Multifamily player Tides Equities faces $6.5B dilemma in the Sun Belt

Multifamily player Tides Equities faces $6.5B dilemma in the Sun Belt

Trending

New apartments could sap Sun Belt rents

Exposed landlords include Camden Property Trust, Mid-America Apartment Communities

An apartment building boom is bad news for Sun Belt multifamily owners whose profits are threatened by the rise in supply.

A historic number of rental apartments is expected to come online in the next 18 months, the Wall Street Journal reported. More than 950,000 units are under construction, according to the U.S. Census Bureau, and many are in the Sun Belt, Green Street reported.

Rent growth is already slowing or declining in many Sun Belt cities, where bidding wars were the norm only a year ago. Tenants are hitting their limits on how much rent they’re willing to pay, though, and some are making decisions based on their dire outlook for the economy.

Phoenix, Las Vegas and Atlanta are among the Sun Belt cities that have seen rents fall after pandemic surges. They may continue to fall as job growth slows in those cities and others in the region.

Read more

Multifamily player Tides Equities faces $6.5B dilemma in the Sun Belt

Multifamily player Tides Equities faces $6.5B dilemma in the Sun Belt

Is the Sun Belt’s multifamily bubble poised to burst?

Is the Sun Belt’s multifamily bubble poised to burst?

Small-time multifamily investors go belly-up

Small-time multifamily investors go belly-up

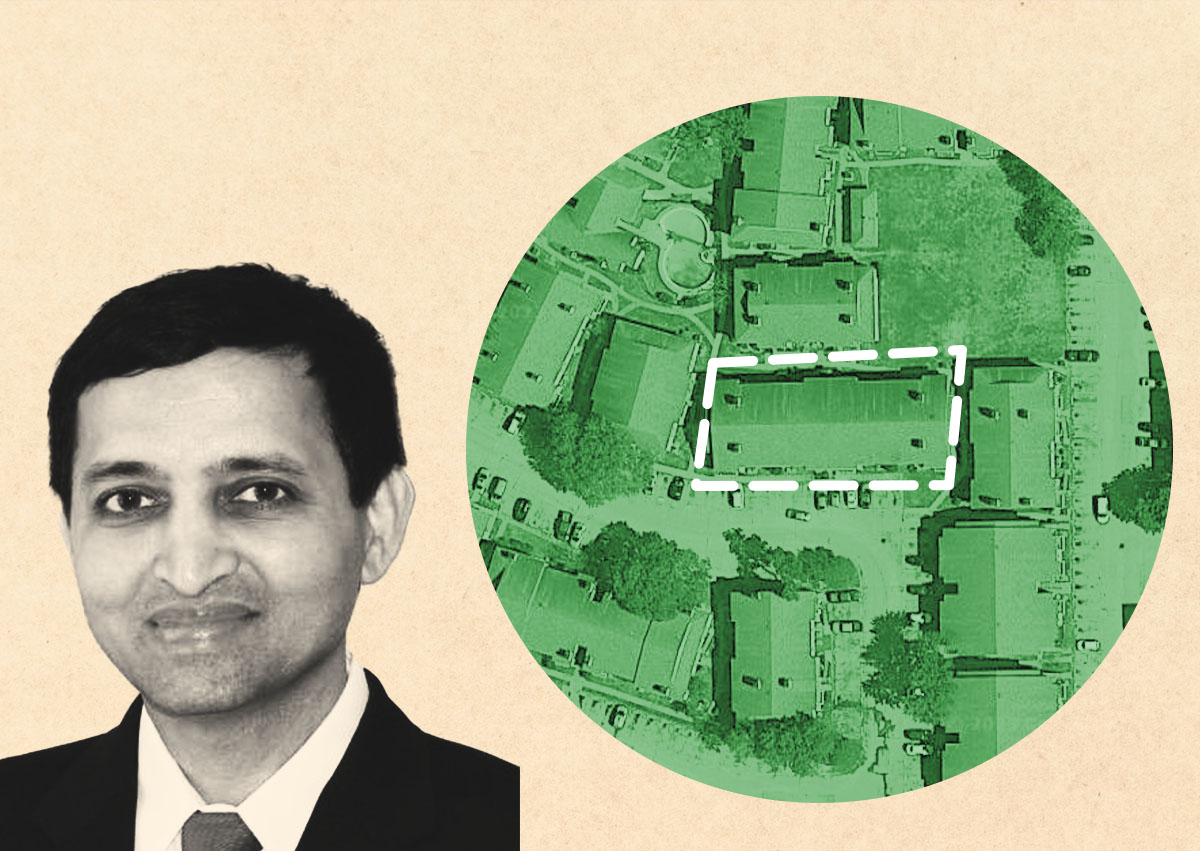

Camden Property Trust and Mid-America Apartment Communities are among the publicly traded landlords with the most exposure to the rental markets in the South and Southwest. While both firms beat first-quarter revenue expectations, their share prices have since fallen.

The rental market is looking softer across the nation. The average asking rent on a market-rate apartment in May was $1,716, according to Yardi Matrix. While that was a 2.6 percent increase from the previous year, the year-over-year increase in the first quarter was 15 percent.

The state of the Sun Belt rental market has been a hot topic for industry veterans given the outsized investment activity there during the pandemic. As rents have cooled, some have suggested the market could go bust.

RealPage chief economist Jay Parsons spoke to this issue in February on The Real Deal’s “Deconstruct” podcast, but called the fear of dilution exaggerated.

“Every year it also plays out that analysts are overstating the impact of supply, understating the impact of demand,” Parsons said.

— Holden Walter-Warner