This summer is shaping up to be a tough one for AirBnB.

The vacation rental platform saw a close to 50 percent decline in revenues per listing last month in some cities, compared to the same period the previous year, according to data from AllTheRooms.

“The Airbnb collapse is real,” Nick Gerli, CEO of real estate investment consulting company Reventure, wrote in a tweet about the data. “Watch out for a wave of forced selling from Airbnb owners later this year in areas hit hardest by the revenue collapse.”

The price drops in cities like Phoenix and Austin come as the number of available properties surged this spring. In April, the platform had 1.4 million active listings — an 18 percent increase from the same period last year, according to data from short-term rental analytics company, AirDNA, reported by Insider.

Sam Randall, a spokesperson for Airbnb, pushed back on the data in a statement to Bloomberg.

“The data is not consistent with our own data,” Randall said. “As we said during our first-quarter earnings, more guests are traveling on Airbnb than ever before, with nights and experiences booked growing 19% in the first quarter of 2023 compared to a year ago.”

Demand for short-term rentals remains elevated, the company has said, though it has dwindled from post-pandemic highs, especially as inflation pushes renters to consider more budget-conscious travel.

AirDNA’s senior vice president, Jamie Lane, also refuted the results of AllTheRoom’s analysis in a Twitter thread on Tuesday, claiming AirDNA’s data shows that the average revenue per available listings decreased by about 4 percent, not 40 percent.

“Let’s get some facts straight… There is not a collapse in [revenue per available listing] happening,” Lane wrote in the tweet. “Is it down in 2023? YES. Is it down 40%? NO.”

In the first quarter of this year, Airbnb posted a record revenue for the period of $1.82 and exceeded expectations set by Wall Street analysts. However, the company’s grim forecast for the second quarter sent stock prices plummeting after the first quarter earnings call.

Airbnb’s shares dropped to $113.19, an 11 percent decline, on the Wednesday following the earnings call in May, marking the largest single-day loss for the company in six months.

The company projected second quarter revenue to fall within a range of about $2.35 billion to $2.45 billion. While the numbers are in line with analysts’ expectations, Airbnb’s projected revenue is only a 12 to 16 percent annual increase — its slowest growth pace since it went public in 2020.

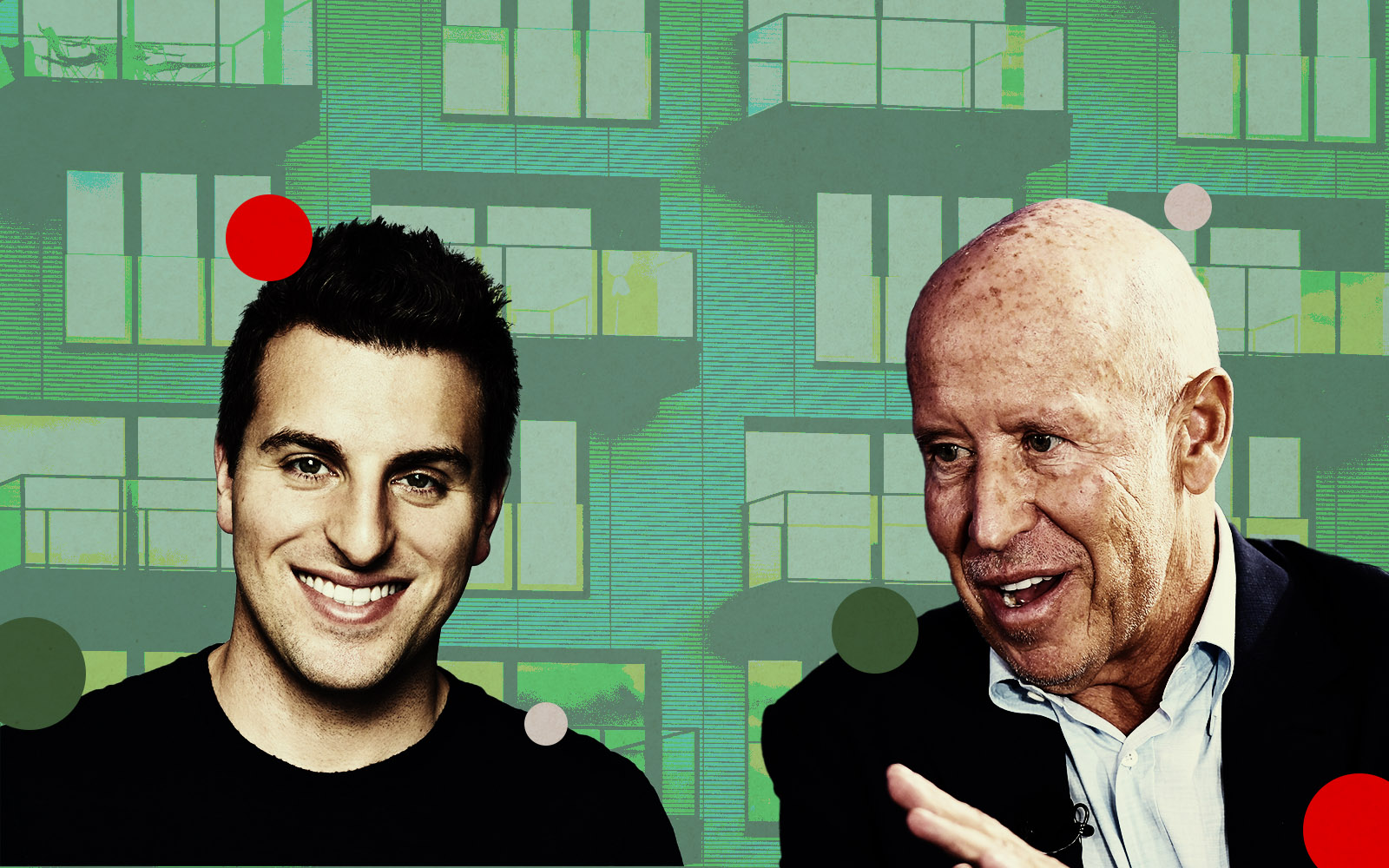

Some of Airbnb’s competitors, including Booking Holding and Expedia, are trailing close behind the company with robust first quarter earnings under their belts, though Airbnb CEO Brian Chesky brushed off their growth.

“No other travel company comes close,” Chesky told Bloomberg in an interview following the earnings call.

Read more