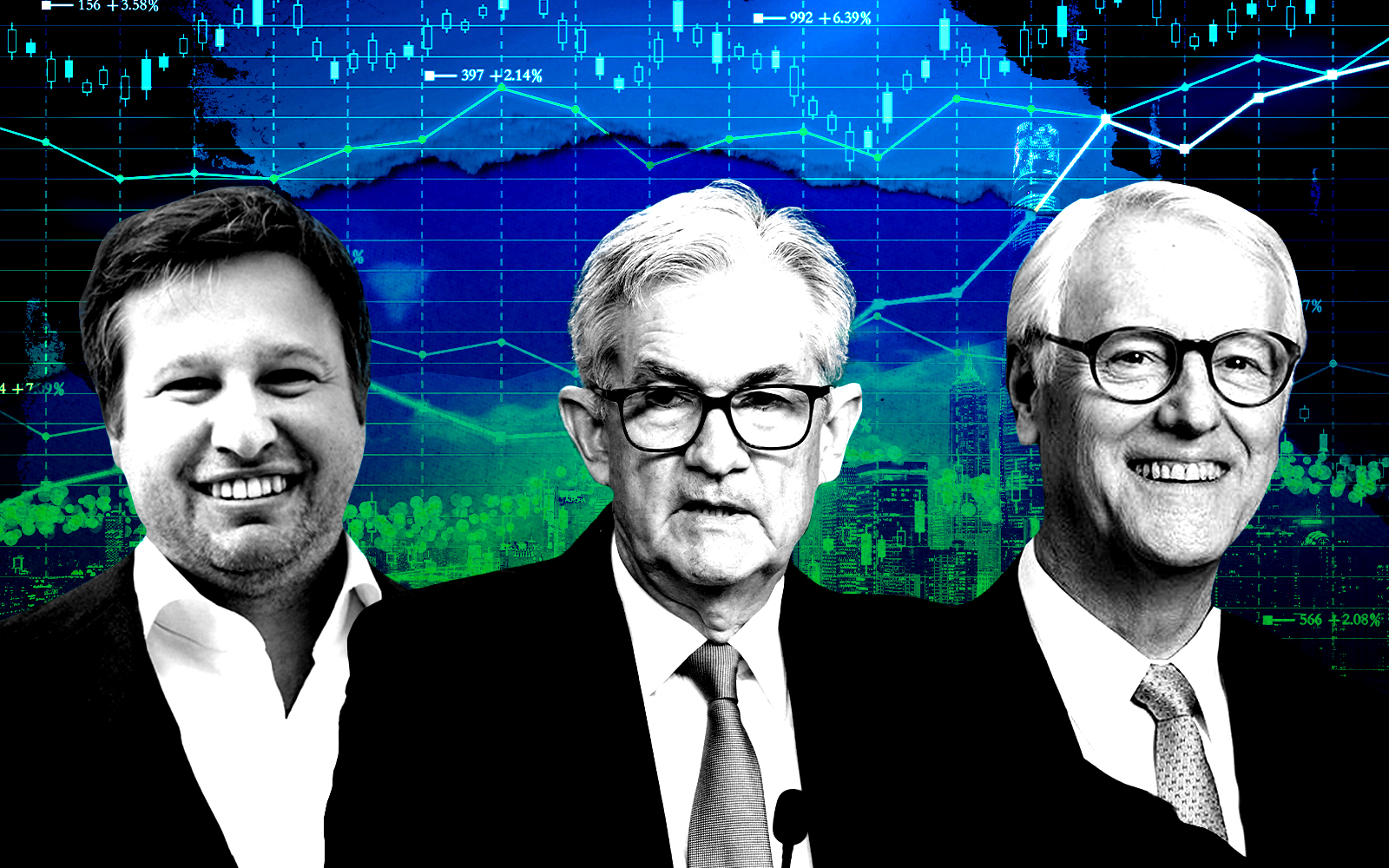

The Federal Reserve is airing its concerns on the distress facing commercial real estate and the impact it could have on the broader economy.

The central bank flagged the sector in its twice-annual Financial Stability Report, the New York Times reported. A survey of 25 professionals in the report ranked commercial real estate as the fourth-biggest financial stability concern, trailing interest rate increases, banking sector stress and tensions between the United States and China.

The report stated what many in commercial real estate already know, some of whom learned the hard way: as loans come due, borrowers will have a harder time refinancing due to higher interest rates, which have spiked dramatically in the last year.

The central bank said commercial real estate values remain “elevated,” though they are falling in light of recent distress, particularly in the office market.

“The magnitude of a correction in property values could be sizable and therefore could lead to credit losses by holders of C.R.E. debt,” the report stated.

Acknowledgement of issues in the sector — and their potential to impact the rest of the economy — is welcome news to commercial landlords, but action would speak louder than words.

In the report, the Fed said it “increased monitoring of the performance of C.R.E. loans and expanded examination procedures for banks with significant C.R.E. concentration risk.” That’s not the same thing as actually changing decisions around interest rates, which the Fed hiked once again last week by a quarter point (while hinting a pause could be forthcoming).

Skeptics can point to three months ago, when the Fed discussed commercial real estate’s impact on the economy during its meeting. The bank pointed to concern over loans provided to office landlords, according to minutes from the meeting.

That acknowledgement doesn’t appear to have spurred action to counter CRE distress, at least in terms of interest rate policy. The sector continues to languish in the wake of rising rates — up to above 5 percent from next to nothing at the start of last year — hindering activity in the market and creating financial pressure.

— Holden Walter-Warner

Read more