Homebuilders’ stock prices fell Friday after the Federal Reserve chairman spoke of more rate hikes down the line.

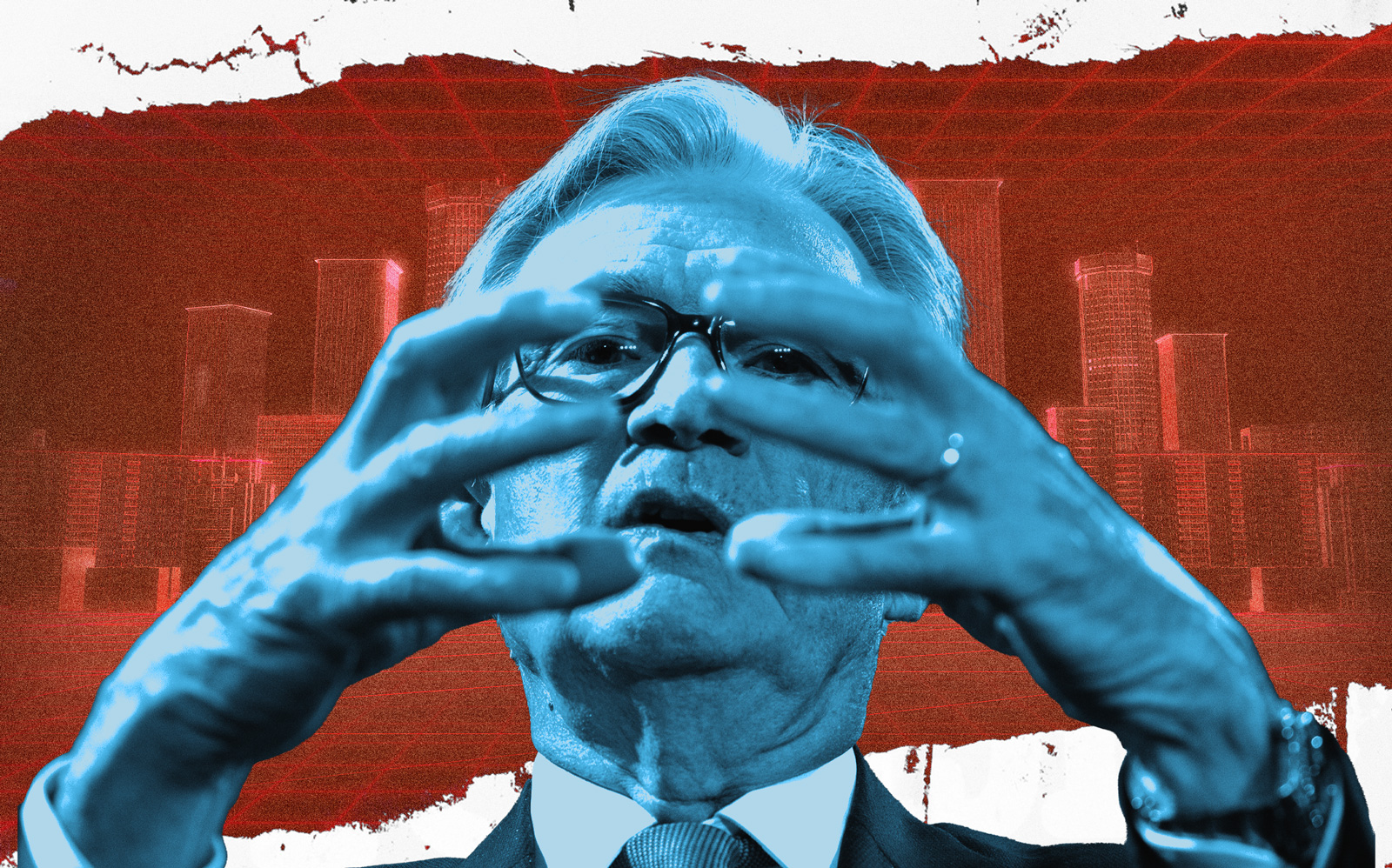

In a speech at the Kansas City Fed’s annual economic symposium Friday in Jackson Hole, Wyoming, Jerome Powell said more hikes are still possible and rates could be kept up for longer than previously expected.

“Although inflation has moved down from its peak — a welcome development — it remains too high,” Powell said. “We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Powell noted mortgage rates doubled over the course of 2022, causing sales to fall and housing growth to plummet. Growth in market rents also “peaked and steadily declined” in the “highly interest-sensitive” housing sector, Powell said.

“The slowing growth in rents for new leases over roughly the past year can be thought of as ‘in the pipeline’ and will affect measured housing services inflation over the coming year,” Powell said, adding that after a sharp decline in the last 18 months, the housing sector is showing signs of picking back up.

“Going forward, if market rent growth settles near pre-pandemic levels, housing services inflation should decline toward its pre-pandemic level as well.”

High interest rates are a major headwind for real estate, which relies heavily on borrowing in nearly every facet of the industry. The rate increases triggered by the Federal Reserve’s war on inflation have wreaked havoc on the home mortgage industry, commercial property owners and developers.

But real estate stocks did not plummet in the wake of Powell’s comments, in part because many have already been beaten up. Home sales and investment sales have slowed to a crawl, and owners of office and apartment buildings have been struggling to refinance.

Homebuilders’ stocks appeared to be hit hardest after Powell’s remarks, although they mostly recovered by the close of trading. On the day, Toll Brothers stock was down 0.9 percent, Hovnanian 0.2 percent and Lennar 1.6 percent.

In the office and retail sphere, Paramount Group’s stock fell 1.8 percent; Empire State Realty Trust was down 0.9 percent and SL Green 0.2 percent. Office REITs’ shares plummeted during the pandemic.

Conversely, brokerage stocks were trending up Friday, perhaps because investors can’t see home sales activity getting any worse.

Compass stock finished the day up 1.2 percent; Redfin 1.1 percent and Douglas Elliman a robust 2.9 percent. A major stump in sales had already pummeled residential brokerages’ share prices and mortgage rates had soared past 7 percent to a 21st century high before Powell spoke.

Powell added that the labor market remains tight and further progress will be “essential” in curbing inflation on the whole. Though core goods inflation remains above pre-pandemic levels, it has fallen “sharply” in the last few months, specifically for durable goods, he noted.

“Over time, restrictive monetary policy will help bring aggregate supply and demand back into better balance, reducing inflationary pressures,” Powell said. “Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth, as well as some softening in labor market conditions.”

Read more