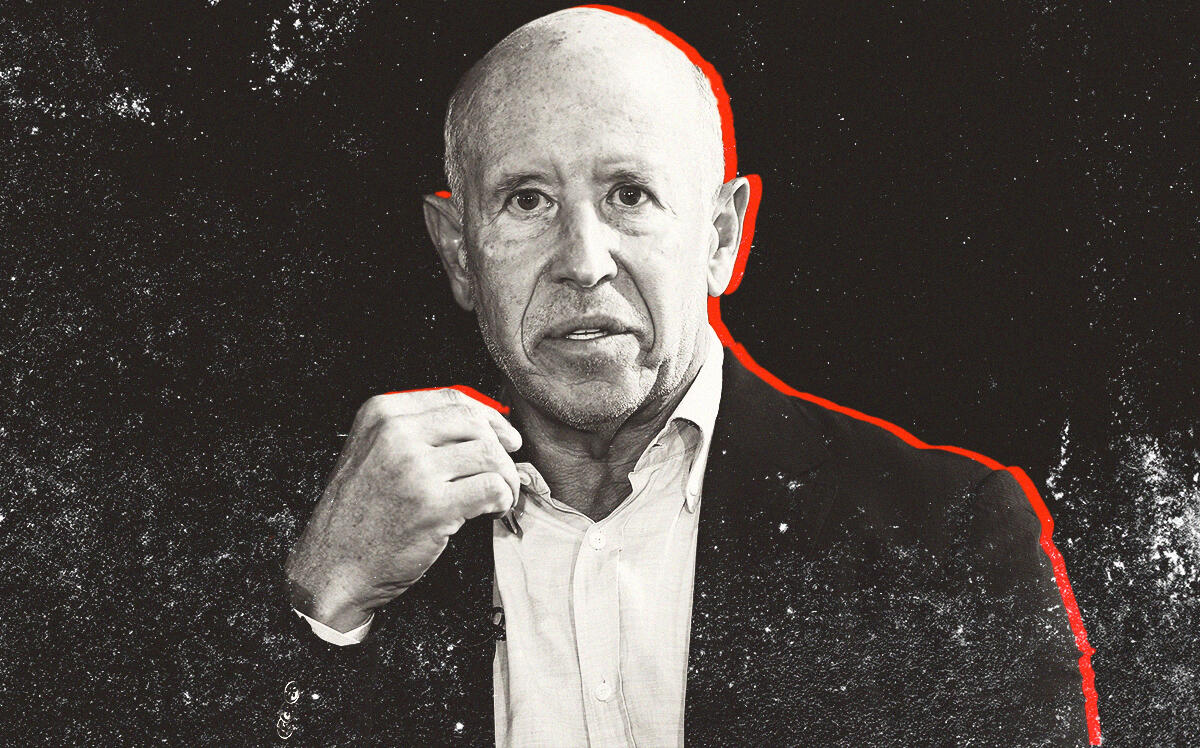

Barry Sternlicht has some grievances to air over the Federal Reserve’s latest interest rate hike and the central bank’s role in the crisis consuming regional lenders.

“The government is completely screwed up,” the Starwood Property Trust chairman said on the REIT’s first-quarter earnings call Thursday.

Sternlicht, the billionaire founder and CEO of Greenwich, Connecticut- and Miami Beach–based Starwood, said regional banks are “the biggest victims” of government “stupidity.”

The Fed hiked interest rates another 0.25 percentage points Wednesday, pushing rates above 5 percent for the first time since 2007. Sternlicht called the move “bordering on idiotic.”

“The only person who seems to not know inflation is going down is Chairman [Jerome] Powell and his merry band of Fed governors,” he said, later calling it “criminal” to put “the people that work at these banks” out of business.

“It is not right, and it should all be on the Fed,” he added. “It’s their fault. So they did this and they don’t need to be blessed for killing inflation, at what cost?”

That aside, Starwood executives defended the company’s position among its peers. Sternlicht said he would be happy to take back multifamily properties with Starwood loans, though that seems unlikely.

“I would be delighted if we would take every single asset back,” he said. “I don’t think that will happen.”

Starwood’s $52 million in first-quarter earnings, or 16 cents per share, marked an 84 percent decline compared to the same period last year. The REIT reported $490.4 million in revenue, up 67 percent.

Sternlicht again singled out the office market, and said the single-family, multifamily and hotel segments of Starwood’s business are performing well. Starwood expects to receive HUD approval to raise rents more than 6 percent for its affordable housing portfolio, president Jeffery DiModica added.

Rina Paniry, Starwood’s chief financial officer, said the REIT placed two loans with five-star risk ratings on nonaccrual status. They are a $42 million senior secured loan backing a two-story retail property in downtown Chicago, which Starwood expects to foreclose on “in the near term,” and a $121 million senior secured loan on an office complex in Washington, D.C.

Sternlicht said the U.S. is the only country in the world where offices are struggling, though he made the point that “good buildings” are full and “holding their rents.”

Starwood has 16 loans maturing this year, which represent less than 10 percent of its loan business, said DiModica. Half of those loans are on office properties. Two of the office loans are risk-rated 4 or 5, including the D.C. property and a loan made on an office building in Houston that Starwood extended for six months. The Houston property is in contract to be sold and will be converted to residential.

DiModica said Starwood downgraded three loans to a four-risk rating from five, including a $197 million loan for an office property in Irvine, California. It’s being marketed for sale, and the seller received offers “above or near our debt basis.” Starwood is considering an extension should it not get paid back.

“We do think the economy is going to slow and our job is really to manage through the cycle, keep our liquidity high. Obviously, our stock is an intoxicating value at these levels,” Sternlicht said. “But caution is the right word for us as we play defense and decide when again, we’ll go on offense. We are again somewhat excited by this.”

Read more