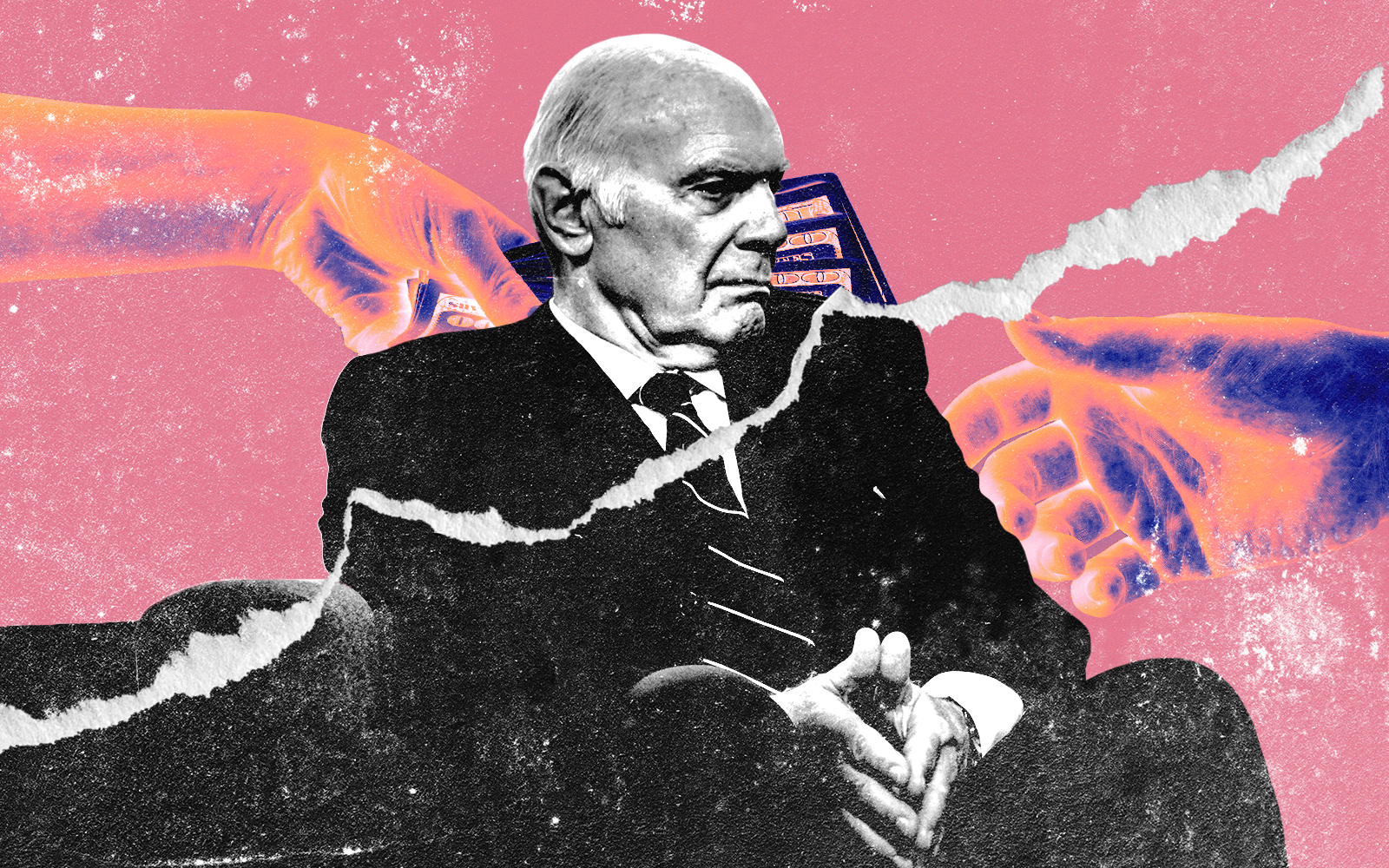

Prominent office landlord Paramount Group slashed its dividend payout by more than half.

The real estate investment trust cut the quarterly payout by 55 percent in a move expected to save Paramount $40 million annually, Crain’s reported.

The company said the move would enhance the REIT’s “already strong financial position.” But the move came as a surprise to analysts such as Steve Sakwa of Evercore ISI, who pointed to Paramount’s already conservative payout ratio of 57 percent.

In a note, Sakwa suggested the dividend slash could cushion Paramount against office leasing decisions set to be made by JPMorgan Chase regarding First Republic Bank.

The failed bank leases 455,000 square feet at 1 Front Street in downtown San Francisco — its headquarters — but JPMorgan could move on from that lease, which would cost Paramount $42 million in rental income.

Paramount has also struggled to fill a 500,000-square-foot hole left by Barclays at 1301 Sixth Avenue in Manhattan; the REIT’s holdings are split between the two coastal cities and the firm’s largest single tenant is First Republic.

Real estate investment trusts are required to distribute 90 percent of taxable earnings in dividends — cutting that dividend signals Paramount is about to take a hit on the earnings front. Last year, it paid out $73 million and it holds $450 million in unrestricted cash. Paramount has $2.5 billion in debt scheduled to mature in the next five years.

Two months ago, Vornado Realty Trust troubled some by suspending its dividend for the rest of the year. Steven Roth’s REIT is the second-largest office landlord in New York City. It paid out more than $400 million in dividends last year.

Before the suspension, the landlord was removed from the S&P 500. Vornado responded by moving to slash its dividend by nearly 30 percent — a larger cut than expected — as office landlords continue to be frustrated by high interest rates, high economic uncertainty and high remote work patterns.

— Holden Walter-Warner

Read more