Two of the country’s biggest hotel companies are jumping into the extended-stay market.

Hilton and Marriott International are both launching extended-stay brands next year, the Wall Street Journal reported. The brands — which are currently unnamed — will target guests looking for weekslong stays.

Hilton is negotiating with more than 100 hotel owners to incorporate properties into the brand. Marriott’s property reach is not as clear, but its typical extended-stay location will be 54,000 square feet and 124 rooms.

Hyatt is also in the market, announcing last month preliminary commitments from developers for 100 hotels under its Hyatt Studios brand, at a higher price point than Hilton and Marriott’s offshoots. Marriott room rates will be about $80 per night, while Hilton is closer to $100 per night — both below last year’s average daily hotel rate of $149.

While buildings will have some traditional hotel amenities, like laundry and gym access, they will not include the same services expected at high-end hotels, such as daily housekeeping. Room layouts typically include a full kitchen with a cooktop and dishwasher.

The major hotel companies are riding a consumer trend geared towards extended-stay hotels, which have become one of the most popular options in the sector. Last year, they had an occupancy rate of 74.7 percent in the United States, according to STR, beating the overall hotel occupancy rate of 62.6 percent.

The segment gained steam during the pandemic when traveling nurses and doctors filled rooms for longer stays than the average traveler. More recently, vacationing families and remote workers have increasingly sought rooms better suited for a longer stay.

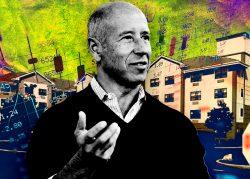

The hospitality segment has caught investor interest in recent years. Blackstone and Starwood Capital Group in 2021 paid $6.3 billion to acquire the 62,257-key portfolio of Extended Stay America, taking the country’s largest lodging REIT private.

More recently, the partners teamed up again to acquire 111 WoodSprings Suites properties from Brookfield Asset Management for $1.5 billion.

— Holden Walter-Warner

Read more