Airbnb set several records in the first quarter and beat Wall Street estimates for earnings, but a dim second quarter outlook sent shares tumbling.

Shares declined by 11 percent on Wednesday to close at $113.19, Bloomberg reported. The single-day loss was the largest for the short-term rental company in six months and a slight recovery from an earlier loss that marked the biggest intraday drop since the company went public in 2020.

The drop came after Airbnb posted $1.82 billion in revenue in the first quarter, a company record for the period. It beat analyst expectations in several areas, including quarterly revenue, earnings per share and adjusted earnings before interest, taxes, depreciation and amortization.

But the company didn’t have a similarly sunny forecast for the second quarter.

Airbnb projected revenue in the second quarter to range from $2.35 billion to $2.45 billion, in line with the $2.4 billion expected by analysts who responded to a survey by the outlet.

But that revenue projection marks only a 12 to 16 percent increase year-over-year. That would mark the slowest pace of growth yet for Airbnb, which has seen revenue growth decline on an annual basis in each of the last few quarters. Annual revenue growth was 78 percent in the fourth quarter of 2021, but only 24 percent in the fourth quarter of 2022 and 20 percent last quarter.

The company said demand is waning alongside the post-pandemic surge in vacations and persistent inflation. It’s expecting year-over-year growth in experiences booked and nights booked to increase at a slower pace than revenue.

Read more

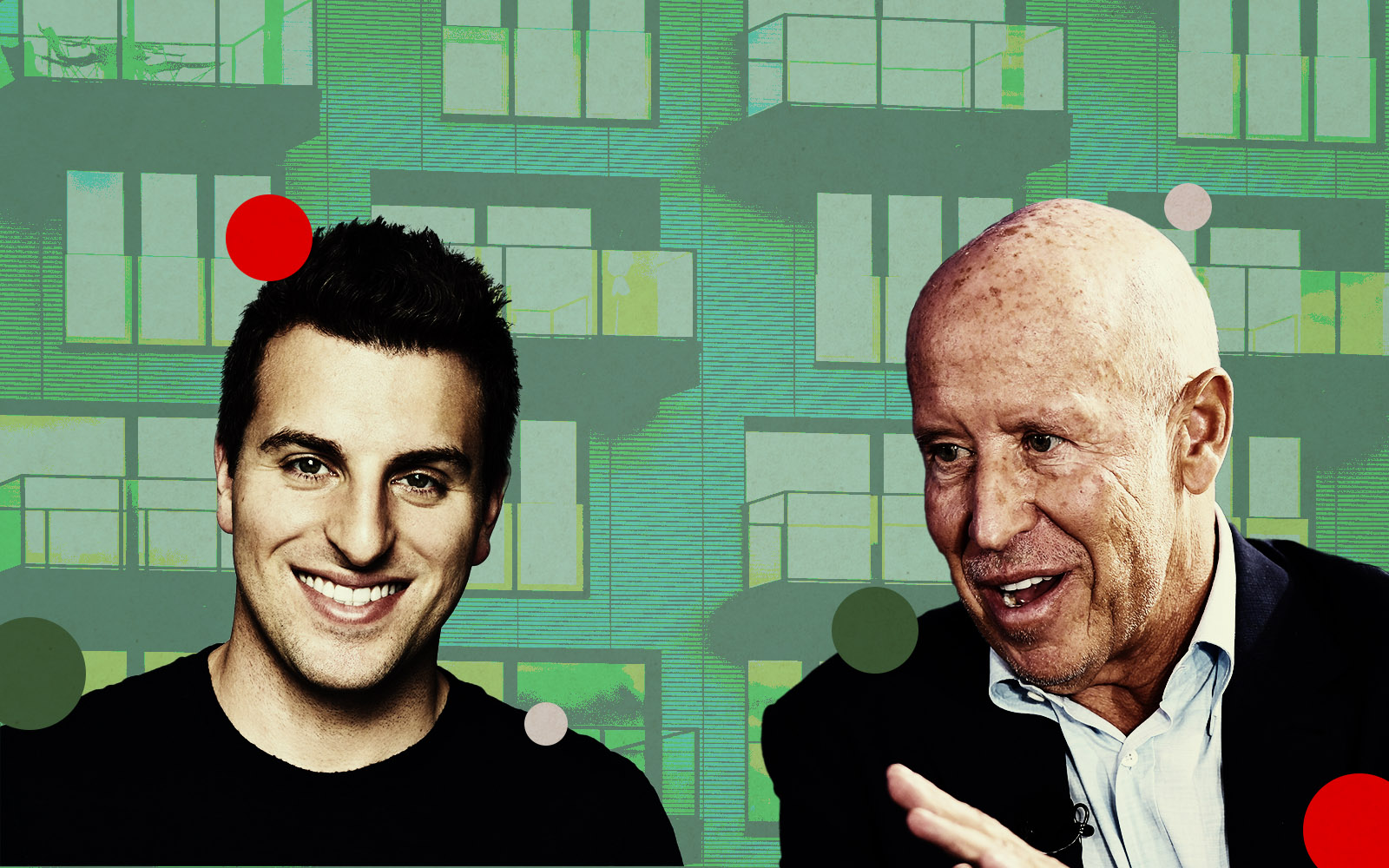

The lowered expectations would give the company room to exceed them, chief executive officer Brian Chesky said in an interview with the outlet after earnings, adding the company “has a super resilient model.”

Booking Holding and Expedia are nipping at Airbnb’s heels, though, posting strong first quarters and double-digit increases in gross bookings. Chesky downplayed the emergence of its peers, saying “no other travel company comes close” to matching its levels since the pandemic.

— Holden Walter-Warner