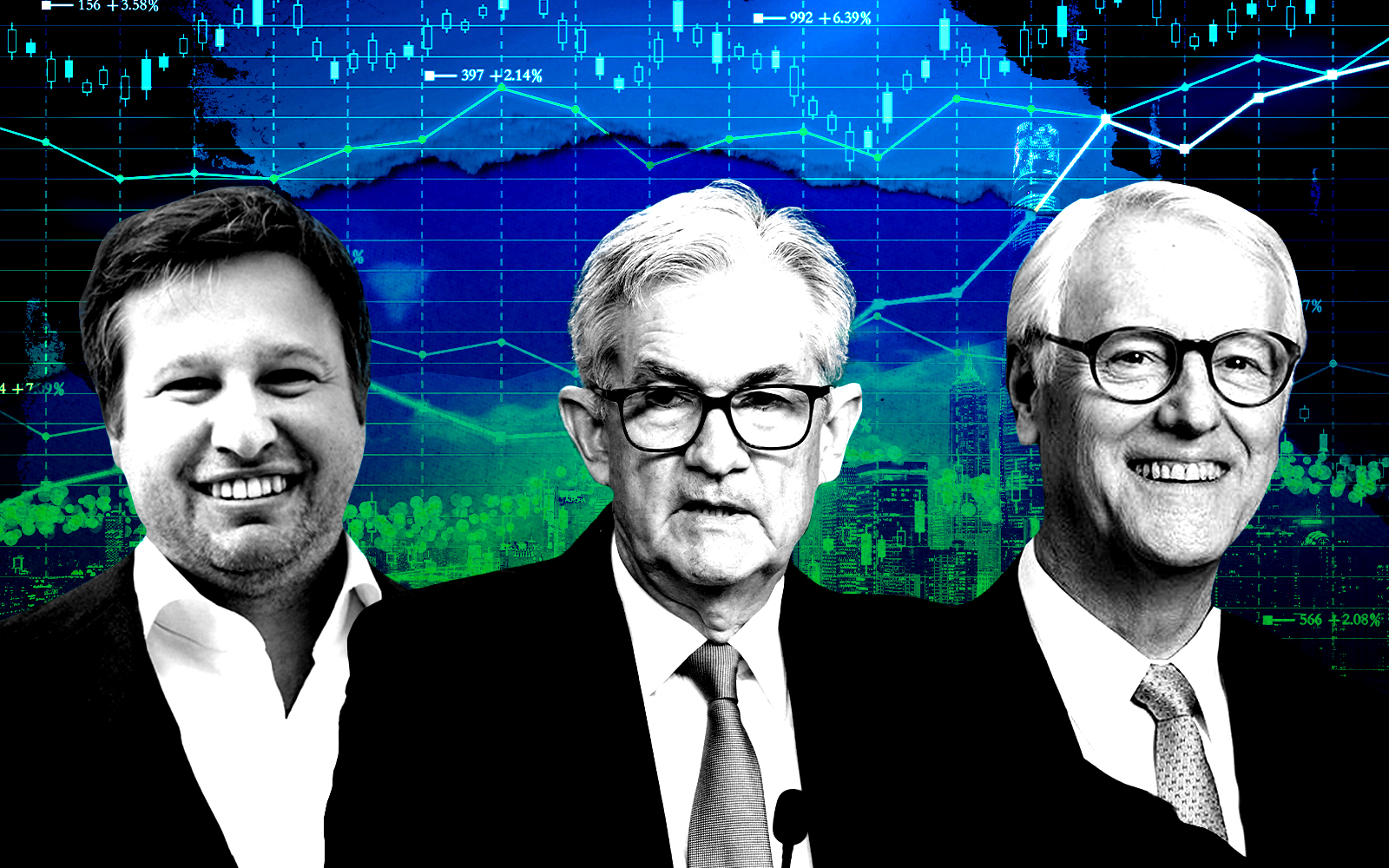

The Fed’s fight over the past year has sent interest rates on a staggering rise, which is expected to continue when the central banking system leaders meet this week. While the hikes have hindered borrowing for development and commercial purchases, construction keeps withstanding the heat.

Spending and employment in construction have both hit record highs already this year.

The federal government is funding infrastructure projects throughout the country, such as airport renovations, which are keeping the industry’s payrolls going. Residential construction dropped $50 billion in the past year, but industrial construction accounted for $108 billion last year and was at an annualized rate of $141 billion through the first two months of this year, according to the Census Bureau.

The sector is also recovering from the onset of the pandemic, when lumber prices went through the roof.

The construction industry may be poised to shift in the opposite direction soon.

Apartment construction is expected to drop once ongoing projects are completed. Financing for projects may also become increasingly hard to come by as rates keep rising and regional banks struggle and tighten standards; this weekend, San Francisco-based First Republic Bank failed, quickly acquired by JPMorgan Chase.

The backlog on construction dropped in March to its lowest level since August, according to Associated Builders and Contractors, meaning the gushing pipeline is springing leaks.

Whether or not a construction slowdown could alter the economy, and the Fed’s mindset, remains to be seen. It took two years of declines in residential construction employment before the broader economy felt the impact during the 2008 financial crisis.

The crisis ultimately bit the hand that built the country — the recession from the crash led to a drop in homebuilding that is feeding today’s housing crisis and housing shortage.

— Holden Walter-Warner

Read more