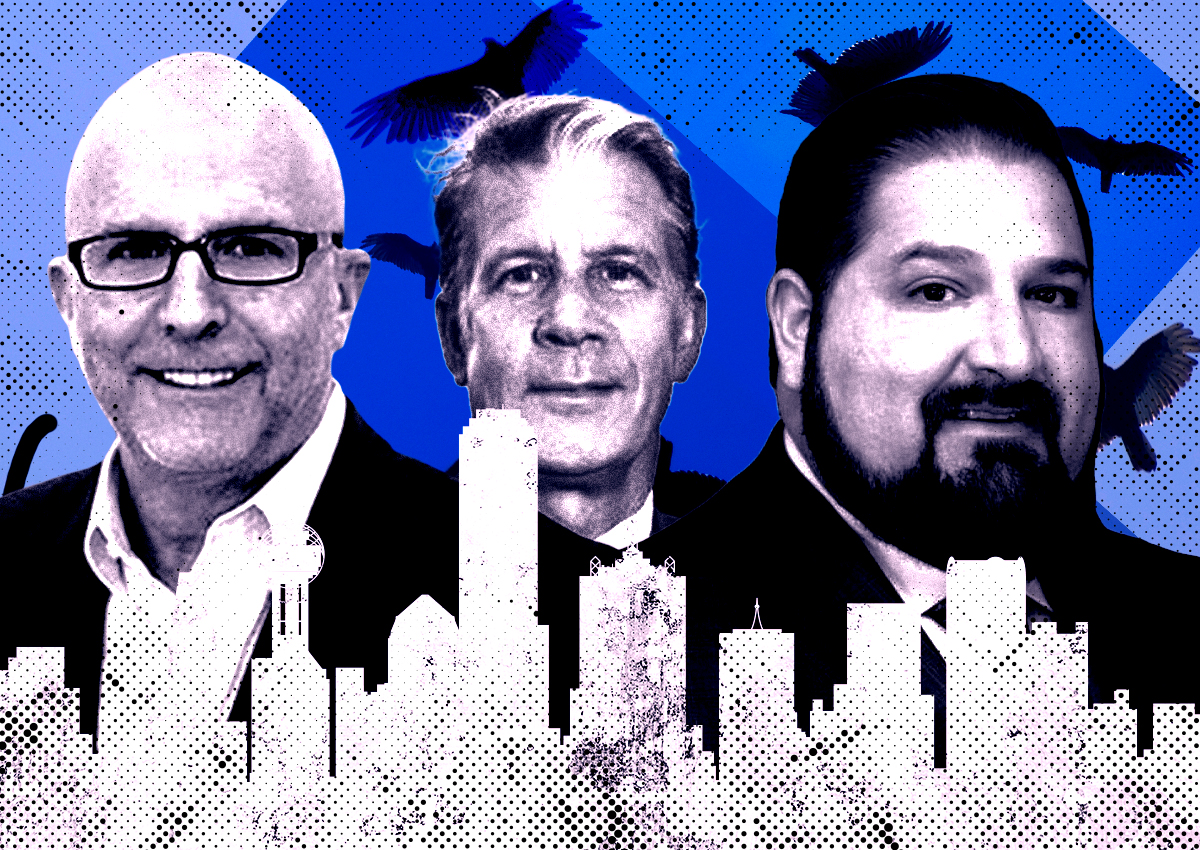

In July, Rise48’s Zach Haptonstall recorded a video to refute an article in The Real Deal naming his firm as a multifamily syndicator heading for trouble.

The founder repeatedly assured investors that his firm was “not distressed,” that renovations were going “really well,” and that properties struggling with rising rates would be “positive cash flowing by Q1 of 2024.”

Four months later, the reality looks quite different.

As of last month, $256 million in debt tied to Rise48 buildings had been watchlisted, according to data from Trepp and Morningstar. The loans back seven Phoenix-area assets with over 1,700 units.

In most of those buildings, Rise isn’t pulling enough revenue to cover monthly debt payments on its floating-rate loans. Much of the debt comes due next year, and servicer commentary shows the firm is behind on renovations at two of the properties.

Haptonstall did not respond to a request for comment.

His biggest problem could be Rise at Estrella Park. Its debt comes due in less than two months. Net cash flow in June was down 36 percent from when the loan was issued in January 2022, and the debt service coverage ratio clocked in at 0.64 this summer, meaning cash flow covered not even two-thirds of loan payments.

In the July video, Haptonstall stressed his firm was “increasing DSCR to be in a good position … to refinance” next year. But Estrella Park’s refinancing prospects appear tenuous at best. Typically, multifamily borrowers must maintain a 1.25 DSCR to refinance or extend a loan. If they can’t, lenders may require a paydown — a tough proposition for cash-strapped firms.

Purchasing a new interest rate cap — an insurance policy against rising rates — would be expensive. Caps, which typically expire when the loan matures, have become much more costly because rates have risen.

Ashcroft Capital this month told investors it would pause distributions so it could pay for new rate caps. The price had soared 3,500 percent from what the firm paid in 2021.

The picture at Rise Skyview and Rise North Mountain is even worse. In June, their respective DSCRs were 0.39 and 0.56, according to Trepp. Haptonstall has a bit more time to right the ship than he does at Estrella Park. Skyview’s debt comes due in December 2024 and North Mountain’s in May 2025.

Unless Rise48 gets a generous deal from lenders or interest rates plunge, the firm will have to increase rent revenue to keep the apartment complexes. Syndicators, who often specialize in value-add investing, rely on organic rent growth and rent hikes made possible by renovations. On both fronts, Rise48 seems to have fallen short, given the unexpected increase in interest costs.

After blockbuster growth in 2021 and 2022, Phoenix rents were 4.7 percent lower in October than a year before, according to Apartment List. North Mountain and Skyview are now advertising deals for new tenants. North Mountain offers six weeks free rent, and Skyview’s “2 BEDROOM BLOWOUT” includes one free month.

Meanwhile, servicer commentary indicates Rise48 has fallen behind on improvements, although Haptonstall had claimed in July that The Real Deal’s reporting that Rise48 had to slow down renovations at its Rise Thunderbird property was “false and fabricated.”

The same month, Morningstar reported that “the renovation project has missed the first-year milestone in the loan agreement.” A June update on Estrella Park said the same.

At Thunderbird, Haptonstall has some runway to get the work done. Its loan matures in January 2025 and commentary noted the borrower intends to complete renovations by June 2024. But higher construction costs and high interest rates may well complicate that plan.

Haptonstall in May said the property’s DSCR was 0.88, but Morningstar’s June update showed it was just 0.54.

Read more