Two of the biggest players in the office sector combined to sell a property in the nation’s capital for $305 million, a shot in the arm for a distressed market.

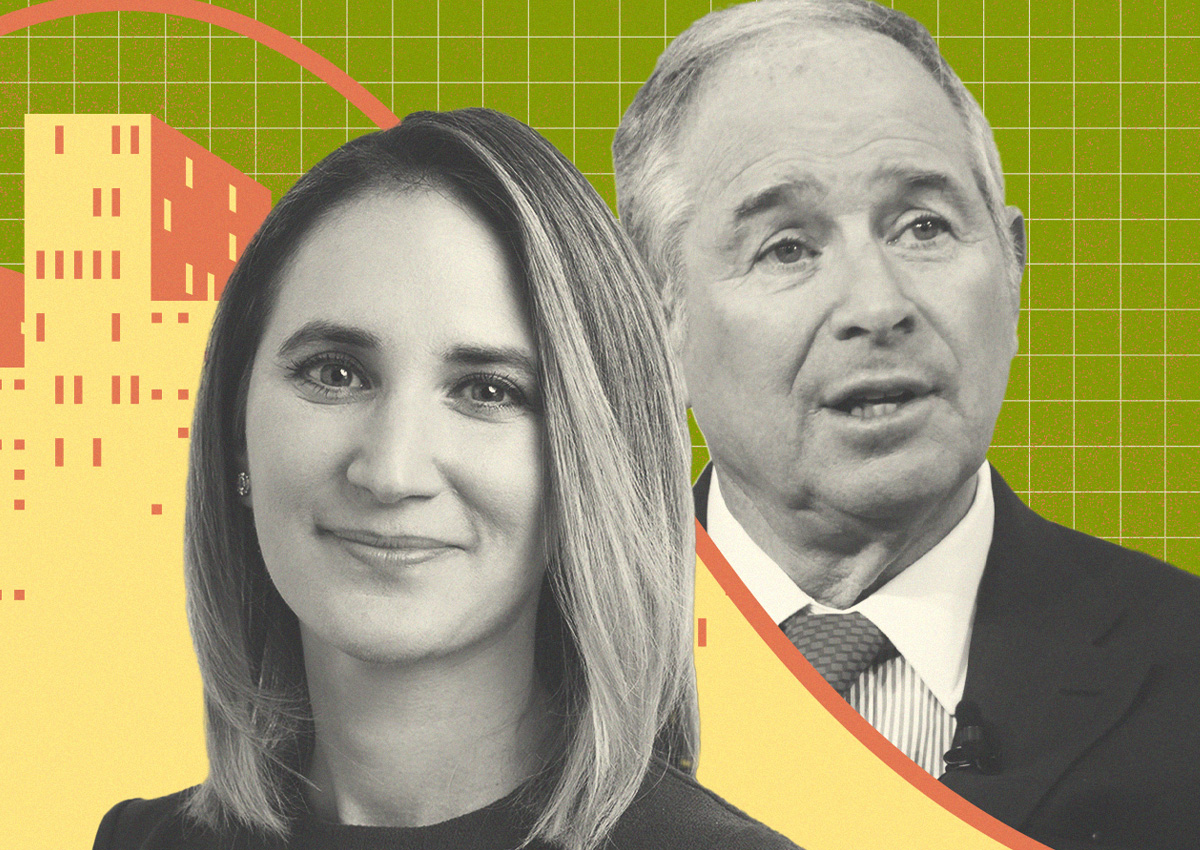

The Blackstone Group and Boston Properties sold Metropolitan Square at 655 15th Street NW to Chevy Chase-based Artemis Real Estate Partners, the Washington Business Journal reported. The Blackstone affiliate had an 80-percent stake in the property, while BXP owned the rest.

The sale of the 654,000-square-foot property works out to roughly $466 per square foot. The deal could prove to be one of the largest in Washington, D.C. this year.

BXP had a majority stake in the building dating back to 1998 before Blackstone entered the picture in 2016. Tenants at the property — the fourth-largest Class A office building in the city — include Old Ebbitt Grill. Asking rents at the property are $79 per square foot, but the building was only 58 percent occupied as of mid-2020 due to the departure of two large tenants.

From 2017 to 2020, the now-former owners conducted a $60 million renovation of the property, which was built in 1983. Upgrades were made to the lobby, building mechanics and amenity spaces.

The timing of the transaction appears to be intentional. In 2019, the D.C. Council approved temporary hikes on transfer and recordation taxes for transactions of at least $2 million. The hikes were sunset at the end of the fiscal year: Sept. 30. Split between buyer and seller, the tax savings amounted to roughly $6.5 million.

In the spring, real estate investment firm Hines bought an 11-story office building in downtown Washington, D.C. from The Lenkin Co. for $60 million. That deal broke down to $388 per square foot.

Despite making massive investments in the office market in the past, Blackstone and BXP both appear to be skeptics about its future. Blackstone has shrunk its office holdings to 2 percent, leaning into other assets such as logistics. Boston Properties, meanwhile, has worked to diversify its portfolio and recently sold a 45 percent stake in 343 Madison Avenue, a planned 49-story tower in Midtown Manhattan, though it retained a majority interest.

— Holden Walter-Warner

Read more