Wall Street did not react favorably to the leadership upheaval at WeWork.

Shares in the company dropped nearly 25 percent on Wednesday to an all-time low, Bloomberg reported. After opening the day at 34 cents per share, WeWork ended the day at 26 cents per share, both far cries from the $11.78 it traded at on its first day of going public 19 months ago.

The stock has slipped 82 percent this year.

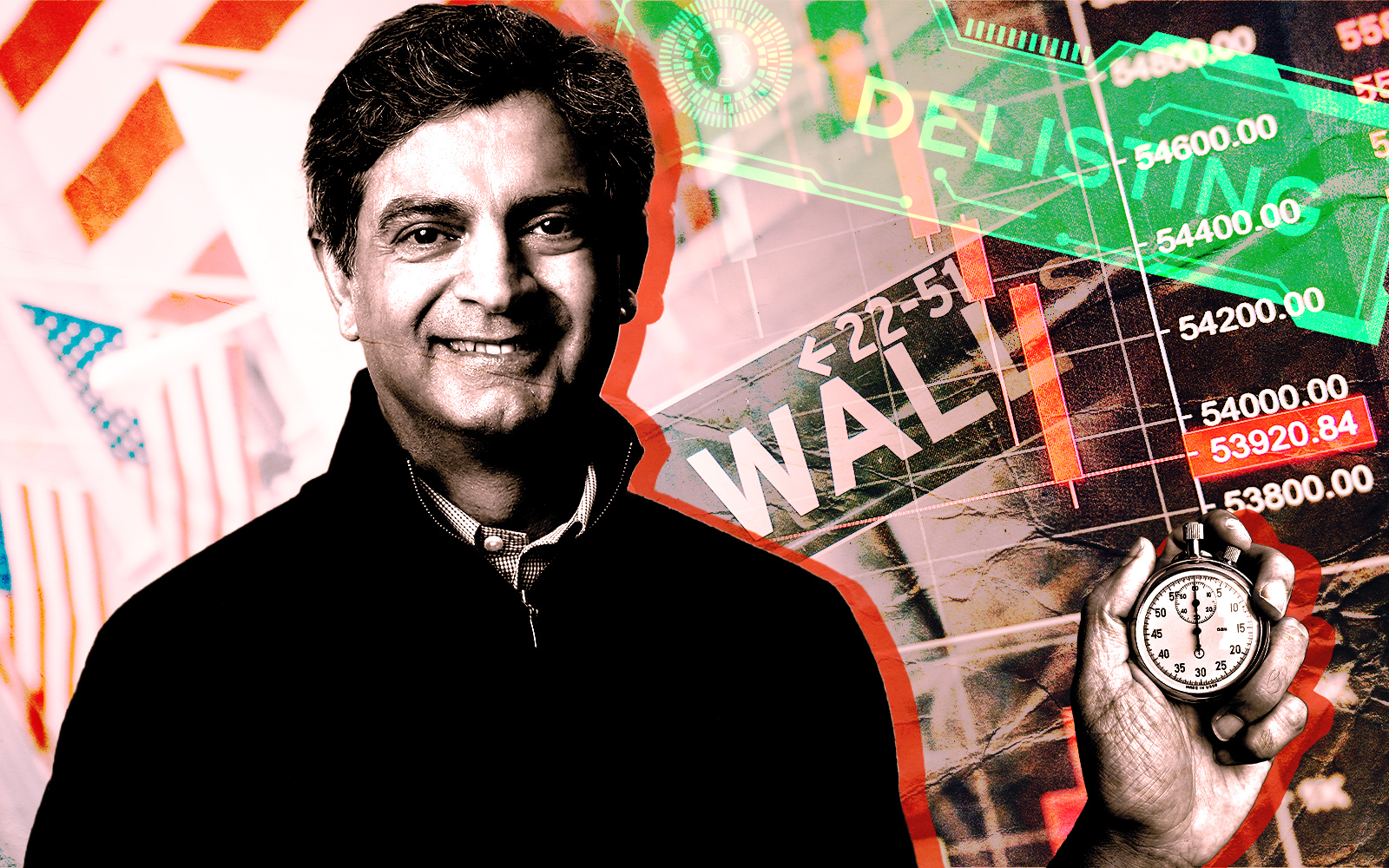

The rough trading day came after Tuesday’s after hours announcement that chief executive officer Sandeep Mathrani is stepping down after three years in charge of the co-working giant. Board member David Tolley will take charge on an interim basis.

The stock drop is particularly concerning, since WeWork was already risking being delisted from the New York Stock Exchange as a result of trading for under one dollar for a prolonged period. Debt restructuring and a reverse stock split are among the financial maneuvers the company is using to try and boost the stock.

Analysts at Mizhuo sounded a pessimistic note, saying the leadership transition throws more fuel on a fire that already included a myriad of macroeconomic concerns. The analysts downgraded WeWork stock from “buy” to “neutral,” also lowering its price target to 30 cents.

“We now see our base case business assumptions, specifically occupancy targets, as unachievable, leading to higher cash burn and eventually driving the need for outside capital,” analysts wrote.

Mathrani predicted the company would be cash-flow positive by the end of this year, but during the latest earnings call, changed that target to the end of next year. Mizuho analysts don’t expect the company to be free cash flow positive until the end of 2025.

Read more

WeWork last year halved its net loss to $2.3 billion and last quarter enacted a $1 billion debt restructuring. It also burned through $700 million in cash last year, reported a loss of $299 million in the first quarter and saw ratings agency S&P Global downgrade the company’s credit worthiness after its debt restructuring with SoftBank in March.

It’s not all gloomy for WeWork on Wall Street. Despite Mizuho’s downgrading, the company doesn’t have any sell ratings and still has four buy ratings, sporting two holds.

— Holden Walter-Warner