The world is settling into post-pandemic patterns. That’s bad news for office landlords in so-called “superstar” cities across the globe.

Falling demand is set to have a major impact on office values in almost any scenario, according to an 88-page report prepared by the McKinsey Global Institute, titled “Empty spaces and hybrid places.” The analysis focused on nine cities across Asia, Europe and the United States, including New York City, San Francisco and Houston.

The authors of the report found that hybrid work is not going anywhere, which means more desolate offices aren’t, either. Office attendance is hovering around 30 percent lower than pre-pandemic levels and values are poised to tumble amid weakened demand.

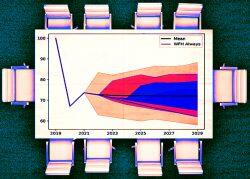

The authors modeled out various scenarios of what values could look like in the nine cities by 2030. Under the moderate scenario projected, office values decline by 26 percent from 2019 to 2030, putting $800 billion at stake. Under a more severe scenario, values could drop by as much as 42 percent.

This isn’t anything office owners haven’t heard before, particularly in New York. Doom-and-gloom estimates include an update provided in May by researchers from New York University and Columbia University, who found that New York offices will lose an estimated 44 percent of their value by 2029 in an increase from a 28 percent decline estimated a year earlier.

But San Francisco was forecasted in the McKinsey report as set for the worst hit among the cities, with a 20 percent drop in demand in a moderate scenario and as much as a 38 percent drop in a severe scenario.

The potential pain in major cities extends beyond office values, as the urban cores of these cities have reported population declines. Not only does that impact the multifamily market, but it also hurts retail in those districts; foot traffic near stores in metro areas is stuck between 10 percent and 20 percent below pre-pandemic levels.

Effects from the pandemic will vary by city, but the report noted “superstar cities” can still thrive if they adapt into more hybrid hubs by creating mixed-use neighborhoods, constructing flexible space and designing floor plans that are modular and multiuse.

Read more

“What is certain is that urban real estate in superstar cities around the world faces substantial challenges,” the report read. “But the challenges also provide an opportunity to spur a historic transformation of urban spaces.”